|

|

|

|

|||||

|

|

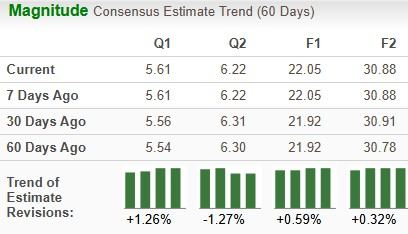

Eli Lilly and Company LLY will report its second-quarter earnings on Aug. 7, before market open. The Zacks Consensus Estimate for sales and earnings is pegged at $14.75 billion and $5.61 per share, respectively. Earnings estimates for 2025 have risen from $21.92 to $22.05 per share over the past 30 days.

The healthcare bellwether’s performance has been mixed, with the company exceeding earnings expectations in two of the trailing four quarters and missing in the other two. It delivered a four-quarter earnings surprise of 6.69%, on average. In the last reported quarter, the company delivered a negative earnings surprise of 5.11%, as seen in the chart below.

Lilly has an Earnings ESP of +0.18% and a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1, #2 (Buy) or #3 have a good chance of delivering an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

In the second quarter, Lilly’s top-line growth is expected to have been driven by its popular GLP-1 drugs, diabetes drug Mounjaro and weight loss medicine, Zepbound, due to high demand trends.

Sales of Mounjaro and Zepbound picked up in the first quarter of 2025 after being below expectations in the second half of 2024, driven by launches of the drugs in new international markets and improved supply from ramped-up production. We believe that increased uptake in outside U.S. markets and deeper penetration in the U.S. market are likely to have driven Mounjaro and Zepbound’s growth in the second quarter.

The Zacks Consensus Estimate for Mounjaro and Zepbound is $4.58 billion and $3.1 billion, respectively. Our estimates for Mounjaro and Zepbound are $4.46 billion and $3.09 billion, respectively.

Higher demand and volume growth for Lilly’s key growth drugs like Emgality, Jardiance, Olumiant, Taltz and Verzenio are likely to have provided top-line support in the second quarter, driven by increased demand trends. While volumes are expected to have increased for most drugs, lower realized prices (including U.S. Part D changes) are likely to have continued to hurt sales of most drugs.

In the first quarter, Jardiance revenues benefited from a one-time payment received from partner Boehringer Ingelheim, which was absent in the second quarter. Unfavorable wholesaler buying patterns and competitive dynamics in the United States for early breast cancer and currency headwinds in international markets hurt Verzenio’s sales somewhat in the first quarter. It remains to be seen whether these trends continued to impact Verzenio’s sales in the second quarter.

Sales of Trulicity are likely to have been hurt by competitive dynamics and lower realized prices in the United States. Sales of Trulicity are also being hurt by patient switches to Mounjaro.

The Zacks Consensus Estimate for Trulicity, Taltz, Verzenio, Jardiance and Emgality is $1.05 billion, $888.0 million, $1.55 billion, $658.0 million and $178.0 million, respectively.

Our estimates for Trulicity, Taltz, Verzenio, Jardiance and Emgality are $924.8 million, $914.8 million, $1.57 billion, $636.9 million and $169.9 million, respectively.

Newer products (products launched from 2022 onwards) like Ebglyss, Jaypirca, Kisunla and Omvoh are likely to have contributed to sales growth.

Sales of most established drugs like Forteo, Alimta and Humulin are likely to have declined in the quarter. Humalog sales might have increased in the quarter.

Higher marketing, selling and administrative expenses to support the launch of new products and indications are likely to have hurt operating profits in the quarter.

Nonetheless, a single quarter’s results are not so important for long-term investors. Let us delve deeper to understand whether to buy, sell or hold Lilly’s stock.

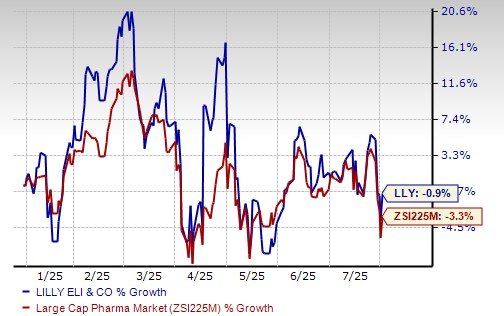

Lilly’s stock has declined 0.9% so far this year compared with a decrease of 3.3% for the industry.

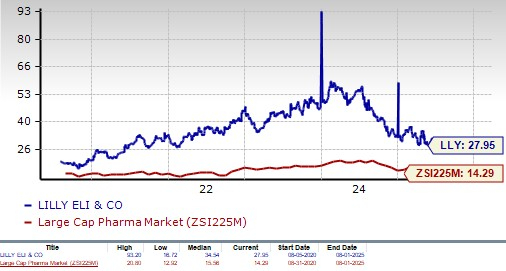

The stock is trading at a premium to the industry, as seen in the chart below.

Lilly has seen tremendous success with its popular tirzepatide medicines, diabetes drug Mounjaro and weight loss medicine, Zepbound.

Despite being on the market for less than three years, Mounjaro and Zepbound became key top-line drivers for Lilly, with demand rising rapidly. Mounjaro and Zepbound account for around 50% of the company’s total revenues.

In addition to Mounjaro and Zepbound, Lilly has gained approvals for several other new drugs over the past couple of years across various therapeutic areas, including Omvoh, Jaypirca, Ebglyss, and Kisunla (donanemab). Lilly expects its new drugs, Mounjaro, Zepbound, Omvoh, Jaypirca, Ebglyss and Kisunla, along with the expanded use of existing drugs, to drive sales growth in 2025.

Lilly is also making rapid pipeline progress in obesity, diabetes and cancer, with several key mid- and late-stage data readouts expected this year. Lilly is investing broadly in obesity and has several next-generation candidates currently in clinical development, like orforglipron, an oral GLP-1 small molecule, and retatrutide, a GGG tri-agonist.

LLY is also working to diversify beyond GLP-1 drugs by expanding into cardiovascular, oncology, and neuroscience areas. In 2025, it announced three M&A deals. It acquired Verve Therapeutics this month to add gene therapies for heart disease to its pipeline. Lilly has also entered into agreements to acquire Scorpion Therapeutics’ oncology drug and SiteOne Therapeutics’ non-opioid pain candidate.

Lilly has its share of problems. Prices of most of Lilly’s products are declining in the United States. In 2025, Lilly expects a mid-to-high single-digit percentage price decline, including U.S. Part D changes. Potential competition in the GLP-1 diabetes/obesity market is a key headwind.

Mounjaro and Zepbound face strong competition from Novo Nordisk’s NVO semaglutide medicines, Ozempic for diabetes and Wegovy for obesity. Last week, Novo Nordisk lowered its sales and operating profit outlook for 2025 due to lower growth expectations for Wegovy and Ozempic for the second half of 2025. NVO expects lower sales of Wegovy due to increased competitive pressure, including from compounded drugs and slower-than-expected market expansion. NVO’s guidance cuts raised investor concerns about rising competitive pressure in the weight loss market, which resulted in a decline in LLY’s stock price too.

Several companies like Amgen AMGN and Viking Therapeutics VKTX are also making rapid progress in late-stage development of more potent and convenient GLP-1-based candidates in their clinical pipeline. AMGN and VKTX’s products can pose strong competition to Mounjaro/Zepbound and NVO’s Ozempic/Wegovy in the future.

Despite its expensive valuation, we suggest investors retain the stock as it is the largest drugmaker currently and has robust growth prospects.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 23 min | |

| 8 hours | |

| 11 hours | |

| 13 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

AMGN

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite