|

|

|

|

|||||

|

|

Rocket Lab USA RKLB continues to solidify its position as a leading player in dedicated small satellite launches with its latest successful deployment of eight satellites for OroraTech, a global wildfire detection company based in Germany. The latest mission, launched from New Zealand, highlights Rocket Lab’s rapid execution and reliability, key factors that make it an attractive investment.

With 21 satellites deployed, thanks to its Electron launch vehicle, Rocket Lab’s increasing launch cadence demonstrates strong operational efficiency and growing market demand in the first quarter of 2025.

Such consistent performance of this company in small satellite launching space might lure investors seeking exposure to the rapidly growing space industry to add RKLB stock to their portfolio. However, before making any hasty decision, let’s delve into the company’s performance over the past year, growth opportunities and investment risks (if any). This way, investors can make an informed decision.

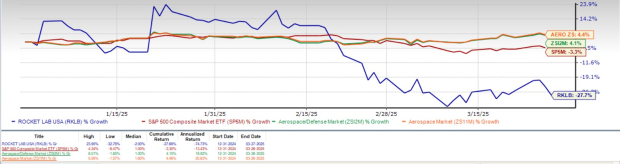

Rocket Lab’s shares have plunged 27.7% in the year-to-date period, underperforming the Zacks aerospace-defense industry’s growth of 4.1%. It has also lagged the broader Zacks Aerospace sector’s rise of 4.4% as well as the S&P 500’s decline of 3.3% in the same time frame.

A similar disappointing performance is delivered by other space stocks, such as Virgin Galactic SPCE and Intuitive Machines LUNR, whose shares have lost 44.7% and 54.4%, respectively, year to date.

A handful of factors that played against RKLB, including its poor financial outlook, along with some major allegations against the company in misleading its investors, might have hurt market sentiment about its growth prospect in recent times. This, in turn, is likely to have caused a plunge in RKLB’s share price in the year-to-date period.

Evidently, in February 2025, Rocket Lab reported fourth-quarter results. It also declared its first-quarter 2025 revenue guidance of $117-$123 million, which fell short of the majority of analysts’ estimates. This might have raised investor concerns about the stock’s near-term growth prospects, which got duly reflected in its share price performance.

In the same month, Bleecker Street Research published a report accusing Rocket Lab of misleading investors about the likelihood of its Neutron rocket launch in mid-2025. The report revealed that the company’s plans for three barge landing tests, originally scheduled to occur between September 2024 and March 2025, had been pushed back to at least September 2025 and could occur as late as March 2026.

The report further revealed significant delays in preparing RKLB’s launch pad, including a potable water issue that was not scheduled to be resolved until January 2026.

In a more recent press release, it has been announced that a securities class action lawsuit has been filed against Rocket Lab USA, citing that the company failed to disclose the aforementioned delays to its investors as well as the fact that the only contract for its Neutron launch vehicle was made at a discount with an unreliable partner.

According to a World Economic Forum report from April 2024, the space economy may reach $1.8 trillion by 2035, driven by the increasing adoption of satellite and rocket-enabled technologies. This outlook strengthens long-run growth prospects of space stocks like LUNR, SPCE and RKLB,. Notably, RKLB’s Electron launch vehicle ranking as the second most frequently launched orbital rocket by U.S. companies.

However, considering the fact that the company failed to disclose significant updates like the aforementioned one to its investors, market sentiment regarding its share price performance might remain soft for the time being.

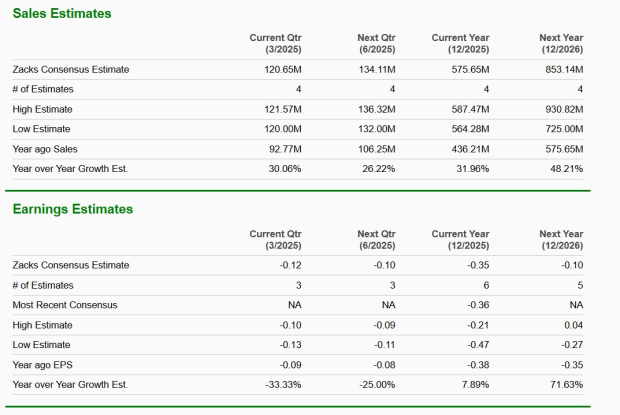

A quick sneak peek at its near-term estimates mirrors mixed growth prospects.

The Zacks Consensus Estimate for RKLB’s 2025 and 2026 sales suggests an improvement of 31.9% and 48.2%, respectively, year over year.

A look at its 2024 and 2025 earnings estimates suggests a similar year-over-year improvement.

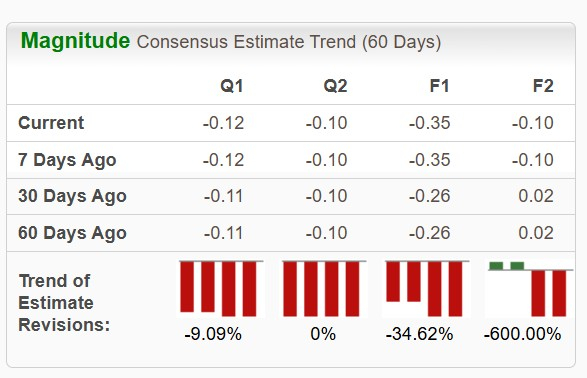

However, its first and second-quarter 2025 earnings estimates reflect a year-over-year decline, most probably due to the litigation costs and other operating expenses RKLB might incur in connection to the aforementioned delay in its vital programs. The downward revision of its first quarter and full-year 2025 estimates further indicates the declining confidence of investors in this stock’s earnings growth prospect.

While Rocket Lab presents significant long-run growth opportunities, it faces notable challenges. A key risk lies in its high operating expenses, caused by investments in innovations like the Neutron launch vehicle, Electron’s first-stage recovery, advanced spacecraft capabilities and an expanded portfolio of components. These expenses often offset revenue gains, leading to losses, as evident from its recent quarterly reports.

Rocket Lab anticipates rising operating costs for the future, and if revenue growth fails to match these cost increases, profitability may remain elusive. Additionally, the delays that RKLB is currently facing, as mentioned above, along with the potential complications it may encounter in designing, manufacturing, and commercializing new technologies, could adversely impact Rocket Lab’s financial performance and prospects.

In terms of valuation, RKLB’s forward 12-month price-to-sales (P/S) is 13.02X, a premium to its industry’s average of 1.59X. This suggests that investors will be paying a higher price than the company's expected sales growth compared to that of its industry.

Other space stocks, LUNR and SPCE, are also trading at a premium when compared to the industry average, in terms of their forward P/S ratio. While SPCE has a P/S ratio of 6.36, LUNR has 3.48.

To conclude, investors interested in Rocket Lab should wait for a better entry point, considering its premium valuation, poor year-to-date share price performance and the challenges it is facing in terms of lawsuit in relation to program delays. The stock holds a VGM score of F, which is also not a very favorable parameter for buying a stock.

The stock’s Zacks Rank #4 (Sell) further support our thesis.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite