|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

RH RH stock jumped 18.5% in the past month, outperforming the Hoya Capital Housing ETF (HOMZ) index, as evidenced by the chart below. HOMZ is an exchange-traded fund that offers a diversified glimpse of the U.S. residential housing industry through 100 companies across homebuilding, rental operators, home improvement, furnishings, mortgage services and real estate tech, to name a few.

This luxury retailer in the home furnishing space seems to be gaining from all the investments it is undertaking across its brand portfolio amid the guarded improvements in the Furniture & Home Furnishing business space. Moreover, the global expansion efforts and supply-chain optimization are adding to its uptrend, creating room for prospective business scale and margin expansion.

Owing to the external and internal tailwinds, RH outshone a few of its market competitors, including Williams-Sonoma, Inc. WSM, Arhaus, Inc. ARHS and The Lovesac Company LOVE. In the past month, the share price performance of Williams-Sonoma, Arhaus and Lovesac Company indicates 16.3%, 12% and 5.1% growth, respectively.

However, even if the industry tailwinds are moving in favor of RH, it is not immune to the housing market uncertainties and tariff-related risks lingering across the United States.

Favorable Market Trends: RH specializes in the luxury home furnishing space and the recent industry-wide improvements witnessed in the Furniture & Home Furnishing business magnify the optimism surrounding its near and long-term growth visibility. Per the recent report by the U.S. Census Bureau on July 17, 2025, sales in the Furniture & Home Furnishing business in June 2025 grew 4.5% year over year, marking the growth prospects in the upcoming period.

With this trend ongoing, RH remains well-positioned to meet its fiscal 2025 revenue guidance, which is expected to grow year over year between 10% and 13%.

Global Expansion Efforts: With the domestic market facing turbulence, RH is strategically cashing out the international market. It is witnessing robust demand trends in the international market, especially Europe, wherein demand grew 60% across RH Munich and RH Dusseldorf in the first quarter of fiscal 2025. Besides, demand acceleration in the noncomparable galleries, RH Brussels and RH Madrid, has boosted its confidence in strategizing further expansion in the European market.

Currently, RH is optimistic about its opening in Paris, with the gallery on the Champs Élysées, which is expected to open in September 2025, alongside another two openings in London and Milan in 2026. Buoyed by these trends, the company expects to continue making meaningful investments to support international expansion moving forward. Notably, in the upcoming years, RH expects to open RH Sydney, The Gallery in Double Bay, in Australia.

Resourcing Strategies: With the ongoing tariff-related risks in the market, RH is positioning itself to weather the storm when it arrives. The company recently highlighted that it is currently focusing on shifting its sourcing out of China with the expectation of receipts reducing from 16% in the first quarter of fiscal 2025 to 2% in the fourth quarter of the same year. Besides, it has successfully resourced a significant portion of its upholstered furniture to its North Carolina factory. By the end of 2025, it projects 52% of its upholstered furniture to be produced in the United States and 21% in Italy.

RH stock is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 17.55X. This is compared with the forward 12-month P/E ratios of 20.98X, 21.61X and 17.61X at which Williams-Sonoma, Arhaus and Lovesac Company are currently trading. The discounted valuation of the stock, compared with two of the other market players, looks promising for investors.

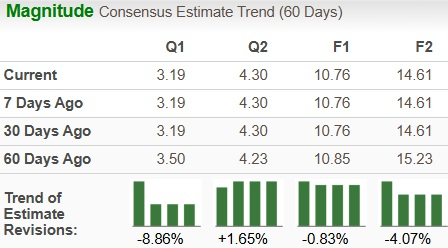

RH’s earnings estimates for fiscal 2025 and 2026 have trended downward in the past 60 days to $10.76 and $14.61 per share, respectively. However, the revised estimates indicate year-over-year growth of 99.6% and 35.8%, respectively.

The current uncertainties in the housing market and global unrest have induced bearish sentiments among analysts. However, the favorable year-over-year comparisons indicate that, despite the external risks, RH will be able to capitalize on its in-house business strategies and ensure incremental prospects.

Housing Market Softness: The housing market directly influences the revenue visibility and profitability of RH, given its business type. With the current housing market softness in the United States, the benefits from the domestic market seem depressed for the company. As homebuyers are navigating through affordability concerns due to a still-high mortgage rate scenario, new home sales remain suppressed, with renovation activities being on the dimmer side due to the inflationary pressures.

Tariff Concerns: The ambiguity surrounding the new tariff regime and the prospective challenges to be faced once fully implemented concern RH. During the earnings call of the first quarter of fiscal 2025, the company highlighted the adverse impacts it faced due to the significant and unexpected Liberation Day tariffs announced on April 2, 2025. It believes that this sudden surge is likely to hurt its second quarter of fiscal 2025 revenues by six percentage points, accompanied by ripple effects into order fulfillment and shipping.

As discussed above, RH is undergoing strategic efforts to weather the market uncertainties in the form of tariff-related risks, inflationary pressures and housing market softness. Given the nature of its business, RH is grappling with the current softness in the U.S. housing market.

However, the recent growth trends witnessed in the Furniture & Home Furnishing business space are encouraging for RH’s upcoming prospects. Moreover, its in-house efforts in international expansion, supply-chain optimization and portfolio enhancements are expected to partially offset the negative impacts in the near term. In the long term, these tailwinds are expected to boost RH’s revenue visibility and expand margins, once they reach full potential.

Before taking any decisions regarding RH stock, investors must weigh both sides of the market currently. Thus, based on the discussion, it is prudent for existing investors to retain this Zacks Rank #3 (Hold) company’s shares for now, whereas new investors might want to wait for a more favorable entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite