|

|

|

|

|||||

|

|

Sysco Corporation SYY has delivered impressive fourth-quarter fiscal 2025 results, wherein both top and bottom lines increased year over year. Also, both sales and earnings surpassed the Zacks Consensus Estimate.

Sysco’s adjusted earnings of $1.48 per share surpassed the Zacks Consensus Estimate of $1.40. This figure increased 6.5% year over year.

The global food product maker and distributor reported sales of $21,138 million, which moved up 2.8% year over year. The metric beat the Zacks Consensus Estimate of $21,002 million. Currency headwinds lowered the company’s sales by $100 million.

Sysco Corporation price-consensus-eps-surprise-chart | Sysco Corporation Quote

Sysco’s gross profit rose 3.9% to $4 billion, while the gross margin improved by 19 basis points to 18.9%. At the enterprise level, product cost inflation stood at 3.5% due to higher costs in the meat and dairy categories. Fiscal fourth-quarter gross profit growth was mainly attributed to the company’s effective handling of product cost inflation.

The company’s operating expenses rose 8.2% year over year to $3.1 billion due to a goodwill impairment in the Other segment, along with investments in business capacity and sales headcount. Adjusted operating expenses increased 4.9% year over year to $2.9 billion.

Operating income declined 9% to $889 million, while adjusted operating income inched up 1.1% to $1.1 billion. We note that the adjusted operating margin decreased 9 basis points year over year to 5.2% in the quarter under review. SYY’s adjusted EBITDA increased 1.8% to $1.3 billion.

The U.S. Foodservice Operations: Sysco’s U.S. Foodservice segment faced headwinds from reduced industry foot traffic and ongoing investments in capacity and workforce, which weighed on volume performance.

Fiscal fourth-quarter sales rose 2.4% year over year to $14.8 billion, beating the consensus estimate of $14.7 billion. Total case volume declined 0.3%, whereas local case volume saw a steeper drop of 1.5%. Gross profit grew 2.8% to $2.9 billion, with the gross margin expanding by 8 basis points to 19.5%. Operating expenses increased 5.7%, while adjusted operating expenses rose 5%. Operating income declined 2% to $1 billion, and adjusted operating income dipped 0.8% to $1.1 billion.

International Foodservice Operations: Sysco’s International Foodservice segment demonstrated strong performance, supported by effective margin management, growth in local volume and double-digit profit expansion.

Sales for the fiscal fourth quarter increased 3.6% to $3.93 billion, beating the consensus estimate of $3.88 billion. On a constant-currency basis, sales rose 1% to $3.8 billion. Foreign exchange contributed $101 million to International Foodservice sales and $100 million to total Sysco sales. Excluding the impacts of the divested Mexico joint venture, International Foodservice sales grew 8.3% and total Sysco sales rose 3.7%.

Gross profit climbed 7.6% to $847 million, with the gross margin improving by 80 basis points to 21.6%. On a constant-currency basis, gross profit increased 4.2% to $820 million. FX contributed $27 million to both International and total Sysco gross profit. Operating expenses rose 4.5%, while adjusted operating expenses increased 4.3%. On a constant-currency basis, adjusted operating expenses rose 0.6%. FX added $23 million to both International and total Sysco operating expenses.

Operating income grew 26.1% to $145 million, and adjusted operating income rose 20.1% to $197 million. On a constant-currency basis, adjusted operating income increased 17.7% to $193 million. FX contributed $4 million to both international and total Sysco operating income for the quarter.

SYGMA: The segment’s sales were $2,164 million, beating the consensus estimate of $2,132.6 million and rising 5.9% year over year.

Meanwhile, the Other segment’s sales decreased 7.1% year over year to $288 million.

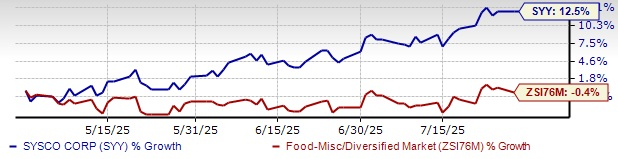

SYY Stock’s Past 3-Month Performance

This Zacks Rank #3 (Hold) company ended the quarter with cash and cash equivalents of $1.07 billion, long-term debt of $12.4 billion, and total shareholders’ equity of $1.83 billion.

Net cash provided by operating activities was $2.51 billion for the 52 weeks of fiscal 2025, while the free cash flow amounted to $1.82 billion. Capital expenditure, net of proceeds from sales of plant and equipment, was $692 million during this time.

In the 52 weeks of fiscal 2025, Sysco returned $2.3 billion to its shareholders through share buybacks worth $1.3 billion and dividends of $1 billion.

Building on the sales and adjusted EPS growth achieved in fiscal 2025, Sysco expects sales to grow 3-5% in fiscal 2026 to $84-$85 billion. Adjusted earnings per share are projected to increase 1-3% to $4.50-$4.60. This guidance includes a headwind of $100 million, or 16 cents per share, related to the prior year’s lower incentive compensation.

Excluding this impact, adjusted EPS growth is anticipated to be 5-7%, with the mid-point aligning with the company’s long-term growth targets. The focus remains on strong operational execution amid continued macroeconomic uncertainty. For fiscal 2026, the company plans to return $2 billion to shareholders, split evenly between dividends and share repurchases.

SYY shares have lost 12.5% in the past three months compared with the industry’s decline of 0.4%.

We have highlighted three better-ranked stocks from the Consumer Staples sector, namely Post Holdings POST, Treehouse Foods, Inc. THS and Vital Farms Inc. VITL.

Post Holdings is a consumer packaged goods holding company. POST presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current sales and earnings indicates growth of 2.7% and 7.3%, respectively, from the year-ago period’s reported figures. POST delivered a trailing four-quarter earnings surprise of 22.9%, on average.

Treehouse Foods is a manufacturer of packaged foods and beverages. It currently flaunts a Zacks Rank of 1.

THS delivered a trailing four-quarter earnings surprise of 58.8%, on average. The consensus estimate for Treehouse Foods’ current financial-year sales and earnings indicates growth of 0.4% and a decline of 5.8%, respectively, from the year-ago period’s reported figures.

Vital Farms offers a range of produced pasture-raised foods. VITL delivered a trailing four-quarter average earnings surprise of 45.3%.

The consensus estimate for VITL’s current financial-year sales and earnings indicates growth of 22.6% and a decline of 7.6%, respectively, from the prior-year reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite