|

|

|

|

|||||

|

|

TSMC generated $30 billion in revenue in Q2, signaling robust demand for its 3nm and 5nm chip nodes.

While revenue is soaring, profits are rising even faster thanks in part to widening gross margins.

Spending on AI infrastructure is expected to reach trillions of dollars over the next several years.

Earnings season is upon us! Last week, Taiwan Semiconductor Manufacturing (NYSE: TSM) reported financial and operating results for the second quarter of 2024. Let's explore the Q2 report from TSMC (as the company is known for short).

From there, I'll dive into some broader industry trends to help explain why the company's latest quarterly result was so impressive, and more importantly, how it is set up for even further growth in the long run.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

TSMC is a major supplier for leading chip companies such as Nvidia, Advanced Micro Devices, and Broadcom. Moreover, the company's reach extends beyond traditional semiconductor businesses since it has also forged strong relationships with tech giants Apple and Amazon.

During the second quarter, the company generated more than $30 billion in sales, thanks in large part to continued robust demand for the company's 5nm and 3nm chip nodes.

TSM Revenue (Quarterly) data by YCharts; EPS = earnings per share.

While the company's revenue grew 44% year over year, steadily improving gross margins and a disciplined cost structure fueled even more acceleration for its bottom line. During the second quarter, earnings per share (EPS) were roughly $2.50 -- representing nearly 61% growth year over year.

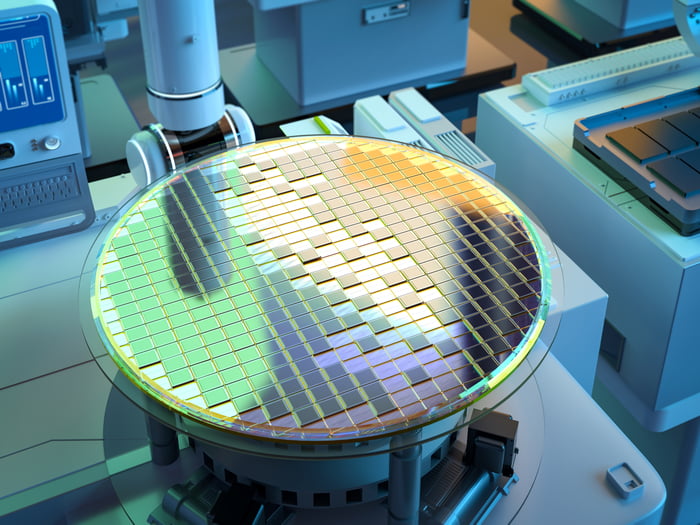

Image source: Getty Images.

In 2025 alone, cloud hyperscalers Microsoft, Alphabet, and Amazon, in combination with social media empire Meta Platforms, are expected to collectively have up to $330 billion in capital expenditures (capex). Taking this one step further, management consulting firm McKinsey & Company forecasts that investments in AI infrastructure -- which include data center buildouts and chips -- are expected to reach $6.7 trillion by next decade.

With TSMC producing more than 40% revenue growth with an estimated 60% of the global chip foundry market, it appears well-positioned to capitalize on these secular tailwinds and acquire even more market share over the next several years.

TSM Revenue Estimates for Current Fiscal Year; data by YCharts.

To me, the simplest explanation of the blowout earnings report is that AI demand is not only strong, but it's also accelerating. While growth will fluctuate from quarter to quarter, I don't really see TSMC as a cyclical semiconductor stock at this point.

Rather, the capex and infrastructure trends referenced above underscore how crucial AI growth is to the global economy at this point. The chipmaker's leading foundry services across edge devices, high-performance computing (HPC), and AI accelerators are at the center of this secular evolution.

Despite the company's jaw-dropping growth and robust outlook, TSMC trades at a forward price-to-earnings multiple (P/E) of just 24. Not only is this much lower than historical levels, but it is also a meaningful discount to many other leading chip stocks, too.

While skeptics may cite the cyclicality of the chip market or potential geopolitical tensions with China as part of the bear narrative, I think TSMC's current financial profile and its future trajectory speak for themselves regardless of these risks.

In my eyes, the disconnect between the company's valuation and its underlying business fundamentals could suggest that investors may not fully understand or appreciate the importance of its role in the broader chip ecosystem.

I see TSMC stock as a no-brainer right now, and I think the company's price action suggests it is undervalued. Investors with a long-run time horizon might want to consider scooping up shares and holding on tight as the infrastructure chapter of the AI story continues to be written. Taiwan Semiconductor Manufacturing is uniquely positioned to ride these tailwinds and sustain high levels of revenue and profit growth for years to come.

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,774!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,064,942!*

Now, it’s worth noting Stock Advisor’s total average return is 1,040% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

TSM

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite