|

|

|

|

|||||

|

|

The companies operating in the Zacks Oil and Gas Production and Pipeline industry play a pivotal role in meeting global demand, fueled by economic growth, industrialization and rising consumption in emerging markets. While the long-term energy transition favors renewables, hydrocarbons remain essential for transportation, heating and petrochemical production. Technological innovations, horizontal drilling and enhanced oil recovery continue to unlock new reserves and improve efficiency, reinforcing the sector’s resilience and profitability.

Pipeline infrastructure is critical for the efficient transport of crude oil, natural gas, and refined products across regions. With stable, fee-based revenue models and long-term contracts, pipeline operators enjoy predictable cash flows and are largely insulated from commodity price fluctuations. As North American shale output grows and export capacity expands, the demand for robust midstream infrastructure is expected to increase significantly. Amid such a backdrop, let’s compare Energy Transfer ET and The Williams Companies WMB, two prominent midstream energy companies in North America, operating vast networks of pipelines and storage facilities for natural gas, crude oil and natural gas liquids.

Energy Transfer presents an attractive investment opportunity, supported by its extensive and diversified midstream infrastructure that encompasses natural gas, NGLs, crude oil, and refined products. The company benefits from stable, fee-based cash flows, strategic access to export terminals, and a disciplined approach to capital allocation, positioning it well to capitalize on growing U.S. energy production and increasing global demand. With a strong distribution yield, steady EBITDA growth, and ongoing deleveraging efforts, ET stands out as a compelling choice for long-term investors seeking both income and growth in the energy sector.

The Williams Companies offers a compelling investment thesis grounded in its strategically located natural gas infrastructure, which plays a critical role in meeting growing U.S. and global energy demand. With over 33,000 miles of pipelines and access to key supply basins and demand centers, Williams generates stable, fee-based revenues under long-term contracts. Its focus on natural gas aligns with the energy transition, offering a lower-carbon solution while supporting power generation and LNG exports. Strong cash flows, disciplined capital allocation, and a reliable dividend make WMB an attractive long-term investment for income-oriented investors seeking exposure to essential energy infrastructure.

As hydrocarbon production continues to increase in the United States, demand for pipeline and storage is also rising. Let’s focus on the fundamental factors of these midstream companies and try to find which one presently has a better possibility to provide higher returns to investors.

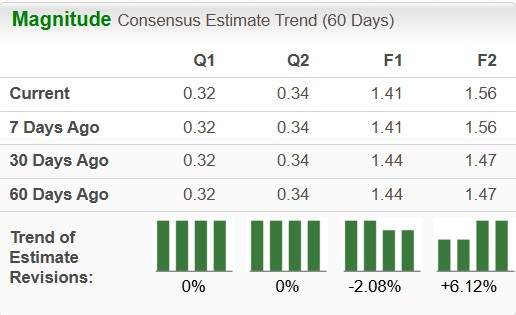

The Zacks Consensus Estimate for ET’s earnings per share in 2025 reflects a decline of 2.08% and an increase of 6.12% in 2026 in the past 60 days. Long-term (three to five years) earnings growth per share is pegged at 13.67%.

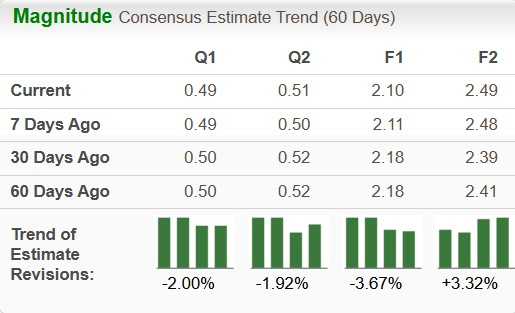

The Zacks Consensus Estimate for WMB’s earnings per share in 2025 reflects a decline of 3.67% and an increase of 3.32% in 2026 in the past 60 days. Long-term (three to five years) earnings growth per share is pegged at 13.64%.

Energy Transfer currently appears to be trading at a discount compared with The Williams Companies on a forward 12-month Price/Earnings basis.

ET is currently trading at 12.03X, while WMB is trading at 25.01X compared with the S&P 500’s 22.81X.

ROE is an essential financial indicator that evaluates a company’s efficiency in generating profits from the equity invested by its shareholders. It demonstrates how well management is utilizing the capital provided to increase earnings and deliver value.

ET’s current ROE is 11.47% compared with WMB’s ROE of 15.95%. Both companies are currently underperforming the S&P 500 ’s ROE of 32.01%.

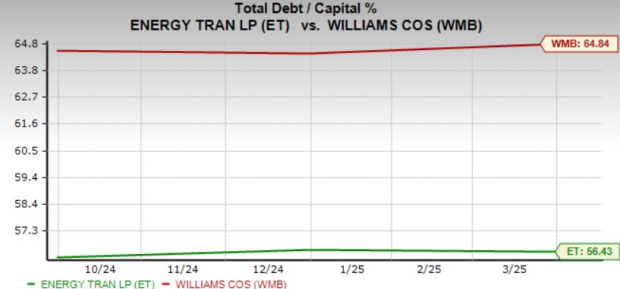

The Oil-Energy sector is a capital-intensive one, and huge investments are required at regular intervals to upgrade, maintain and expand operations. The usage of new evolving technology also requires investments. Therefore, the companies operating in the sector borrow from the market and add it to their internal cash generation to fund their long-term investments.

ET’s current debt-to-capital currently stands at 56.43% compared with WMB’s debt-to-capital of 64.84%. Both companies are using debt to fund their business; however, The Williams Companies currently has a higher percentage of debt to fund its operations.

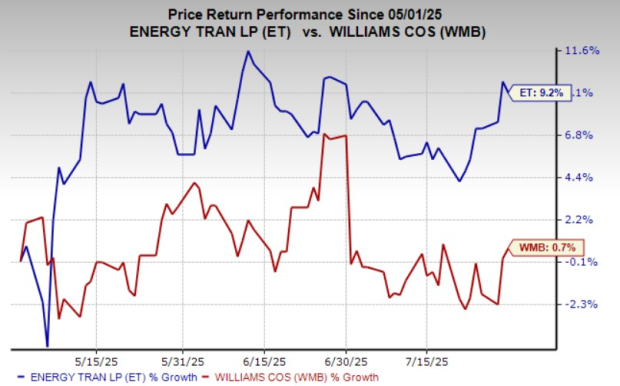

ET’s units have gained 9.2% in the past three months compared with WMB’s rally of 0.7.

Energy Transfer and WMB are strategically investing in their infrastructure to expand operations and successfully transfer hydrocarbons from the production region to their end users.

ET’s 2026 earnings estimates increase at a higher clip, with comparatively lower debt usage, cheaper valuation, and better price performance, making it a better choice than WMB in the oil and energy midstream space.

Based on the above discussion, Energy Transfer currently has an edge over The Williams Companies, despite the stocks carrying a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite