|

|

|

|

|||||

|

|

Wix.com Ltd. (WIX) is scheduled to release second-quarter 2025 results on Aug. 6, before market open.

For the quarter, management expects revenues between $485 million and $489 million, indicating 11-12% growth from the prior-year quarter's reported figure. The Zacks Consensus Estimate is pegged at $487.6 million, suggesting an increase of 11.9% from that reported a year ago.

The Zacks Consensus Estimate for earnings is pegged at $1.75 per share, implying a 4.79% rise from the year-earlier quarter's actual.

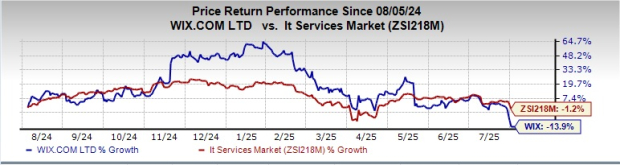

WIX’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, while missing once, with the average surprise being 11%. The stock has fallen 13.9% compared with the Zacks Computers - IT Services industry’s loss of 1.2% in the past year.

Improvements in operational efficiency, AI product rollouts and evolving macroeconomic conditions are likely to have influenced Wix’s second-quarter results. While macroeconomic volatility remains a factor, Wix’s diversified geographic footprint is expected to have boosted its top-line performance. Increasing uptake of Wix Studio & enterprise tools is a key growth driver.

Wix has been quickly integrating AI capabilities into its platforms. During the quarter, it launched Wixel, a new visual design platform that uses AI, offers a simple interface and provides advanced tools to help anyone create high-quality photo and video content, no design experience required. This aligns with Wix’s mission to make creative tools easy and accessible, just as it simplified website building in 2006. Wix has partnered with Microsoft to bring Wixel’s features to Microsoft Copilot, making it easier for Microsoft 365 users, such as small businesses, students and creators, to design more efficiently.

Wix intends to continue adding powerful features to Wixel as part of its broader strategy to expand beyond web design into all areas of digital creation. Flagship tools like adaptive content application, Wix Functions and Wix Automations enhance website customization and efficiency. In addition to AI-driven innovations, WIX remains at the forefront of strategic buyouts. In May 2025, Wix acquired Hour One, a pioneer in generative AI media creation.

Hour One offers technology that helps create high-quality videos and interactive content at scale. Its platform lets users make personalized media with real-time engagement. Using AI and advanced 3D rendering in the cloud, Hour One strengthens Wix’s position in scalable, high-impact content creation. In June, it acquired Base44, an innovative AI-powered platform that empowers users to build fully functional custom software solutions using natural language – no coding required. The buyout not only bolsters Wix’s AI portfolio but also redefines the future of application development.

Wix.com Ltd. price-eps-surprise | Wix.com Ltd. Quote

The percentage of registered users using Wix Payments grew every quarter throughout 2021. It continued in the last reported quarter, with nearly 5.3 million new user additions, up 7% year over year, with strong conversion to paid subscriptions.

Revenue growth amid improved collections from both Creative Subscriptions and Business Solutions is likely to have cushioned its top line. Creative Subscriptions benefit from higher pricing tiers, improved retention and growing global demand from SMBs and freelancers. Business Solutions revenue is driven by increased adoption of Wix Payments, marketing tools and premium add-ons. Partner Revenue rises as Wix strengthens relationships with agencies, webmasters and enterprise clients managing multiple sites.

The Zacks Consensus Estimate for revenues from the Creative Subscriptions and Business Solutions segments is pegged at $345.4 million and $142 million, respectively.

Nonetheless, Wix continues to incur a lumpsum amount of expenses primarily due to strategic investments in its business expansion and technology enhancements. This might have hurt its margins in the second quarter. Further, forex fluctuations and competition from peers are added worries.

In July 2025, Wix expanded its partnership with PayPal, adding more online payment options to Wix Payments. U.S. merchants can now access PayPal directly within Wix Payments, making checkout smoother and backend operations easier, helping boost sales.

Also, it released AI Visibility Overview, a tool that aligns websites with the next frontier of digital discovery — Large Language Models (LLMs) — such as ChatGPT, Gemini, Perplexity and Claude. This initiative marks a significant advancement under Wix’s Generative Engine Optimization initiative, enabling brands to understand and manage their online presence across AI-powered search ecosystems.

Wix announced a partnership with Alibaba.com, a global leader in business-to-business e-commerce. This collaboration is set to empower digital entrepreneurs, small businesses and emerging brands by expanding their global presence and simplifying international trade.

Our proven model does not conclusively predict an earnings beat for Wix this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here.

Wix has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Here are three stocks you may want to consider, as our model shows that these have the right elements to post an earnings beat in this reporting cycle.

Emerson Electric Co. (EMR), expected to release earnings on Aug. 6, currently has an Earnings ESP of +0.39% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here

The consensus estimate for Emerson Electric’s earnings for the third quarter of fiscal 2025 is pegged at $1.51 per share, indicating year-over-year growth of 5.6%. EMR has a trailing four-quarter average surprise of 3.4%.

BCE Inc. (BCE) is expected to release earnings on Aug. 7, currently has an Earnings ESP of +0.97% and a Zacks Rank of 2.

The consensus estimate for BCE’s earnings for the second quarter of 2025 is pegged at 52 cents per share, indicating a year-over-year fall of 8.7%. BCE has a trailing four-quarter average surprise of 3.5%.

Watts Water (WTS) is expected to release earnings on Aug. 6, currently has an Earnings ESP of +0.86% and a Zacks Rank of 2.

The consensus estimate for WTS’ earnings for the second quarter of 2025 is pegged at $2.68 per share, indicating a year-over-year rise of 8.9%. WTS has a trailing four-quarter average surprise of 6.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite