|

|

|

|

|||||

|

|

McDonald's Corporation MCD stock has gained 7.8% in the year-to-date period, outperforming the Zacks Retail-Restaurant industry, the broader Retail-Wholesale sector and the S&P 500 index. The detailed price performance of the industry players is shown in the chart below.

After hitting a pause due to the catastrophic E. coli outbreak announcement, this leading fast-food chain has bounced back due to favorable customer trends after it advocated food safety as its prime priority. By immediately removing the supplier from the supply chain, due to which it faced severe backlash, McDonald's was able to reinstate the consumers’ confidence. Besides this, the effective implementation of its in-house initiatives like the Accelerating the Arches strategy, menu innovation, value offerings and global expansion strategies has been supporting the company’s uptrend.

The industry MCD operates in is highly competitive and maintaining a recognized position in the market is a strenuous task. Backed by favorable tailwinds, the company has notably outperformed a few of the recognized industry players, including Restaurant Brands International Inc. QSR, The Wendy's Company WEN and Chipotle Mexican Grill CMG, year to date. During the said time frame, the stock price of Restaurant Brands gained 5.5% while Wendy's and Chipotle shares have tumbled 7.9% and 15.5%, respectively.

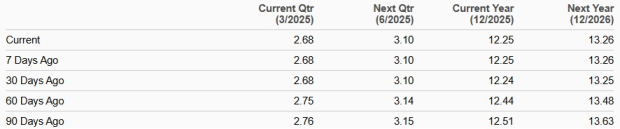

As observed in the chart below, the 2025 earnings estimate revision of McDonald's has trended upward 0.1% in the past 30 days. The year’s earnings estimate trend indicates 4.5% year-over-year growth, reflecting the optimistic views of the analysts, driven by the trends in favor of the company.

EPS Trend

McDonald’s is the world’s largest chain of fast-food restaurants, with a presence in more than 100 countries. Increasing guest counts remain the company’s top priority and it intends to regain customers by focusing on food quality, convenience and value. The brand recognition has helped the company gain positive results in its Arches campaign strategies, especially Accelerating the Arches, initiated in its top markets across the globe, thereby driving growth.

Notably, MCD’s focus on enhancing its core menu and ensuring value offerings has been driving its prospects. In January 2025, it launched its McValue platform in the United States to provide consistency and compelling customers with flexibility over choices. By the first quarter of 2025 end, the company aims to enhance its value programs across several international markets to increase customer engagement and foster traffic growth. Similar to the company, industry players like Chipotle and Wendy's are witnessing favorable customer responses to menu innovation and pocket-friendly offerings.

Another growth driver of MCD is its focus on expanding its global footprint. It believes that there is a huge opportunity to grow all its brands globally by expanding its presence in existing markets and entering new ones. McDonald’s plans to open approximately 2,200 restaurants globally in 2025, with a quarter of these new openings in its US and IOM segments. It targets to open 50,000 restaurants by 2027. Global expansion effort is one of the prime growth-driving strategies in this competitive industry as Restaurant Brands is also witnessing growth across its reportable brands through strong store development.

Furthermore, McDonald’s increased focus on delivery, fostering digital penetration and offering a robust loyalty program also bode well. The company expects to increase the percentage of system-wide delivery sales originating from its mobile app to 30% by 2027. Since the launch of its loyalty program, the total number of 90-day active users has reached more than 170 million. In 2024, the system-wide sales to loyalty members were about $30 billion. MCD anticipates reaching 90-day active users of 250 million with $45 billion in annual loyalty system-wide sales by the end of 2027.

The company’s current valuation is enticing for investors to look into it. MCD stock is currently trading at a discount compared with the industry peers on a forward 12-month price-to-earnings (P/E) ratio basis. The discounted valuation indicates that, despite the recent stock price increase so far this year, it remains an attractive option for investors looking for a suitable entry point.

As the company paves through 2025, the lingering macroeconomic factors and inflationary pressures remain concerns.

Softer demand patterns in France, the United Kingdom and China are expected to restrict the company’s comps growth. In 2024, its global comps inched down 0.1% against 9% growth in the prior year. Furthermore, high wage inflation and elevated commodity costs are going to pressure the margins for some time. In 2025, the company expects commodity costs and food, paper and labor inflation to impact margins to some extent.

Analysts are optimistic about MCD. Out of 37 recommendations contributing to the company’s Average Brokerage Recommendation (ABR), 22 have rated the stock as a Strong Buy and two have rated it as a Buy, leading to an impressive ABR of 1.74 (representing 59.5% and 5.4% of all recommendations, respectively). A month ago, Strong Buy represented 58.3%. Wall Street’s average price target for MCD stock is $331.1 per share, implying a potential upside of 5.9% from recent levels.

Per the discussion above, the company is witnessing a boost in its performance thanks to its in-house initiatives, including menu innovation, value offerings, a robust loyalty program and a focus on delivery sales through its mobile app. By increasing the digital penetration among its customers, MCD is expected to bolster its sales trends globally.

However, headwinds in the form of ongoing macroeconomic uncertainties and inflationary pressures are pressuring its margins to a certain extent. Also, softer comps trends in a few of the major international markets are off-putting as well.

Thus, by considering both sides of the coin, it is prudent for existing investors to hold on to this Zacks Rank #3 (Hold) company’s shares for now, whereas new investors might want to wait for a more favorable entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours |

Cava Fourth-Quarter Sales Rise on Higher Prices, New Restaurant Openings

CMG

The Wall Street Journal

|

| 2 hours | |

| 3 hours |

Wendy's CEO says chain may close more locations. How many are in Tennessee?

WEN

The Commercial Appeal

|

| 4 hours | |

| 7 hours | |

| 8 hours | |

| 10 hours | |

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Sinks As EU Makes Trump Tariff Move; IBM Dives On This AI Threat (Live Coverage)

MCD

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite