|

|

|

|

|||||

|

|

Hotel company Hilton (NYSE:HLT) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 6.3% year on year to $3.14 billion. Its non-GAAP profit of $2.20 per share was 7.8% above analysts’ consensus estimates.

Is now the time to buy Hilton? Find out by accessing our full research report, it’s free.

Christopher J. Nassetta, President & Chief Executive Officer of Hilton, said, "We continued to demonstrate the power of our resilient business model as we delivered strong bottom line results in the quarter, even with modestly negative top line performance given holiday and calendar shifts, reduced government spending, softer international inbound business and broader economic uncertainty. With that being said, we believe the economy in our largest market is set up for better growth over the intermediate term, which should accelerate travel demand and, when paired with low industry supply growth, unlock stronger RevPAR growth. On the development side, we achieved the largest pipeline in our history, and we remain confident in our ability to deliver net unit growth between 6.0 percent and 7.0 percent for the next several years."

Founded in 1919, Hilton Worldwide (NYSE:HLT) is a global hospitality company with a portfolio of hotel brands.

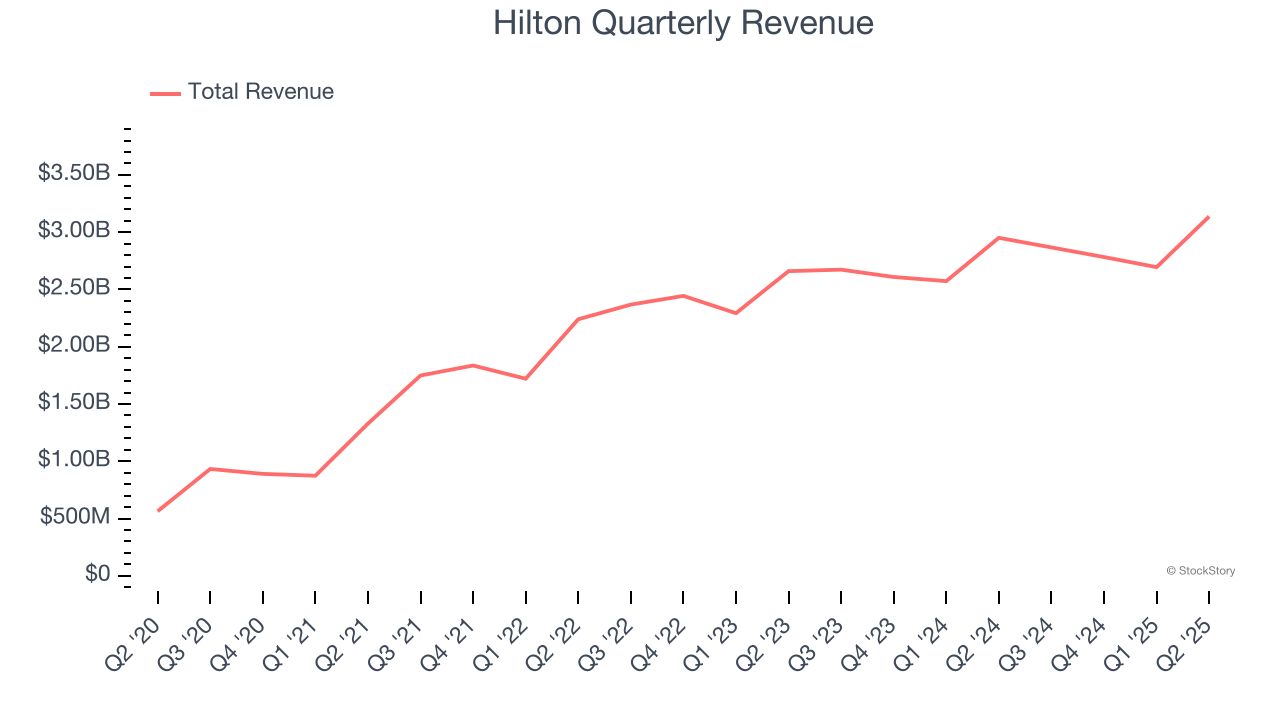

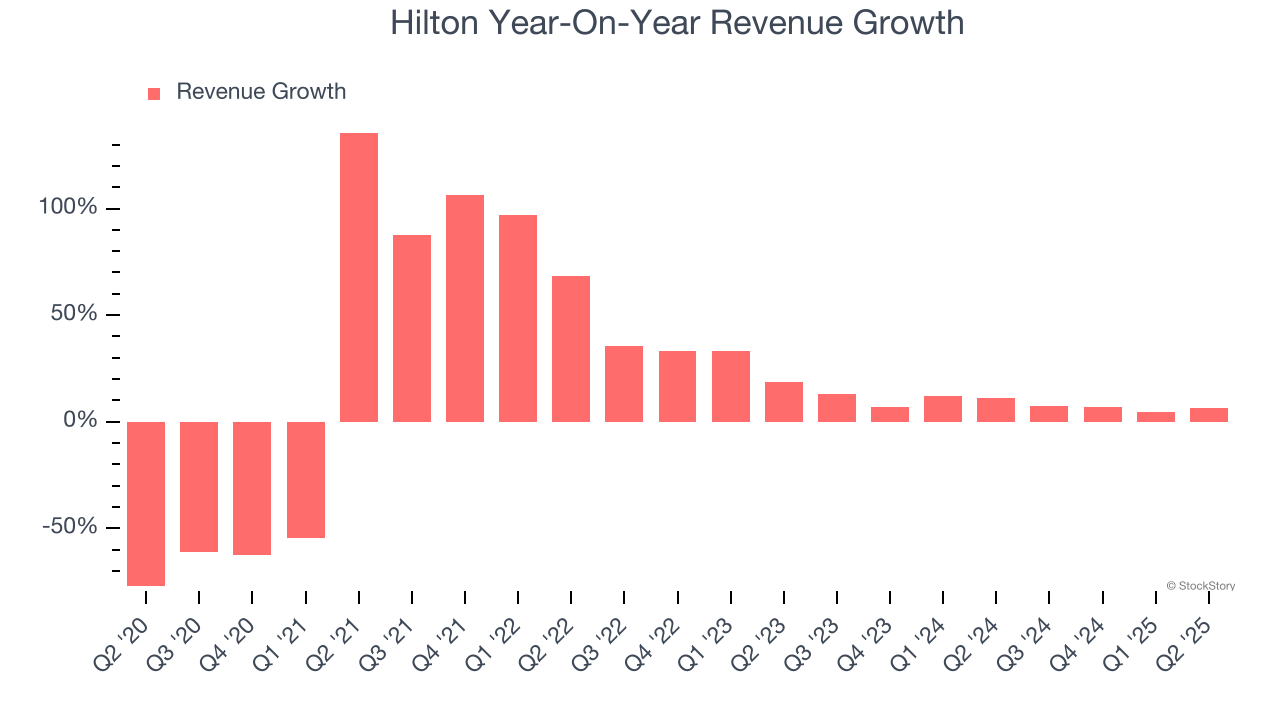

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Hilton’s sales grew at a tepid 9.6% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Hilton’s recent performance shows its demand has slowed as its annualized revenue growth of 8.4% over the last two years was below its five-year trend.

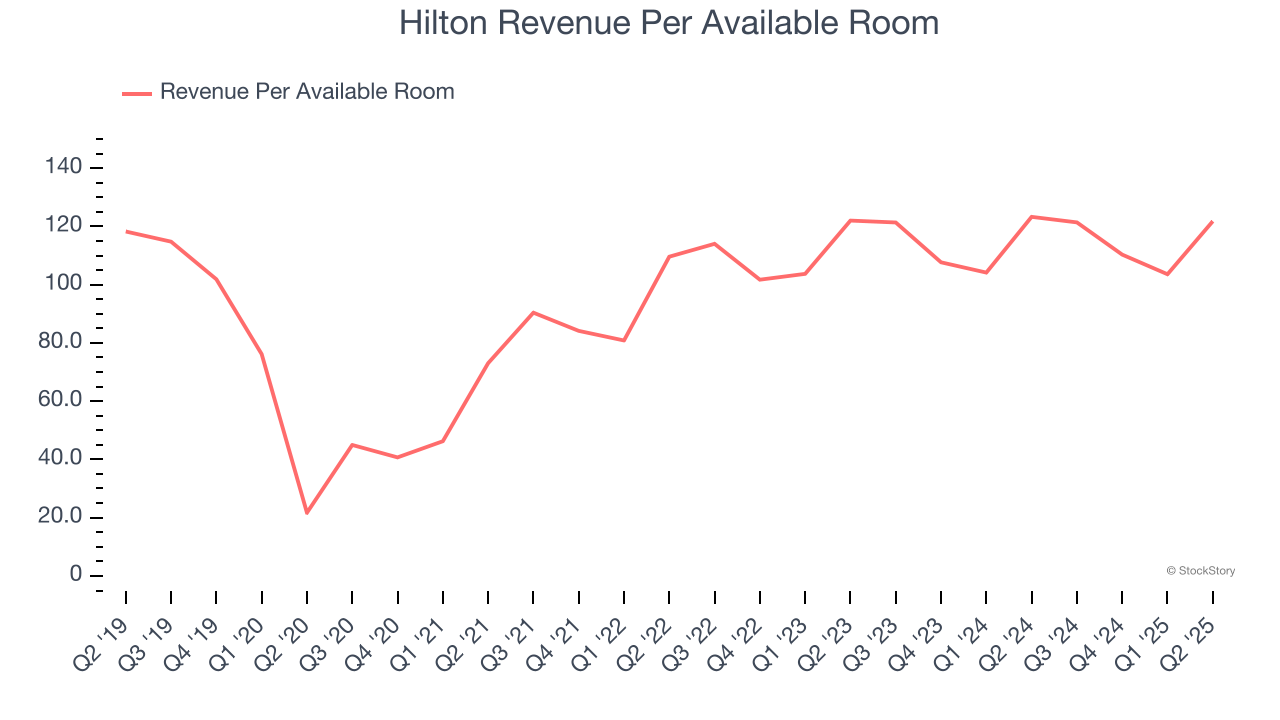

We can better understand the company’s revenue dynamics by analyzing its revenue per available room, which clocked in at $121.79 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Hilton’s revenue per room averaged 1.8% year-on-year growth. Because this number is lower than its revenue growth, we can see its sales from other areas like restaurants, bars, and amenities outperformed its room bookings.

This quarter, Hilton reported year-on-year revenue growth of 6.3%, and its $3.14 billion of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hilton’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 21.3% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Hilton generated an operating margin profit margin of 24.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

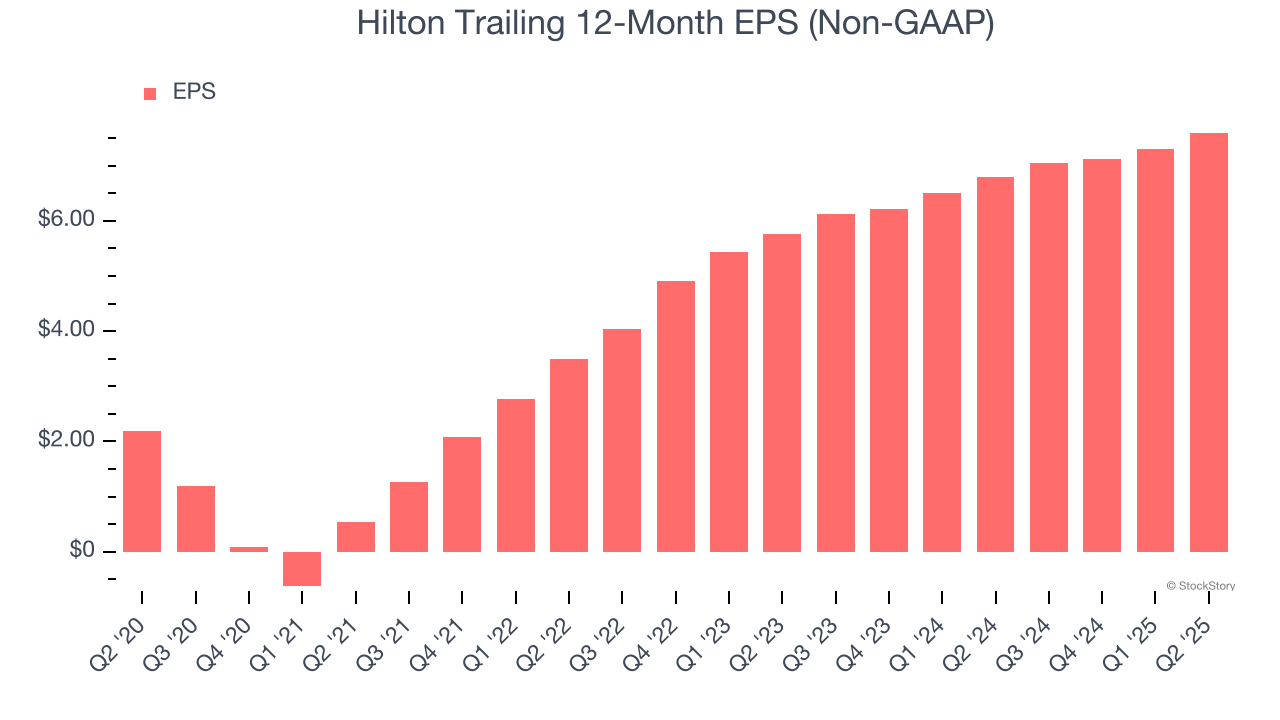

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hilton’s EPS grew at an astounding 28.4% compounded annual growth rate over the last five years, higher than its 9.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Hilton reported EPS at $2.20, up from $1.91 in the same quarter last year. This print beat analysts’ estimates by 7.8%. Over the next 12 months, Wall Street expects Hilton’s full-year EPS of $7.60 to grow 9.9%.

It was encouraging to see Hilton beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Zooming out, we think this was a mixed quarter. The guidance missed seems to be weighing on shares, and the stock traded down 1% to $271.25 immediately following the results.

Big picture, is Hilton a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite