|

|

|

|

|||||

|

|

SoundHound AI SOUN is scheduled to report its second-quarter 2025 results on Aug. 7, after the closing bell.

In the last reported quarter, SoundHound delivered solid results with revenues of $29.13 million, up 151% year over year, driven by strong enterprise momentum and deeper penetration across verticals like restaurants, financial services, and healthcare. However, revenue missed expectations by 3.6%, partly due to a customer undergoing a change of control. The company reported a non-GAAP net loss per share of 6 cents in the quarter, better than the year-ago loss of 7 cents. Non-GAAP gross margin was 51%, down from prior levels due to the impact of recent acquisitions, particularly low-margin call center and professional services contracts.

This maker of artificial intelligence (AI) tools for computer interpretation of voice commands surpassed earnings estimates in two of the trailing four quarters and missed on the other two occasions, with an average negative surprise of 127.6%. You can see the historical figures in the chart below.

The Zacks Consensus Estimate for the second-quarter bottom line has remained unchanged at a loss of 6 cents per share over the past 60 days. The company reported a year-ago loss per share of 11 cents. The consensus mark for revenues is $33.03 million, suggesting a 145.4% year-over-year increase.

For 2025, SOUN is expected to register a 91.1% increase from a year ago in revenues. Its bottom line is expected to witness an improvement to a loss of 16 cents per share from $1.04 a year ago.

Our proven model does not conclusively predict an earnings beat for SoundHound for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Earnings ESP: SoundHound has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Management expects the first half of 2025 revenue mix to be approximately 40% of the full-year total, indicating projected second-quarter revenues of $33 to $42 million, implying a sequential growth from the first quarter. Notably, SoundHound reaffirmed its full-year 2025 revenue guidance of $157 to $177 million, suggesting continued strength in the second quarter.

While macro uncertainty remains, the company cited strong tailwinds from the adoption of voice AI and agentic platforms, as well as a recovering pipeline after a first-quarter revenue hit due to a one-off customer event.

Revenue contributions are increasingly diversified. Restaurant deployments continue to accelerate with 13,000+ live locations as of the first quarter. This vertical is expected to remain a key growth engine for the second quarter, bolstered by high-margin AI ordering and Smart Answering solutions. Automotive remains a strategic focus, particularly with the voice commerce solution gaining traction among OEMs. While geopolitical pressures affected auto unit volumes in the first quarter, pilots and proof-of-concept engagements in the second quarter signal potential upside. Enterprise sectors—spanning healthcare, telecom, energy, and financial services—are also seeing upsell and cross-sell momentum, particularly from the Amelia 7.0 agentic platform.

While SoundHound did not provide specific gross margin guidance for the second quarter, management anticipates gradual improvement in margins throughout 2025. This is tied to realizing synergies from acquisitions, optimizing product mix, and exiting or renegotiating low-margin legacy contracts. Gross margins are expected to trend back toward the pre-acquisition range of more than 70% over time, supported by improved automation, higher-value AI deployments, and more cloud-based revenue.

Adjusted EBITDA is projected to improve sequentially in the second quarter, consistent with SoundHound’s full-year guidance to achieve adjusted EBITDA profitability by year-end 2025. With ongoing cost discipline and operational efficiencies, the second quarter is expected to mark a meaningful step in narrowing losses. The company continues to invest in GTM execution, AI infrastructure, and customer success—critical to driving long-term scale.

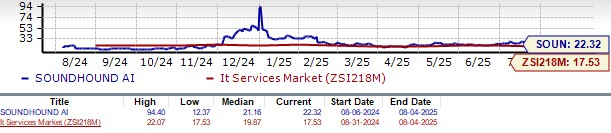

SOUN shares have gained 21.1% in the past three months, outperforming the Zacks Computers - IT Services industry but lagging the broader Zacks Computer & Technology sector.

SOUN Stock’s 3-Month Performance

In the rapidly evolving voice AI landscape, SoundHound finds itself up against formidable rivals, both from tech titans and specialized players. Chief among them are Alphabet Inc. GOOGL and Baidu, Inc. BIDU. Alphabet’s Google Assistant maintains a global stronghold, thanks to its multilingual capabilities and tight integration with Android and smart home ecosystems. With the backing of Google’s massive search infrastructure, the Assistant benefits from unmatched contextual understanding, brand trust, and scalability—factors that continue to challenge SoundHound’s more enterprise-centric approach.

On the other side of the Pacific, Baidu is making significant strides with its Ernie Bot and cutting-edge AI research. Focused on expanding voice AI across automotive and smart device segments, Baidu excels in Mandarin and regional dialects, giving it a distinct advantage in key Asian markets, a territory where SoundHound is still working to gain a foothold.

Although SoundHound may have a technical edge in real-time responsiveness and speech recognition in noisy environments, both Alphabet and Baidu are pouring resources into advancing conversational AI. As these giants accelerate their innovations, the competitive landscape grows more challenging for SoundHound.

SOUN shares are currently overvalued. In terms of its forward 12-month price-to-sales (P/S) ratio, SOUN is trading at 22.32, higher than the Zacks Computers - IT Services industry’s 17.53.

SOUN’s P/S Ratio (Forward 12-Month) vs. Industry

Despite facing stiff competition from tech giants like Alphabet and Baidu and trading at a premium valuation, investors should hold SoundHound stock ahead of its second-quarter 2025 earnings report. The company is showing strong momentum, with second-quarter revenues expected to surge more than 145% year over year. Growth is fueled by expanding deployments across restaurants, healthcare, and automotive sectors, supported by high-margin AI offerings like Smart Answering and agentic platforms.

Management’s reaffirmed full-year guidance and commitment to adjusted EBITDA profitability by year-end 2025 signal improving operational discipline. While macro and geopolitical challenges persist, margin recovery and a shift toward higher-value, cloud-based revenue offer encouraging signs.

Investors may want to wait for clearer signs of sustained profitability and improved gross margins before considering a more aggressive stance. For now, holding the stock remains a prudent strategy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 47 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite