|

|

|

|

|||||

|

|

Amazon AMZN stock has seen a sharp rebound in the last three months, surging more than +20% to help lead the unprecedented recovery among the broader indexes.

That said, with tariff uncertainty starting to become somewhat benign in regard to affecting the stock market, Amazon stock looks poised to keep soaring ahead of its Q2 results on Thursday, July 31.

Keeping this in mind, let’s take a look at Amazon’s Q2 growth expectations and a few catalysts that could keep lifting AMZN shares from here.

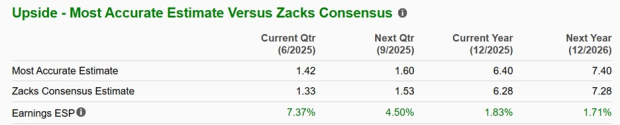

As a brief preview, Amazon’s Q2 sales are thought to have increased 9% to $162.28 billion compared to $147.98 billion a year ago. On the bottom line, Amazon’s Q2 earnings are expected to be up 8% to $1.33 per share from EPS of $1.23 in the prior period. Notably, Amazon has exceeded the Zacks EPS Consensus for 10 consecutive quarters with a very impressive average earnings surprise of 20.68% in its last four quarterly reports.

More intriguing, the Zacks ESP (Expected Surprise Prediction) indicates Amazon could keep this compelling streak of beating earnings expectations going with the Most Accurate and recent estimate among Wall Street analysts having Q2 EPS pegged at $1.42 and 7% above the underlying Zacks Consensus (Current Qtr below).

As reason to believe Amazon could offer very favorable guidance for Q3, the e-commerce giant’s Prime Day event has been stretched to four days (July 8-11) and recently shattered previous records. Being Amazon’s largest sales event on record, U.S. online sales for what could now be deemed as "Prime Week" are thought to have hit $24.1 billion.

It’s noteworthy that AI-driven advertising was a large contributer. To that point, Adobe Analytics reported a 3,300% surge in AI-driven traffic during "Prime Week" after analyzing over a trillion visits to retail sites. This mind-blowing spike refers to traffic generated from generative AI tools like Amazon’s AI-powered shopping assistant “Rufus” and its revamped next-generation voice assistant “Alexa+”.

In the grand scheme of things, Amazon is focused on using AI to supercharge its cloud division, Amazon Web Services (AWS), which is still the largest cloud service ahead of Microsoft’s MSFT Azure and Alphabet’s GOOGL Google Cloud.

1. Nova models: Amazon’s proprietary generative and agentic AI models, integrated across Alexa+, shopping (Rufus), and AWS services.

2. Custom AI chips: Continued development of its own custom AI chips, including the Trainium 2 and the upcoming Trainium 3, designed to outperform traditional GPUs in cost and efficiency.

3. Amazon Bedrock: A marketplace for foundational large language models (LLMs) from leaders like Anthropic, Meta Platforms META, Mistral, and others, allowing developers to build AI apps without managing infrastructure.

4. Data Center Buildouts & Sustainability Push: New AI-ready data centers in Pennsylvania and North Carolina that are collocated with nuclear power facilities to complement investments in small modular reactors (SMRs) that power AI workloads with carbon-free electricity.

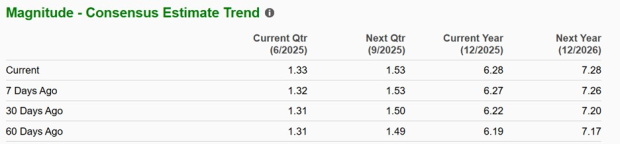

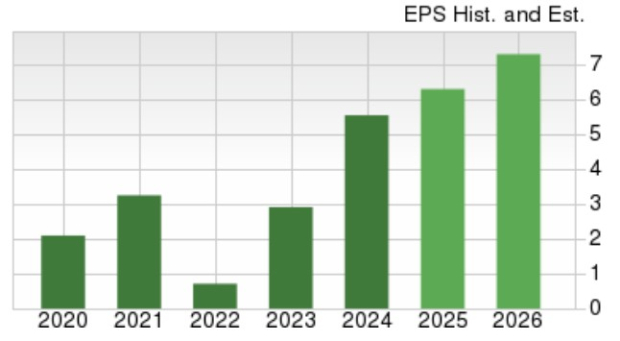

Correlating with the rebound in Amazon stock, EPS revisions have continued to trend higher in the last 60 days for fiscal 2025 and FY26. Amazon’s annual earnings are now expected to increase 13% this year and are projected to spike another 16% in FY26 to $7.28 per share.

Furthermore, following the pandemic, FY26 EPS projections would reflect 248% growth with Amazon’s post-split adjusted earnings being the equivalent of $2.09 a share in 2020. (Amazon did a 20-1 Stock Split in June of 2022).

As a reminder that Amazon's stock previously traded over $2000 a share before its most recent stock split, now appears to be an ideal time to buy AMZN before it gets more expensive.

At the moment, the Average Zacks Price Target for Amazon stock is $254, suggesting 10% upside from current levels. However, it would be no surprise if this consensus price target is eventually lifted toward $300 or higher, considering the tech giant’s businesses are starting to be streamlined by AI.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 48 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

AMZN

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite