|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Molson Coors Beverage Company TAP posted second-quarter 2025 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. Earnings per share improved year over year, while sales declined.

The company’s adjusted earnings of $2.05 per share rose 6.8% year over year and beat the Zacks Consensus Estimate of $1.83.

Net sales dropped 1.6% year over year on a reported basis and 2.6% on a constant-currency basis to $3.2 billion and beat the Zacks Consensus Estimate of $3.1 billion. The decline was due to lower financial volumes, partly offset by an improved price and sales mix, and favorable currency.

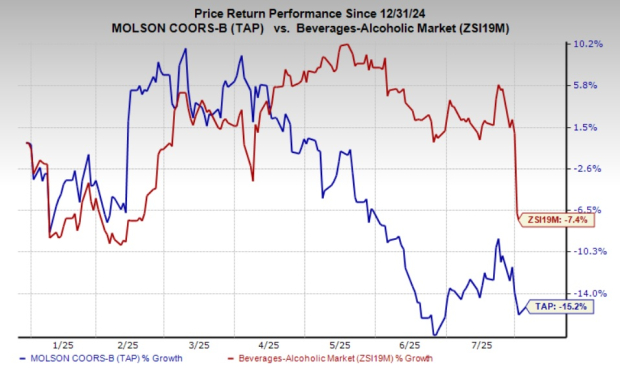

Shares of Molson Coors fell 1.3% in the pre-market trading session today, driven by a bleak view for 2025. The Zacks Rank #4 (Sell) company has declined 15.2% in the past three months compared with the industry’s 7.4% decline.

Financial volumes decreased 7% year over year due to lower shipments across the Americas and EMEA&APAC segments. Brand volumes fell 5.1%, with a 4% dip in the Americas and a 7.8% decline in EMEA&APAC.

Net sales were positively influenced by the price and sales mix, which increased 4.4% year over year, driven by a favorable sales mix and higher net pricing across both segments.

Gross profit decreased 3.6% year over year to $1.28 billion and the gross margin fell 30 basis points (bps) to 34.3% in the quarter.

Marketing, general and administrative (MG&A) expenses declined 4.9% year over year on a reported basis to $693.1 million due to the timing of marketing investments and lower general and administrative expenses resulting from lower incentive compensation, partly negated by unfavorable currency impacts. Underlying MG&A declined 5.8% in constant currency.

Underlying earnings before taxes (EBT) rose 0.1% year over year to $531.5 million. On a constant-currency basis, underlying EBT declined 0.8%, led by lower financial volumes and cost inflation with respect to materials and manufacturing expenses, partly offset by a favorable mix, higher net pricing, lower MG&A expenses and cost savings initiatives.

Molson Coors Beverage Company price-consensus-eps-surprise-chart | Molson Coors Beverage Company Quote

Americas: Net sales in the segment fell 2.8% year over year to $2.5 billion on a reported basis and 2.6% on a constant-currency basis. The decline was due to lower financial volumes and currency headwinds, offset by a favorable price and sales mix. Sales in the segment surpassed the Zacks Consensus Estimate of $2.42 billion.

Financial volumes were down 6.6% year over year, resulting from lower U.S. brand volumes, and a 3% impact of lower contract brewing volume due to the exit of contract brewing arrangements across the United States and Canada at the end of 2024. This was partly negated by the favorable timing of U.S. shipments. Brand volumes in the Americas were down 4%, including a 5.3% decline in the United States, due to the macroeconomic impacts of industry softness and a lower share performance.

The price and sales mix positively impacted net sales by 4%, mainly owing to a favorable sales mix from lower contract brewing volumes, positive brand mix and higher net pricing. Underlying EBT improved 5.4% on a constant-currency basis, driven by a favorable mix, higher net pricing, lower MG&A expenses, and cost-saving initiatives, partly offset by lower financial volumes and cost inflation related to materials and manufacturing expenses.

EMEA&APAC: The segment’s net sales (on a reported basis) rose 3% year over year to $703.9 million and fell 2.3% on a constant-currency basis. Reported sales benefited from a favorable price and sales mix, and favorable currency effects, partially offset by lower financial volumes. The price and sales mix improved 5.5% on geographic mix, premiumization and higher factored brand volumes, along with improved net pricing. The Zacks Consensus Estimate for the segment’s sales was pegged at $687 million.

Financial and brand volumes dipped 7.8% year over year due to lower volumes across all regions, led by soft market demand and a heightened competitive landscape. The segment’s underlying EBT declined 17.9% year over year on a constant-currency basis due to lower financial volumes and increased U.K. waste management fees from changes in extended producer responsibility regulations. These pressures were partially offset by reduced MG&A expenses, led by lower incentive compensation and cost-saving initiatives, as well as improved net pricing and a favorable product mix.

Molson Coors ended the second quarter with cash and cash equivalents of $613.8 million. As of June 30, 2025, the company had a total debt of $6.32 billion, resulting in a net debt of $5.7 billion.

Net cash provided by operating activities amounted to $627.6 million for the six months ended June 30, 2025. Moreover, it recorded a negative underlying free cash flow of $293.5 million for the six months ended June 30, 2025, mainly due to lower operating cash flows.

In first-quarter 2025, Molson Coors paid out $306.8 million, including brokerage commissions, for share repurchases and dividends of $192.7 million.

Molson Coors revised its 2025 guidance for select key financial metrics to reflect the impacts of the global macroeconomic environment on the beer industry and shifting consumer trends, along with softer-than-expected U.S. market share performance. While the company’s guidance incorporates the best estimates of certain factors, such as the indirect tariff-related impact on aluminum pricing, particularly the Midwest Premium, these trends remain unpredictable. As such, there are inherent uncertainties that may affect TAP’s financial performance beyond the assumptions reflected in its outlook.

Molson Coors now projects a year-over-year sales decline of 3-4% on a constant-currency basis for 2025, compared with a low-single-digit decrease stated earlier. The company anticipates the 2025 underlying EPS to decline 7-10% year over year compared with low-single-digit growth mentioned earlier.

It expects underlying EBT to decline 12-15% year over year at constant currency compared with a low-single-digit decline projected previously. Underlying depreciation and amortization are projected to be $675 million, plus or minus 5%. The company expects an underlying effective tax rate of 22-24% for 2025. Underlying net interest expenses are anticipated to be $225 million (plus or minus 5%) compared with the earlier expected $215 million (plus or minus 5%).

The company estimates a capital expenditure of $650 million (plus or minus 5%) for 2025. The underlying free cash flow is expected to be $1.3 billion, plus or minus 10%.

PepsiCo Inc. PEP is one of the leading global food and beverage companies. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PEP delivered a trailing four-quarter earnings surprise of 1%, on average. The Zacks Consensus Estimate for PepsiCo’s current financial-year sales indicates growth of 1.3% from the year-ago reported number, while the EPS estimate indicates a year-over-year decline of 1.8%.

Diageo Plc DEO is involved in producing, distilling, brewing, bottling and packaging, as well as distributing spirits, wine and beer. DEO currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Diageo’s current financial-year sales indicates growth of 0.7% year over year, while the EPS estimate suggests a decline of 2.3% from the year-ago reported number.

Carlsberg CABGY is a brewing company and has operations in Northern and Western Europe, Eastern Europe, and Asia. CABGY has a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for CABGY’s current financial-year sales and EPS implies growth of 31.8% and 11.3%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 8 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite