|

|

|

|

|||||

|

|

The global aviation industry is soaring to new heights lately, driven by rising aircraft deliveries, expanding airline fleets, and increasing demand for fuel-efficient, high-performance jet engines. As air travel continues its post-pandemic growth and defense spending grows, engine manufacturers like Rolls-Royce RYCEY and GE Aerospace GE are at the forefront of this expansion. These industry giants are capitalizing on advancements in propulsion technology, sustainable aviation initiatives and lucrative aftermarket services — key factors propelling investor interest in the stocks.

Rolls-Royce, a leader in power systems for wide-body aircraft and military engines, is undergoing a strategic transformation, focusing on improved operational efficiency and next-gen technologies like hybrid-electric propulsion. Meanwhile, GE Aerospace, another dominant force in commercial and military engines, benefits from its strong aftermarket services and next-generation engine programs, including the GE9X for Boeing’s 777X and the CFM International LEAP engine, widely used in narrow-body jets.

With both companies positioned for growth amid rising demand for air travel and defense modernization, investors face a critical question: Which engine maker offers more thrust in 2025? Let’s analyze their strengths, innovations and market positioning to find out.

Rolls-Royce ended June 2025 with a cash and cash equivalent of approximately $7.95 billion, while its gross debt totaled $4.64 billion. So, it is safe to conclude that the stock boasts a solid solvency position, which should enable it to continue investing in its next-generation engine that will offer higher power density, lower emissions and improved fuel consumption compared to its peers.

In contrast, GE Aerospace’s cash and cash equivalents amounted to $11.86 billion as of June 30, 2025. Its long-term debt totaled $17 billion, while its current debt was $1.89 billion at the end of the second quarter of 2025. So, one can safely conclude that the stock holds a solid solvency position for the near term. This should offer it the flexibility to invest in its test infrastructure to accelerate the development of next-generation hypersonic propulsion systems, as well as in its U.S. factories and supply chain to strengthen manufacturing capabilities.

With respect to growth drivers, the steadily improving air passenger traffic worldwide (for the past couple of years), resulting in increased jet engine and related services demand, has been playing the role of the primary growth catalyst for both RYCEY and GE Aerospace. Evidently, Rolls-Royce registered a 17% year-over-year sales improvement for its Civil Aerospace segment in the first half of 2025. On the other hand, the Commercial Engines & Services (“CES”) unit of GE Aerospace witnessed a solid 29% year-over-year increase in revenues during the second quarter of 2025.

Sales growth for defense-related aerospace parts and equipment, backed by an increasing defense product acquisition trend worldwide, has also been contributing to both RYCEY and GE’s top-line performance. Notably, RYCEY witnessed a 1% rise in its defense revenues during the first half of 2025, while GE’s Defense & Systems unit’s revenues grew 6% in the second quarter of 2025.

In terms of divergent growth trajectories, Rolls-Royce leverages its strengths in widebody aircraft engines and a diversified portfolio that includes marine propulsion technologies — an area where GE Aerospace has no direct presence (in marine). In contrast, GE Aerospace benefits from its dominance in the narrowbody engine market and advanced avionics integration in both commercial and defense aviation, where Rolls-Royce has limited exposure.

With RYCEY and GE operating in the broader aerospace sector, both stocks face industry-specific challenges that investors should consider before investing in them.

In particular, persistent supply-chain disruptions remain a major headwind for jet engine makers like RYCEY and GE. In its June 2025 outlook, the International Air Transport Association (“IATA”) mentioned that the global aircraft backlog has risen to a record-high of 17,000 jets owing to a significant lag in aircraft deliveries. This shortfall was largely due to ongoing supply-chain bottlenecks.

Additionally, the newly imposed U.S. tariffs on imported goods are expected to significantly intensify the global supply-chain issues, potentially delaying the procurement of critical aerospace components. These factors may elevate production costs and disrupt manufacturing timelines, adding to more uncertainty for industry players and thereby constraining growth prospects for both stocks.

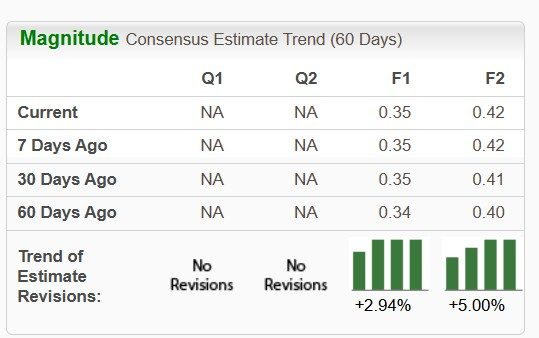

The Zacks Consensus Estimate for RYCEY’s 2025 sales and earnings per share (EPS) implies an improvement of 24.4% and 34.6%, respectively, from the year-ago quarter’s reported figures. RYCEY’s 2025 and 2026 EPS estimates have moved north over the past 60 days.

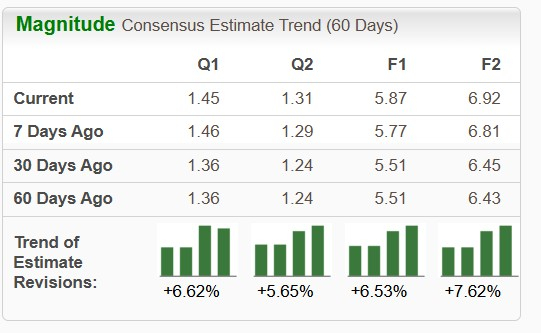

The Zacks Consensus Estimate for GE’s 2025 sales implies a year-over-year decline of 4.4%, while that for EPS suggests a 27.6% surge. The stock’s near-term EPS estimates have moved north over the past 60 days.

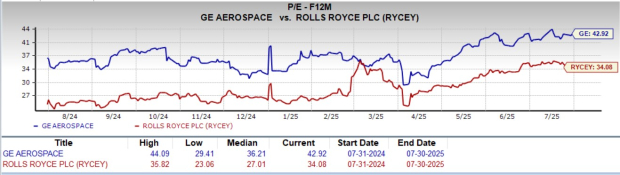

RYCEY (up 28.4%) has underperformed GE (up 34.3%) over the past three months. However, in the past year, RYCEY has outperformed GE. While RYCEY’s shares have surged 117.4%, GE rose 61.1%.

Roll-Royce is trading at a discount, with its forward 12-month price/earnings of 34.08X being less than GE’s forward price/earnings of 42.92X.

While both Rolls-Royce and GE Aerospace stand to benefit from strong long-term aerospace tailwinds, Rolls-Royce appears better positioned to outperform in 2025.

RYCEY trades at a more attractive valuation, boasts stronger EPS growth projections and continues to benefit from a strategic focus on widebody aircraft, marine propulsion and sustainable aviation technologies. GE Aerospace, while offering broader exposure in narrowbody engines and avionics, faces a weaker near-term sales outlook and higher debt levels, which could constrain short-term upside.

Ultimately, both companies remain fundamentally sound and well-aligned with the evolving needs of the global aerospace market. However, for investors seeking stronger near-term momentum and compelling valuation, Rolls-Royce currently offers the more attractive investment opportunity.

While GE Aerospace sports a Zacks Rank #1 (Strong Buy) at present, Rolls-Royce carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite