|

|

|

|

|||||

|

|

Both CoreWeave CRWV and Amazon AMZN, through the Amazon Web Services platform, provide cloud infrastructure tailored for AI workloads.

CoreWeave provides specialized GPU-accelerated infrastructure for AI through its 33 data centers, supported by 420 megawatts of active power, spread across the United States and Europe. It recently announced a $6 billion investment to set up a new data center in Lancaster, PA, with an initial capacity of 100 megawatts (MW) and a potential to scale up to 300MW. On the other hand, Amazon’s AWS is a structurally dominant force in the cloud space (and is also making aggressive inroads in the AI infra space) and commands a leading share of the cloud market, followed by Microsoft and Google Cloud.

Increased spending on AI infrastructure benefits both Amazon and CoreWeave, but not equally. So, if an investor wants to make a smart buy in the AI infrastructure space, which stock stands out?

Let’s break down how each company is performing and which one looks like the better investment right now.

CoreWeave is well-positioned to gain from the AI infrastructure boom. In the last earnings call, management highlighted that AI is forecasted to have a global economic impact of $20 trillion by 2030, while the total addressable market is anticipated to increase to $400 billion by 2028.

Strategic partnerships with major players like OpenAI and NVIDIA bode well, along with a massive $259 billion revenue backlog. Apart from a $11.9 billion deal with OpenAI, CRWV has added several new enterprise customers and a hyperscaler client. It has signed expansion agreements with many customers, including a $4 billion expansion with a big AI-enterprise customer. CRWV added that the $4 billion expansion agreement signed with a big AI client will be reflected in revenue backlog beginning in the second quarter.

Apart from scaling capacity and getting adequate financing for infrastructure, CRWV is also expanding its go-to-market capabilities. Moreover, the buyout of the Weights and Biases acquisition has added 1,400 AI labs and enterprises as clients for CoreWeave.

The stock has declined sharply post its announcement of $9 billion takeover of Core Scientific. Since the announcement on July 7, CRWV has lost nearly 25%. Apart from scrutiny surrounding the company’s latest acquisition bid, it also faces other headwinds. CRWV’s aggressive capital deployment strategy is a key concern. CRWV expects capex to be between $20 billion and $23 billion for 2025 due to accelerated investment in the platform to meet customer demand. High capex, even with a success-based model, exposes CoreWeave to execution risks if contract revenue does not materialize on time.

CoreWeave’s aggressive data center buildout is being funded in part by debt, leading to ballooning interest expenses, which can exert pressure on the adjusted net income and potentially affect free cash flow generation. Stiff competition from the likes of AWS and Azure, and intense customer concentration risk remain concerning. CoreWeave’s 77% of total revenues in 2024 came from the top two customers.

AWS is the market leader in the cloud compute space and is now aggressively moving into AI infrastructure. To stay ahead of rivals, Amazon has launched custom AI chips (Trainium and Inferentia) and strengthened partnerships with the likes of NVIDIA while forging new collaborations with other AI developers to train and deploy models on AWS. AWS revenues surged 17% year over year in the first quarter of 2025, with an annualized revenue run rate pegged at $117 billion. AWS backlog reached $189 billion with a 4.1-year weighted average life, offering forward revenue visibility.

In the last reported quarter, AWS signed new agreements with major companies, including Ericsson, Adobe, Uber Technologies, Nasdaq, Fujitsu and many others. Amazon highlighted that more than 85% of global IT spending is still on-premises, suggesting immense growth potential for AWS. Its increasing investments in generative AI are likely to continue aiding it in gaining momentum among cloud customers in the near term.

More importantly, Amazon's AI business segment now operates at a multi-billion-dollar annual revenue run rate with triple-digit percentage growth year over year. Amazon's strategy focuses on custom silicon development, particularly its Trainium 2 chips, which offer 30-40% better price performance compared to GPU-based instances. The company has also expanded its AI model offerings through Amazon Bedrock and introduced services like Amazon Nova foundation models. AMZN has added the latest foundation models in Amazon Bedrock, including Anthropic’s Claude 3.7 Sonnet, Meta’s Llama 4 family of models, DeepSeek’s R1 and Mistral AI’s Pixtral Large.

AMZN is ramping up investment to build its technology infrastructure, primarily related to AWS and for custom silicon like Trainium. Moreover, its diversified businesses and stupendous financial resources give it an edge. As of March 31, 2025, cash and cash equivalents were $66.2 billion, while operating cash flow generated in the first quarter stood at nearly $17 billion.

However, capacity constraints pose a challenge. Amazon has indicated that AI demand currently outstrips available capacity, suggesting the company could drive higher revenues with additional infrastructure. The intense competition from Microsoft’s Azure and Google Cloud is concerning. Heavy capex spend could strain margins if AI returns do not materialize.

Over the past month, AMZN shares have gained 6.9% while CRWV stock has lost 24.1%.

Valuation-wise, both Amazon and CoreWeave are overvalued, as suggested by the Value Score of D and F, respectively.

In terms of Price/Book, CRWV shares are trading at 30.22X, lower than AMZN’s 8.06X.

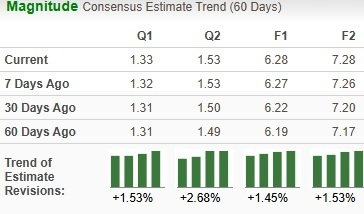

Analysts have kept their earnings estimates unchanged for CRWV's bottom line for the current year.

For AMZN, there is a marginal upward revision.

Amazon remains a more stable and diversified AI cloud/infra bet, with AWS as a high growth engine. AWS is well poised to benefit from AI demand at a massive scale, as it aggressively improves on specialization. CRWV gains from niche specialization in AI infrastructure and strategic alignment with major AI players, but is capital-intensive.

AMZN currently sports a Zacks Rank #1 (Strong Buy) while CRWV has a Zacks Rank #4 (Sell).

If investors are seeking an AI infrastructure stock with long-term growth potential, Amazon is a better pick in terms of Zacks Rank.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 26 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite