|

|

|

|

|||||

|

|

Hims & Hers Health, Inc. HIMS is scheduled to report second-quarter 2025 results on Aug. 4, after the closing bell.

In the last reported quarter, the company’s earnings per share (EPS) of 20 cents topped the Zacks Consensus Estimate by 66.7%. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on two occasions, missed once and broke even in the other, delivering an earnings surprise of 19.6%, on average.

Let’s check out the factors that have shaped HIMS’ performance prior to this announcement.

Hims & Hers has consistently witnessed strong market acceptance of its range of curated health and wellness products and services over the past few months. The company ended first-quarter 2025 with nearly 2.4 million subscribers (up 38.4% year over year). Monthly online revenue per average subscriber increased 52.7% year over year in the first quarter, primarily resulting from subscriber uptake of HIMS’ GLP-1 weight loss offering, along with changes in product mix. We expect the company to continue to have gained subscribers in the second quarter of 2025, thereby driving up its revenues.

On the first-quarter earnings call in May, management stated that more than 80% of subscribers in Hims & Hers’ dermatology specialty are benefiting from a personalized solution, which was a critical part in driving nearly 50% year-over-year subscriber growth across those specialties. Sexual health was also observed to follow a similar path. Management also confirmed that HIMS has been working toward making blood testing easier and more accessible, and giving customers access to testing for key biomarkers tied to heart, hormone, liver, thyroid and prostate health. These tools are expected to support its current specialties and unlock entirely new ones. This is likely to have aided Hims & Hers in serving a wider population, thereby paving the way for higher revenues in the to-be-reported quarter.

For second-quarter 2025, the Zacks Consensus Estimate for revenues is pegged at $551.8 million, implying an improvement of 74.8% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at 18 cents, indicating a surge of 200% from the prior-year period’s reported number.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold), along with a positive Earnings ESP, has higher chances of beating estimates. This is not the case here, as you can see below.

Earnings ESP: HIMS has an Earnings ESP of -20.20%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hims & Hers Health, Inc. price-eps-surprise | Hims & Hers Health, Inc. Quote

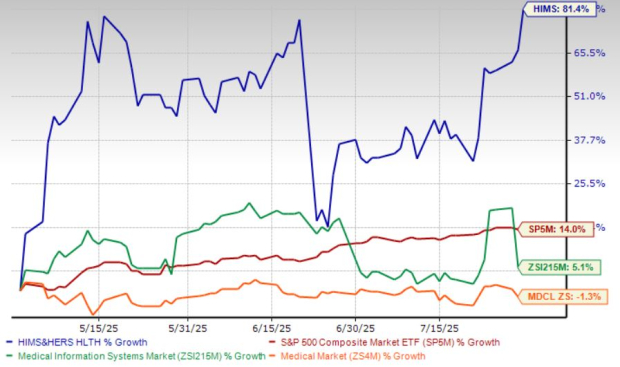

Over the past three months, Hims & Hers’ shares have gained 81.4%, outperforming Medical Info Systems’ 5.1% growth. HIMS’ shares also outperformed the Zacks Medical sector and the S&P 500’s decrease of 1.3% and gain of 14%, respectively.

Hims & Hers’ peers like Veeva Systems Inc. VEEV, Inspire Medical Systems, Inc. INSP and Omnicell, Inc. OMCL have all underperformed the company. VEEV, INSP and OMCL’s shares are up 23.4%, down 17.3% and down 5%, respectively, in the same time frame.

From a valuation standpoint, HIMS’ forward 12-month price-to-sales (P/S) is 5.1X, a discount to the industry's average of 5.8X.

The company is trading at a discount to its peer, Veeva Systems. However, Hims & Hers is trading at a premium to its other peers, Omnicell and Inspire Medical. Veeva Systems P/S currently stands at 14.3X, while the ratio for Omnicell and Inspire Medical stands at 1.2X and 3.7X, respectively.

This suggests that investors may be paying a lower price relative to the company's expected sales growth.

On the first-quarter earnings call, management stated that Hims & Hers is planning to continue expanding into new specialties that deeply impact people's lives. Building on its success in weight loss, the company expects to launch new offerings in low testosterone and menopause support this year, with longer-term opportunities emerging in longevity, sleep and preventative care as Hims & Hers expand lab testing and peptide capabilities.

This month, HIMS announced its planned expansion into Canada. It expects to meet growing demand with a better model of care by pairing the arrival of generics with a platform designed to scale, affordability and clinical integrity. Hims & Hers recently acquired ZAVA, marking a significant step toward its global expansion. The deal will likely expand the company’s footprint in the U.K. and will officially launch the company into Germany, France and Ireland, with more markets anticipated soon. Hims & Hers is also planning to introduce a new, personalized dimension of digital health in Europe. To ensure a localized experience, this expansion is also expected to include access to British, German and French healthcare providers in local languages.

There is no denying that Hims & Hers sits favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. The stock’s strong core growth prospects are a good reason for existing investors to retain shares for potential future gains.

For those exploring to make new additions to their portfolios, the valuation indicates superior performance expectations compared with its industry and sector peers. It is still valued lower than the broader market, which suggests potential room for growth if it can align more closely with overall market performance. However, as there are no chances of beating estimates, it would not be a wise choice to add the stock to one’s portfolio before the earnings. However, if investors are already holding the stock, it would be prudent to hold on to it at present. The favorable Zacks Style Score with a Growth Score of A suggests continued uptrend potential for HIMS.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 26 min | |

| 32 min | |

| 53 min | |

| 1 hour | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite