|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

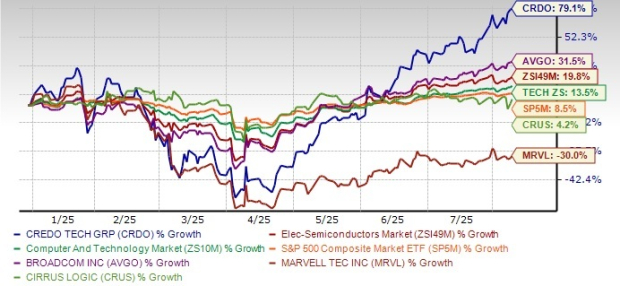

Credo Technology Group Holding Ltd CRDO has been an impressive performer in the semiconductor space, surging 79.1% year to date. The rally has been fueled by strong AI-driven demand and high investor enthusiasm for companies enabling next-generation data center connectivity.

It has outperformed the Electronic-Semiconductors and the broader Computer and Technology sector’s growth of 19.8% and 13.5%, respectively. The S&P 500 Composite is up 8.5% over the same time frame. CRDO’s stock price appreciation is also much higher than peers like Broadcom Inc. AVGO, Marvell Technology MRVL and Cirrus Logic, Inc. CRUS. Broadcom and Cirrus Logic have gained 31.5% and 4.2%, respectively while Marvell has declined 30%.

CRDO stock hit a new 52-week high of $121.50 last week. It gained 0.5% last session and closed trading at $120.41.

After a steep run, investors are likely to contemplate whether CRDO still offers attractive upside or if expectations are running ahead of fundamentals. Let’s unpack CRDO’s pros and cons to ascertain the way forward.

Credo lies at the intersection of AI and data center build-outs with its active electrical cables (AECs), optical Digital Signal Processors (DSPs), and PCIe retimers solutions that address the growing need for high-speed, low-power connectivity in the data center space.

AEC product line posted double-digit sequential growth in the fiscal fourth quarter of 2025. The demand for AECs is increasing as ZeroFlap AECs offer more than 100 times improved reliability than laser-based optical solutions. This made AECs an increasingly attractive option for data center applications, contributing to the new expansion of AEC usage and further solidifying Credo Technology’s position in the market. With demonstration of PCIe Gen6 AECs and increasing hyperscaler interest, this product line is expected to remain a growth engine going forward.

Strength in the optical business, particularly DSPs, is another key catalyst. CRDO achieved revenue targets for this business in fiscal 2025 and expects expansion of customer diversity across lane rates, port speeds and applications to accelerate revenue growth going ahead. CRDO announced that it achieved a key 800-gig transceiver DSP design win and unveiled ultra-low-power 100-gig per lane optical DSPs built on 5-nanometer technology. CRDO highlighted that this particular suite, including full DSP and linear receive optics or LRO variants, sets “new industry benchmarks for power efficiency”.

CRDO expects its 3-nanometer 200-gig-per-lane optical DSP (port speeds up to 1.6 terabits per second) to boost the industry’s transition to 200-gig lane speeds.

Supplementing these businesses is CRDO’s PCIe retimers and Ethernet retimers business. This particular product line continues to witness customer interest, especially for scale-out networks in AI servers. CRDO highlighted that the retimer business delivered “robust” performance in both the fiscal fourth quarter and fiscal 2025, driven by 50 gig and 100 gig per lane Ethernet solutions.

This growing demand underscores the increasing importance of high-performance solutions in the rapidly expanding AI server market. Shift to 100 gig per lane solutions and higher demand for system-level expertise and software capabilities for dealing with AI-optimized architectures bode well for CRDO’s retimer business.

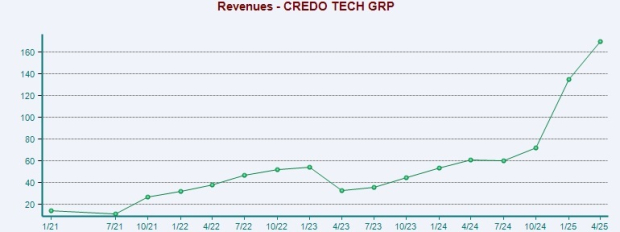

Strong AI-driven demand and solid execution continue to fuel momentum. For fiscal 2026, Credo anticipates revenues to surpass $800 million, implying more than 85% year-over-year growth. Non-GAAP operating expenses are expected to grow at less than half the revenue growth rate, driving non-GAAP net margin to nearly 40%.

For the first quarter of fiscal 2026, the company expects revenues between $185 million and $195 million, up 12% sequentially at the midpoint. The Zacks Consensus Estimate for fiscal first-quarter revenues is pegged at $190 million, suggesting growth of 218.2% from the year-ago quarter’s reported figure. Non-GAAP gross margin is projected at 64-66%, with operating expenses between $54 million and $56 million.

Increasing market competition and macroeconomic uncertainties amid tariff troubles may impact CRDO’s growth trajectory. Credo competes with semiconductor giants like Broadcom and Marvell Technology.

While hyperscaler demand is a growth driver, it also poses risks. In the fiscal fourth quarter, three customers contributed more than 10% of revenues each, and management expects this pattern to persist. A change in spending or in-house solution from one of these customers could materially affect revenue numbers. Also, two new hyperscaler ramps, a key part of fiscal 2026 guidance, are not expected until the year's second half. This leaves the first half dependent on existing customers, raising the risk that delays in the ramps could lead to a guidance miss.

Moreover, CRDO’s bullish narrative hinges on AI investment. While these segments are currently experiencing high growth, they are also cyclically dependent on AI capex spending, which could decelerate after initial buildouts.

Credo’s non-GAAP operating expenses in the fiscal fourth quarter surged 19% sequentially to $52 million, primarily due to higher headcount. Increasing costs could become a problem if the revenue growth does not keep pace.

Increasing uncertainty prevailing over the global economy and shifting trade policy remain additional overhangs. On the last earnings call, management stated that though the guidance assumes the current tariff regime, it remains “fluid.” Any untoward change in tariff policy — especially on China-related supply chains — could directly impact margins.

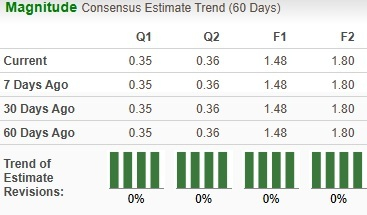

Given these pros and cons, analysts have kept their earnings estimates unchanged in the past 60 days.

In terms of the forward 12-month Price/Sales ratio, CRDO is trading at 24, higher than the Electronic-Semiconductors sector’s multiple of 8.95.

In comparison, Broadcom trades at a forward 12-month P/S multiple of 19.79, while Cirrus Logic and Marvell are trading at a multiple of 2.89 and 7.41, respectively.

In a market increasingly driven by AI tailwinds, CRDO stands out as a pure-play beneficiary with differentiated products, strong financials, and increasing demand. However, premium valuation, hyperscaler concentration risk, competitive pressures, and macro uncertainties limit near-term upside potential.

With a Zacks Rank #3 (Hold), CRDO seems to be treading in the middle of the road. Investors looking to invest are better off waiting for a favorable entry point, while investors already having a position can retain the stock given the compelling long-term fundamentals.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite