|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Goldman Sachs Group GS, which released second-quarter 2025 results on July 16, posted strong growth in its investment banking (IB) business. This led the company’s profit to rise 22% year over year. The primary driver for strong IB business was a rebound in deal-making activities.

Global mergers and acquisitions (M&As) in the second quarter of 2025 were impressive than previously expected. While markets plunged at the start of the second quarter as Trump announced sweeping tariffs, deal-making gained momentum in the latter part of the quarter following clarity on several macroeconomic matters. This supported Goldman’s IB business.

IB fees jumped 26.6% year over year to $2.19 billion in the second quarter of 2025. Specifically, advisory revenues rose a whopping 71% year over year to $1.2 billion. Revenues in Debt underwriting increased 1.5% and net revenues in Equity underwriting grew nearly 1%. The company maintains its long-standing #1 rank in announced and completed M&As, and has ranked #2 in equity underwriting.

Likewise, JPMorgan’s JPM IB fees were up 7% from the prior-year quarter. Alternatively, Morgan Stanley MS reported a 5% decline in total IB fees in the second quarter of 2025.

A solid financial performance of the corporates, buoyant equity markets and expected rate cuts this year, along with the leadership position, lent Goldman an edge over its peers.

Given its strong IB performance, many investors must be tempted to buy the GS stock. But is it the right time? Let us delve deeper and analyze other factors at play.

Focus on Core Business: GS is making efforts to exit non-core consumer banking business and sharpen its focus on areas wherein it holds a competitive edge — IB, trading, and asset and wealth management (AWM).

Goldman has received a proposal from Apple to end their consumer banking partnership, according to The Wall Street Journal. A Reuters report from January 2025 suggests the split could occur well before the contract’s 2030 expiration, affecting the Apple Card and Apple Savings account.

In 2024, Goldman divested its GM credit card business and GreenSky, its home-improvement lending platform. In 2023, the company sold its Personal Financial Management unit. These moves demonstrate a well-thought-out exit from consumer finance, allowing the company to reallocate capital and attention toward higher-margin, more scalable businesses.

This strategic shift is benefiting the AWM division, which now plays a crucial role in the company’s long-term growth. The segment is expanding into fee-based revenue streams to help offset the volatility of the IB business. As of June 30, 2025, it managed $3.3 trillion in assets under supervision, and is experiencing strong momentum in alternative investments and customized wealth solutions for ultra-high-net-worth individuals.

In the first half of 2025, Goldman reported significant net inflows into its wealth management platform, providing solid evidence of the segment’s increasing market traction and client confidence.

GS is placing more emphasis on its AWM division, viewing it as a more stable revenue source. The company is reportedly exploring acquisitions to expand its AWM footprint. During the second-quarter earnings call, management highlighted the critical role of scale in growing this business. CEO David Solomon noted, “There’s got to be a strategic fit in terms of things that we’re prioritizing in the growth of our asset and wealth management franchise.”

Strong Liquidity Profile: GS maintains a fortress balance sheet, with the Tier 1 capital ratios well above regulatory requirements. This financial strength allows it to return capital to shareholders aggressively through buybacks and a healthy dividend yield (1.67%).

As of June 30, 2025, cash and cash equivalents were $153 billion, and near-term borrowings were $69 billion. Given its strong liquidity, the company rewards its shareholders handsomely.

Post-clearing the 2025 Fed stress test, the company increased the quarterly dividend to $4.00 per common share, marking an increase of 33.3% from the prior payout. In the past five years, the company has hiked dividends five times, with an annualized growth rate of 22%. Currently, its payout ratio sits at 26% of earnings.

Meanwhile, JPMorgan raised its dividend five times over the past five years, with a payout ratio of 29%. Morgan Stanley raised its dividend five times over the past five years and has a payout ratio of 42%.

Additionally, Goldman has a share repurchase plan in place. In the first quarter of 2025, the board of directors approved a share repurchase program authorizing additional repurchases of up to $40 billion of common stock. In February 2023, GS announced a share repurchase program, authorizing repurchases of up to $30 billion of common stock with no expiration date. At the end of the second quarter of 2025, GS had $40.6 billion worth of shares available under authorization.

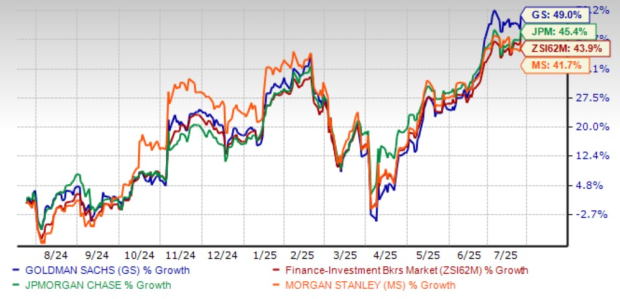

GS shares have jumped 49% over the past year, outperforming the industry's 43.9% rise. Its peers, JPMorgan and Morgan Stanley shares, rose 45.4% and 41.7%, respectively, over the same time frame.

Price Performance

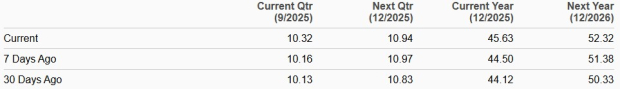

Over the past month, the Zacks Consensus Estimate for 2025 and 2026 earnings has been revised upward to $45.63 and $52.32, respectively. The Zacks Consensus Estimate for Goldman’s 2025 and 2026 earnings implies year-over-year growth of 12.4% and 14.4%, respectively.

Estimates Revision Trend

Goldman has delivered outstanding returns over the past year, driven by growth initiatives, strong capital returns and an improving wealth management business. The rebound in M&As and robust deal pipeline will continue to support the company’s IB business. Its strong liquidity profile will enable a sustainable capital distribution plan.

In terms of valuation, the GS stock looks inexpensive. The stock is trading at forward price/earnings (P/E) of 14.66X compared with the industry average of 14.81X. Then again, Goldman’s stock is trading at a discount to its peers, JPMorgan and Morgan Stanley, which have forward P/E multiples of 15.12X and 15.64X, respectively.

Price-to-Earnings F12M

However, the constantly evolving macroeconomic backdrop, given uncertainty related to tariff plans and their impact on inflation, will likely affect the company’s performance. Also, IB business remains cyclical and highly dependent on broader market conditions and client engagement.

Hence, GS’ performance in the near term will be greatly influenced by its capacity to navigate these challenges to maximize financial performance. Investors should keep a close eye on these issues before taking a well-informed investment decision.

However, it remains a strong long-term holding for investors looking for exposure to a diversified, well-capitalized financial giant. At present, Goldman carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite