|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

MP Materials MP and Lynas Rare Earths Limited LYSDY are the leading integrated rare earth producers, supplying critical minerals for magnets used in EVs, defense and high-tech applications. As strategic players in a market dominated by China, both companies are expected to play key roles in efforts to diversify global supply chains.

Las Vegas, NV-based MP Materials is the only fully integrated rare earth producer in the United States with capabilities spanning the entire supply chain, from mining and processing to advanced metallization and magnet manufacturing. MP has a market capitalization of $11.35 billion. Perth, Australia-based Lynas, with a market capitalization of around $6.64 billion, engages in the exploration, development, mining, extraction and processing of rare earth minerals in Australia and Malaysia.

For investors considering this sector to capitalize on the future growth of rare earth elements, the main question is which stock you should put your bets on – MP or LYSDY. To make an informed decision, let us analyze their fundamentals, growth potential and key challenges.

MP owns and operates the Mountain Pass Rare Earth Mine and Processing Facility, which is the only rare earth mining and processing site of scale in North America. The company’s facility in Fort Worth, TX, has commenced commercial production of neodymium-praseodymium (NdPr) metal and trial production of automotive-grade, sintered neodymium-iron-boron (NdFeB) magnets. It is poised to produce approximately 1,000 metric tons of finished NdFeB magnets per year.

MP Materials’ first-quarter 2025 revenues rose 25% year over year to $60.8 million. The company reported record NdPr production of 563 metric tons in the quarter, skyrocketing 330% from the year-ago quarter. It also reported the second-best quarterly rare earth oxides production of 12,213 metric tons, a 10% increase year over year on higher recoveries from the continued implementation of Upstream 60K optimizations.

However, higher production costs and selling, general and administrative expenses, as well as elevated interest expenses, led to a loss of 12 cents per share in the quarter, wider than the year-ago quarter’s loss of four cents.

On April 17, 2025, MP Materials halted rare earth concentrate shipments to China in response to Chinese tariffs and export controls, thereby cutting off a revenue stream. This sale accounted for approximately 50% of the company’s revenues in the first quarter of 2025. Meanwhile, MP is focusing on ramping up production and selling separated rare earth products to markets outside China, including Japan and South Korea.

MP Materials recently signed a Memorandum of Understanding (MoU) with Saudi Arabian mining company Maaden to explore and develop a fully integrated, end-to-end rare earth supply chain in Saudi Arabia.

As the company continues to produce and sell more separated products at Mountain Pass, it will lead to higher costs in 2025. This reflects higher production costs associated with separated rare earth products compared with rare earth concentrate. Its ramp-up of output of magnetic precursor products will also lead to higher costs.

Recently, MP Materials announced a landmark long-term agreement to supply Apple AAPL with rare earth magnets manufactured in the United States entirely from recycled materials. The $500 million agreement marks a transformative step for MP, launching its recycling platform and scaling up its magnet production business. Apple and MP Materials have collaborated over the past five years to develop advanced recycling technology that enables recycled rare earth magnets to be processed into material that meets Apple’s rigorous standards.

MP Materials has entered into a public-private partnership with the United States Department of Defense (DoD) to fast-track the development of a domestic rare earth magnet supply chain. Backed by a multibillion-dollar investment package and long-term commitments from DoD, MP will construct the second domestic magnet manufacturing facility (dubbed the 10X Facility), slated to begin commissioning in 2028. It will take MP Materials’ total U.S. rare earth magnet manufacturing capacity to an estimated 10,000 metric tons and will cater to both the defense and commercial sectors. The company, meanwhile, plans to expand its heavy rare earth separation capabilities at the Mountain Pass facility.

Lynas has established itself as an ethical and environmentally responsible producer of rare earth materials, supporting global manufacturing supply chains across East Asia, Europe and North America. The company ensures traceability from mine to finished product through its fully integrated and secure supply chain. At the core of Lynas’ operations is its high-grade, long-life Mt Weld mine in Western Australia, recognized as one of the world’s premier rare earth deposits.

The concentrate sourced from Mt Weld is processed at its Rare Earths Processing Facility in Kalgoorlie, Western Australia and the Lynas Malaysia advanced materials plant in Kuantan, Malaysia. Lynas is also building a new Rare Earths Processing Facility in Texas to separate pre-processed mixed rare earths.

In its recently reported fourth-quarter fiscal 2025 results, Lynas achieved record NdPr production at 2,080 tons, exceeding the 2,000-ton mark for the first time.

Total REO production was at 3,212 tons. The results reflect the progressive commissioning of the various assets constructed as part of the Lynas 2025 capital project. The company stated it remains on track to deliver its 2025 target capacity of 10.5 kt per year.

Sales revenues grew 38% year over year to AUD$170.2 million ($110.61 million), with production levels continuing to be managed in line with the market demand.

The company announced that Dysprosium Oxide (Dy) and Terbium Oxide (Tb) were produced on the new production line at Lynas Malaysia in May and June, respectively. It is the first commercial production of separated Heavy Rare Earths (HRE) for Lynas and the first commercial production outside China in decades.

Lynas recently inked a MoU with the Kelantan Menteri Besar (MB) Inc for the development of rare earth deposits and the future supply of mixed rare earths carbonate (MREC) to the Lynas Malaysia plan, as well as another MoU with Korea’s JS Link to collaborate on the development of a new magnet manufacturing facility in Malaysia.

The Mt Weld Expansion Project continues to progress as planned and remains within budget. Now in its final stages, the expansion is expected to deliver increased production capacity, improved efficiency and enhanced sustainability. Commissioning of Stage 2 is anticipated in the first quarter of fiscal year 2026, with the Mt Weld Project and Operations teams working closely to ensure a smooth ramp-up.

The Zacks Consensus Estimate for MP Materials’ fiscal 2025 earnings is pegged at a loss of 43 cents per share. The estimate has moved up to a loss of 43 cents per share from the loss of 53 cents anticipated 60 days ago. The company reported a loss of 44 cents in fiscal 2024.

The estimate for fiscal 2026 for MP Materials is pegged at an earnings of 71 cents. The estimate has moved north over the past 60 days.

The Zacks Consensus Estimate for Lynas’ fiscal 2026 earnings (ending June 2026) is 16 cents per share, indicating year-over-year growth of 167%. The fiscal 2027 estimate indicates 42.2% year-over-year growth.

Both the estimates for Lynas’ fiscal 2026 and fiscal 2027 have moved up in the past 60 days.

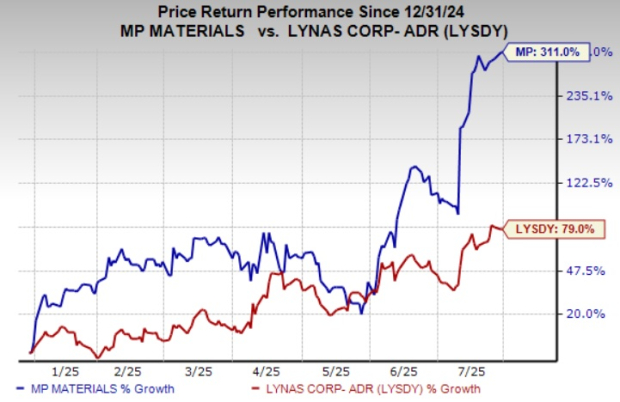

So far this year, MP Materials stock has surged 311% compared with Lynas’ 79% rise.

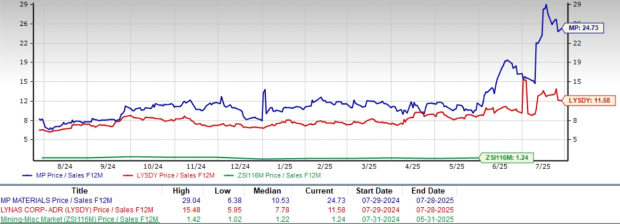

MP Materials is currently trading at a forward 12-month price-to-sales ratio of 24.73X at a significant premium to the industry’s 1.24X. Lynas is trading lower at a forward 12-month price-to-sales ratio of 11.58X.

MP and LYSDY stocks offer long-term strategic potential in the promising rare earth space. Both stocks currently have a Zacks Rank #3 (Hold) each, which makes choosing one a difficult task.

MP has been reporting upbeat production numbers and making investments in boosting production capacity, but elevated costs will continue to pressure earnings. It is expected to incur a loss in the current fiscal. Meanwhile, Lynas appears better positioned for improved financial performance, supported by strong growth projections and upward estimate revisions. While MP has significantly outperformed Lynas in terms of year-to-date share price gains, Lynas appears to be the better choice now, considering its cheaper valuation.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours |

AI Stocks Reset In 2026. What's Next For Apple, Nvidia, Google And Microsoft?

AAPL

Investor's Business Daily

|

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite