|

|

|

|

|||||

|

|

Ralph Lauren Corporation RL posted impressive first-quarter fiscal 2026 results, wherein both the top and bottom lines increased year over year and surpassed the Zacks Consensus Estimate. The first-quarter results put an emphasis on the company’s strong brand momentum, operational discipline and strategic execution.

RL reported adjusted earnings per share of $3.77, which surpassed the consensus estimate of $3.48 per share. Also, the bottom line increased 39.6% from from $2.70 per share in the year-earlier quarter.

Ralph Lauren Corporation price-consensus-eps-surprise-chart | Ralph Lauren Corporation Quote

Net revenues grew 14% year over year to $1,719 million and beat the Zacks Consensus Estimate of $1,651 million. On a constant-currency (cc) basis, revenues were up 11% from the year-ago quarter. The top line witnessed growth across all regions, driven by brand strength, pricing efforts and continued strategic investments.

Global direct-to-consumer comparable store sales (comps) jumped 13%, backed by positive retail comps in all regions and channels. The top line was favorably impacted by 230 basis points (bps) from foreign currency rates.

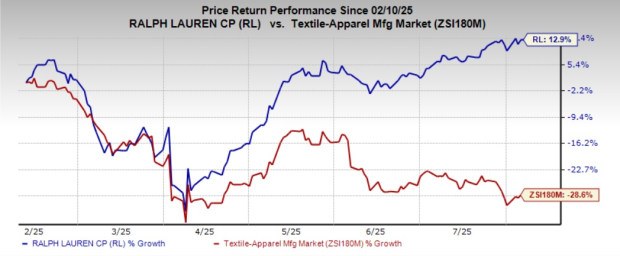

Shares of this Zacks Rank #3 (Hold) company have gained 12.9% in the past six months against the industry’s decline of 28.6%.

North America: The segment’s revenues were up 8% year over year to $656 million. Comps for North America’s retail channel rose 12% year over year, while those for brick-and-mortar stores and digital commerce moved up 10% and 19%, respectively. Revenues from the North America wholesale business rose 2% year over year.

Europe: The segment’s revenues rose 16% year over year to $555 million. The metric was up 10% on a currency-neutral basis. Comps for the retail channel in Europe were up 10%, while brick-and-mortar stores grew 10% year over year. Digital sales witnessed an 11% rise. Revenues for the segment’s wholesale business increased 15% on a reported basis and rose 10% on a cc basis.

Asia: The segment’s revenues increased 21% year over year to $474 million on a reported basis and 19% on a currency-neutral basis. Comps in Asia were up 18%, backed by 16% growth in brick-and-mortar stores and a 35% increase in the digital business.

Ralph Lauren's adjusted gross profit margin expanded 180 bps year over year to 72.3%. This was mainly driven by favorable geographic, channel and product mix, along with AUR growth and lower cotton costs, which helped offset increased pressure from tariffs and other product-related expenses.

Adjusted operating expenses rose 12% from the year-ago period to $949 million. Adjusted operating expenses, as a percentage of sales, contracted 100 bps to 55.2%.

The company’s adjusted operating income was $293 million for the reported quarter. The adjusted operating margin increased 270 bps year over year to 17%.

Ralph Lauren ended first-quarter fiscal 2026 with cash and short-term investments of $2.3 billion, total debt of $1.6 million and total shareholders’ equity of $2.5 billion. Inventory gained 18% year over year to $1.2 billion at the end of the quarter under review.

The company reported $187 million in capital expenditures for the first quarter of 2026, up from $33.4 million in the prior year.

RL repurchased nearly $250 million of Class A Common Stock in the fiscal first quarter of 2026. It returned about $300 million to its shareholders via dividends and repurchases of Class A common stock.

As of June 28, 2025, Ralph Lauren had 569 directly operated stores and 665 concession shops globally. The directly operated stores included 259 Ralph Lauren and 310 Outlet stores. The company operated 120 licensed partner stores globally as of the same date.

The company’s outlook reflects its best assessment of the current geopolitical and macroeconomic environment, including inflationary pressures, tariffs, consumer spending-related headwinds, global supply chain disruptions and foreign currency volatility.

For fiscal 2026, management expects revenues to increase in the low to mid-single digits on a constant currency basis. Based on current exchange rates, foreign currency is expected to benefit revenue growth by approximately 150 to 200 basis points. Operating margin is now expected to expand by approximately 40 to 60 basis points in constant currency, an improvement over the prior outlook, primarily driven by operating expense leverage.

Foreign currency is anticipated to contribute approximately 10 basis points to gross margin and 40 basis points to operating margin. The full-year effective tax rate is projected to be between 19% and 20%, while capital expenditures are expected to remain in the range of 4% to 5% of revenues. These projections exclude any potential restructuring-related and other net charges that may arise in future periods.

For the fiscal second quarter, RL expects revenue growth in the high single digits on a constant currency basis, with foreign currency expected to contribute an additional 100 to 150 basis points. Operating margin for the quarter is forecasted to expand by approximately 120 to 160 basis points in constant currency, primarily due to operating expense leverage. Foreign currency is also expected to benefit gross and operating margins by approximately 10 and 20 basis points, respectively. The company anticipates an effective tax rate of approximately 15% to 17% for the second quarter.

Wolverine World Wide WWW designs, manufactures and distributes a wide variety of casual and active apparel and footwear. The company sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WWW’s current financial-year sales indicates growth of 4.6% from the year-ago reported figure. The consensus mark for EPS reflects significant growth of 20% from the prior year’s figure. WWW has a trailing four-quarter earnings surprise of 39.09%, on average.

Revolve Group, Inc. RVLV operates as an online fashion retailer for millennial and Generation Z consumers in the United States and internationally. It carries a Zacks Rank #2 (Buy) at present. Revolve Group delivered a trailing four-quarter average earnings surprise of 63.4%.

The Zacks Consensus Estimate for RVLV’s current fiscal-year revenues implies growth of 5.4% from the year-ago actuals.

Savers Value Village, Inc. SVV sells second-hand merchandise in retail stores in the United States, Canada and Australia. It has a Zacks Rank of 2 at present. SVV delivered an earnings surprise of 22.1% in the trailing four quarters, on average.

The Zacks Consensus Estimate for Savers Value Village’s current fiscal-year sales indicates growth of 9% from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite