|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Intuitive Surgical ISRG posted second-quarter fiscal 2025 results on July 22. It delivered a solid top-line beat and healthy procedure growth, but shares have lost more than 7% since the release. While operational execution remained strong, investors zeroed in on margin pressures, cost headwinds, and certain demand risks that overshadowed the positives.

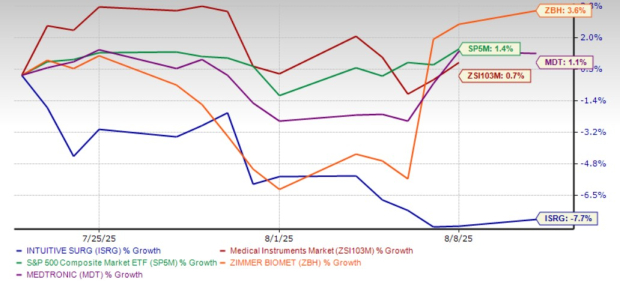

ISRG has lost 7.7% since July 22 against the industry’s growth of 0.7%. It has also underperformed its peers like Medtronic MDT and Zimmer Biomet ZBH over this period. While MDT has gained 1.1%, ZBH improved 3.6%. The S&P 500 Index was up 1.4% in the same period.

Tariff and Cost Inflation Weigh on Margins: Management acknowledged that recently enacted tariffs will have a roughly 100-basis-point negative impact on cost of sales in 2025, with the effect likely to increase each quarter as higher-cost inventory moves through the system. The tariffs compound existing pressure from higher facilities costs, increased service costs related to the da Vinci 5 rollout, and a greater mix of lower-margin Ion systems and da Vinci 5 platforms. Pro-forma gross margin slipped to 67.9% from 70% a year ago.

International and Domestic CapEx Headwinds: The company noted ongoing budgetary and financial constraints in international markets such as Japan, China, and parts of Europe, which could slow hospital capital spending. There is also a possibility for U.S. CapEx risk if macro or policy pressures intensify. These dynamics raise concerns about sustaining placement momentum.

Procedure Mix Shift Dampening Revenue per Case: ISRG cited downward pressure from fewer bariatric procedures, which tend to drive higher instrument and accessory (I&A) revenues. Moreover, higher cholecystectomy procedures, which typically yield lower per-procedure revenue, are also adding to the pressure.

Shifts in Transaction Structure: A higher mix of trade-in transactions, alongside expectations for leasing to increase over time, may weigh on near-term capital sales.

Operational Expense Growth: Rising headcount and increased depreciation from newly commissioned facilities and other investments are driving operating expenses higher, limiting near-term operating leverage.

Medicaid Coverage Uncertainty: Management also flagged the potential for loss of coverage for Medicaid patients, introducing an element of U.S. demand uncertainty.

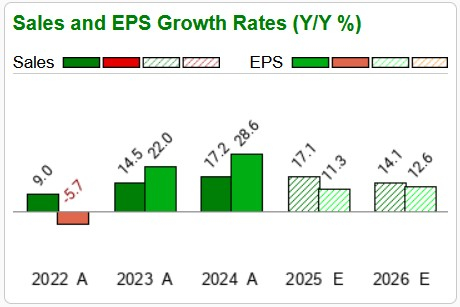

The top and bottom-line estimates for 2025 and 2026 suggest continued growth for both the metrics. However, the estimates imply a slower growth rate for ISRG going forward as compared to 2024. A slower growth in 2025, especially for EPS, reflects ongoing pressure on gross margin due to increasing depreciation, a higher product mix of low-margin Ion and da Vinci 5, and tariff risks.

Both its peers, Medtronic and Zimmer Biomet, are also anticipated to have a weaker EPS growth rate, primarily due to ongoing macro headwinds similar to ISRG.

Intuitive Surgical is currently trading at a forward 12-month price-to-earnings of 53.61X, significantly higher than the industry average of 27.98X. However, the current valuation is lower than its five-year median of 72.19X. The company currently carries a Zacks Value Score of ‘D.’ Meanwhile, Medtronics and Zimmer Biomet are trading at a significantly cheaper valuation of 16.35X and 12.3X. MDT and ZBH are also trading below their industry-average, reflecting an attractive valuation with a Zacks Value Score of ‘B’.

Promising da Vinci 5 Adoption: Despite near-term margin pressure, the da Vinci 5 platform is gaining traction, with procedures and placements increasing. The company is enhancing its value proposition through clinical and workflow features, although force-feedback instruments remain supply-constrained until at least the first quarter of 2026.

Encouraging Approvals for New Instruments and Procedures: ISRG secured approval for multiple new instruments — such as the SP stapler, vessel sealer curved, and 50-use endoscope — and new procedures, including tracheal bronchoplasty, transanal local excision and resection. These additions expand the addressable market and offer opportunities for higher I&A utilization per case over time.

International Expansion Bolstering Growth: Despite budget pressures in certain regions, the company continues to expand its footprint across Europe, Japan, China, India, Australia and Korea. Management emphasized that procedure growth in several of these markets is contributing meaningfully to the top line.

During the earnings call, management reiterated its commitment to developing Intuitive Telepresence, a platform designed to enable surgeons to perform operations remotely using ISRG’s robotic systems. This technology could dramatically extend the reach of skilled surgeons beyond the physical confines of a single hospital, potentially addressing critical shortages of surgical expertise in underserved or rural areas.

From a strategic standpoint, telesurgery has the potential to redefine ISRG’s addressable market. By decoupling surgeon location from patient location, the company could tap into hospitals that currently lack on-site access to specialized procedures. This not only expands the customer base but also increases the frequency of complex, high-value surgeries performed using ISRG’s platforms.

Management noted that Intuitive Telepresence remains in early development stages, with ongoing work to ensure reliability, precision, and compliance with stringent regulatory and data-security requirements. While commercialization is still some years away, the initiative aligns with broader healthcare trends toward telemedicine and remote care delivery. If successful, telesurgery could become a multi-billion-dollar incremental opportunity, opening up licensing, subscription, and service revenue streams alongside traditional system sales.

Intuitive Surgical, Inc. price | Intuitive Surgical, Inc. Quote

The post-earnings pullback reflects a clear investor concern — margin resilience in the face of tariffs, cost inflation and an evolving procedure mix. The combination of lower-margin platform sales, rising operating expenses, and international CapEx constraints has introduced uncertainty into what had been a consistently high-margin growth story.

Yet, the structural tailwinds remain compelling. The da Vinci 5’s clinical differentiation, an expanding portfolio of approved instruments and procedures, and ongoing international market penetration provide avenues for growth. Longer term, telesurgery could open entirely new revenue streams.

For now, investors will likely key in on three near-term milestones –visibility on tariff mitigation strategies, signs of gross-margin stabilization, and progress in easing supply constraints for high-value da Vinci 5 instruments. We caution investors against taking any new position in the stock. However, existing investors may continue to hold it at present. ISRG carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite