|

|

|

|

|||||

|

|

Here we highlight 2 small cap stocks with Zacks’ Outperform ratings that pulled back despite recent quarterly announcements which were arguably strong but a bit noisy.

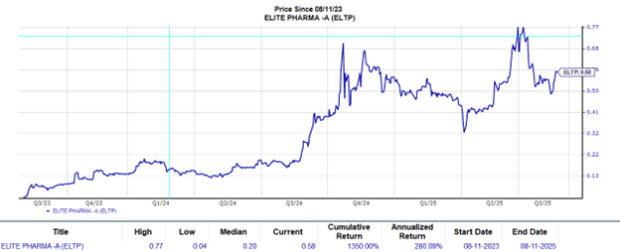

Elite Pharmaceuticals Inc. (ELTP) is a manufacturer of generic drugs. Its focus on controlled-release products which requires a higher level of manufacturing skill, combined with vertical integration, are key differentiators in what is commonly viewed as a price-sensitive commodity business. These complex formulations include CNS stimulants, abuse-deterrent pain medications and antimetabolites.

Elite Pharmaceuticals (ELTP) maintains strong positions in the mixed Amphetamine Immediate Release (IR) and Extended Release (ER) markets, which serve as foundational cash flow generators. But the real growth driver is coming from the ADHD (Attention-Deficit/ Hyper-active Disorder) market.

According to IQVIA data cited in fiscal 2025 earnings commentary, ELTP commands approximately 20% of the $400 million generic Adderall IR market and 16% of the $800 million Adderall ER market, split between 11% under the Elite label and 5% under Prasco’s label.

In fourth-quarter fiscal 2025, total revenues were approximately $31.9 million, up 78.3% from $17.9 million in the year-ago period. For fourth-quarter fiscal 2025, operating income came in at roughly $11.2 million, up from $3.7 million in the year-ago period.

Elite Pharmaceuticals entered the competitive lisdexamfetamine (Vyvanse generic) market in early 2025 and quickly captured an estimated 8–10% market share despite competing with more than a dozen suppliers. While pricing pressures persist, management noted that the product’s contribution has been substantial and margin-accretive. The Attention-Deficit/ Hyper-active Disorder treatment category remains large and growing, particularly as branded prescriptions continue transitioning to generics.

So why the pull-back after earnings? While difficult to speculate exactly, a few things may have caused some investor anxiety. Firstly, the quarter contained some noise in the form of a roughly $7.2 m warrant charge which negatively impacted EPS and resulted from the significant appreciation in the stock.

However, this is a required accounting treatment which is a non-cash charge and doesn’t impugn the underlying strength and leverage to the business. The company did cite increased competition in the ADHD generic space which may cause concerns about pricing erosion. In terms of tariff impact there is no current material impact and the significant inventory build in the quarter is most likely a hedge against this.

Lastly, perhaps recent priority to selling the business vs. uplisting to Nasdaq is creating fear of a rushed process and a possible sub optimal price take-out.

Regardless, we believe the investment thesis remains intact predicated upon continued penetration in the ADHD market with potential additional upside from international expansion.

The stock is currently trading at 6.8X trailing 12-month EV/Sales TTM, which compares to 2.9X for the Zacks sub-industry, 2.8X for the Zacks sector and 5.5X for the S&P 500 Index. Over the past five years, the stock has traded as high as 10.5X and as low as 0.7X, with a five-year median of 2.2X.

The stock is currently trading at 20.6X trailing 12-month EV/EBITDA TTM, which compares to 8.8X for the Zacks sub-industry, 10X for the Zacks sector and 18X for the S&P 500 Index.

Over the past five years, the stock has traded as high as 64.2X and as low as 3.7X, with a five-year median of 12.3X.

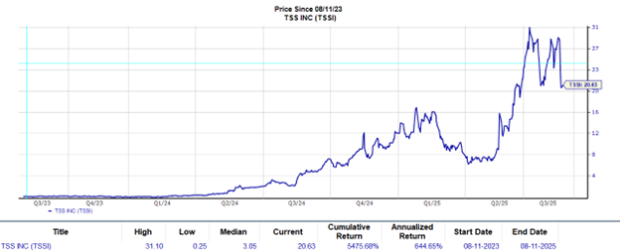

The other small cap with an even larger recent pull-back is TSS, Inc. (TSSI). TSS’s core business includes systems integration, facilities management, and IT procurement services, with a recent strategic focus on integrating AI-enabled computer racks.

This is essentially a “picks and shovels” or infrastructure play on the growth of AI. TSS, Inc. (TSSI) has been experiencing parabolic sales growth due to the expansive cap ex spending of its largest customer which constitutes nearly all of its revenue. This high level of customer concentration is also arguably the greatest risk factor.

Robust sales growth continued in this recent Q2 at 262% to $44 m and the company raised its 2025 adj. EBTIDA growth guidance from at least 50% to now at least 75%.

Despite the seemingly rosy picture the stock has pulled in nearly 30%. No doubt some investors were looking for better leverage and perhaps, like other fast-growing AI-related stocks, it was due for a breather.

EPS was flat YOY at $.06 due mostly to elevated depreciation expense stemming from the new facility build-out to accommodate growth which was fully expected. Higher interest expense connected to increased borrowing to facilitate the build-out also contributed to the flat EPS but to a lesser degree.

In May 2025, TSS began production at its new 213,000-square-foot facility in Georgetown, TX. This site, more than twice the size of its prior facility, is optimized for high-volume AI rack integration. It currently has 6 megawatts of power, expected to scale to 15 megawatts, addressing the growing power demands of modern AI infrastructure. Management expects the investment to be profitable within a two-year payback period.

We believe the recent pull-back seems excessive and represents a potential ideal entry point for new investors. The stock is now trading at a reasonable trailing EV/Sales multiple of 1.84x for a business with multi-year sales visibility and a proven growth calculus and ROI. And the company is profitable with $36.8 m in cash and 6-month operating cash flow of $37 m. Additionally, interest expense and debt issuance to accommodate further build-outs may become more favorable if a sustained interest-rate lowering period begins.

Investors should also that big IT company cap ex forecasts for data center spending is a reasonable proxy for estimating the strength of potential demand for TSS, Inc. (TSSI) products.

The stock is currently trading at 1.84X trailing 12-month EV Sales/TTM, which compares to 1.19X for the Zacks sub-industry, 3.30X for the Zacks sector and 5.38X for the S&P 500 index. Over the past five years, the stock has traded as high as 3.28X and as low as -0.56X, with a 5-year median of 0.14X.

The stock is currently trading at 37.32X trailing 12-month EV/EBITDA TTM, which compares to 13.82X for the Zacks sub-industry, 19.12X for the Zacks sector and 17.49X for the S&P 500 index. Over the past five years, the stock has traded as high as 57.90X and as low as -60.47X, with a 5-year median of 7.71X.

Disclosure: Mark owns ELTP in his personal portfolio.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Jan-15 | |

| Jan-09 | |

| Dec-08 | |

| Nov-20 | |

| Nov-19 | |

| Nov-14 | |

| Nov-13 | |

| Nov-13 | |

| Oct-30 | |

| Sep-10 | |

| Sep-02 | |

| Aug-18 | |

| Aug-14 | |

| Aug-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite