|

|

|

|

|||||

|

|

Microsoft Corp. MSFT has been capitalizing on artificial intelligence (AI) business momentum and Copilot adoption alongside accelerating Azure cloud infrastructure expansion. Strong Office 365 Commercial demand has been propelling Productivity and Business Processes revenue growth. ARPU (average revenue per user) is increasing through E5 and M365 Copilot uptake across key segments.

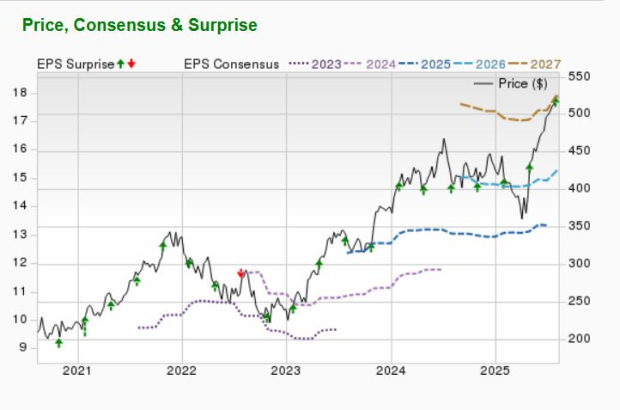

MSFT delivered exceptional fourth-quarter fiscal 2025 results, which exceeded the Zacks Consensus Estimate across all key metrics, demonstrating the company's dominant position in the rapidly expanding cloud and AI markets. These robust results underscore Microsoft's successful execution of its cloud-first, AI-powered strategy and present a compelling investment opportunity for the rest of 2025.

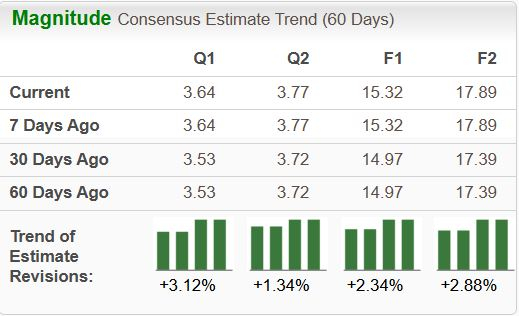

For first-quarter fiscal 2026, the Zacks Consensus Estimate currently shows revenues of $75.38 billion, suggesting an increase of 14.9% year over year and EPS of $3.64, indicating an improvement of 10.3% year over year. The Zacks Consensus Estimate for current quarter earnings has improved 3.7% over the last 30 days.

For fiscal 2026 (ending June 2026), the Zacks Consensus Estimate currently shows revenues of $320.3 billion, suggesting an increase of 13.7% year over year and earnings per share of $15.32, indicating an improvement of 12.3% year over year. The Zacks Consensus Estimate for current-year earnings has improved 2.3% over the last 30 days.

For fiscal 2027 (ending June 2027), the Zacks Consensus Estimate currently shows revenues of $366.3 billion, suggesting an increase of 14.4% year over year and earnings per share of $17.89, indicating an improvement of 16.7% year over year. The Zacks Consensus Estimate for current-year earnings has improved 2.9% over the last 30 days.

The Zacks Consensus Estimate for long-term (3-5 years) EPS growth of MSFT is currently pegged at 14.9%, higher than the S&P 500’s EPS growth rate of 12.8%.

Microsoft delivered exceptional growth across its Azure, AI, and Copilot platforms during the fourth quarter of fiscal 2025, demonstrating its leadership in the AI transformation. Azure achieved remarkable scale, surpassing $75 billion in annual revenues with 34% growth, while expanding its global infrastructure to more than 400 datacenters across 70 regions. MSFT added more than two gigawatts of new capacity and made every Azure region AI-first, with all locations now supporting liquid cooling for enhanced performance and flexibility.

Despite stiff competition in the AI-powered cloud space, Azure holds approximately 20-24% of the global cloud market share, second only to Amazon.com Inc.’s AMZN around 31% hold. Azure is well ahead of Alphabet Inc.’s GOOGL Google cloud and Oracle Corp.’s ORCL cloud.

The AI momentum extends beyond infrastructure, with Microsoft's Copilot products achieving significant traction. The company reported that its AI assistants, including Microsoft 365 Copilot for commercial customers and the consumer Copilot in Windows, have reached 100 million monthly active users. This rapid adoption demonstrates MSFT’s ability to monetize AI investments through practical applications that enhance productivity across its ecosystem.

Microsoft currently trades at higher valuations with respect to several valuation metric compared with its peers and the S&P 500 Index. While this elevated valuation might typically signal caution, several factors justify the premium.

MSFT’s accelerating Azure growth, expanding margins, and leadership position in the AI revolution support higher multiples. The premium valuation reflects investor confidence in Microsoft's ability to sustain above-market growth rates and capture an outsized share of the cloud and AI opportunity.

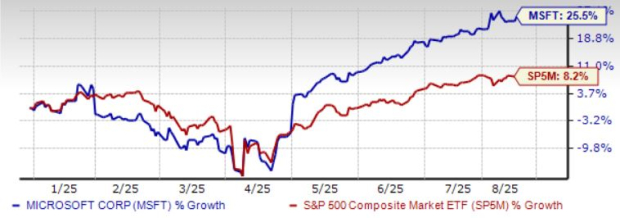

Consequently, the average short-term price target of brokerage firms represents an increase of 17.6% from the last closing price of $529.24. The brokerage target price is currently in the range of $678-$485. This indicates a maximum upside of 28.1% and a downside of 8.4%. Therefore, the current risk-reward ratio is highly beneficial for the Stock. Year to date, the stock price of MSFT climbed 25.5%.

MSFT benefits from deep enterprise relationships and seamless integration with its Office productivity suite, Windows operating system, and enterprise software solutions. This ecosystem approach creates significant switching costs and drives the adoption of Azure services among existing Microsoft customers.

Furthermore, Microsoft's early and aggressive investments in AI, particularly through its partnership with OpenAI, have positioned Azure as the preferred platform for AI workloads, attracting both startups and enterprises seeking to leverage cutting-edge AI capabilities.

Microsoft's differentiated approach focusing on hybrid cloud solutions and enterprise integration continues to resonate with customers. The company's ability to deliver consistent growth while operating at such a massive scale demonstrates the sustainability of its competitive advantages and the effectiveness of its strategic investments.

Microsoft currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

With Azure showing acceleration rather than deceleration at its current scale, and AI monetization still in early stages, MSFT appears well-positioned to grow into and potentially exceed its current valuation multiples.

Microsoft currently carries a Zacks Momentum Style Score B and a Zacks Growth Style Score B. For growth-oriented investors seeking exposure to secular technology trends, Microsoft presents an attractive entry point despite the premium valuation, particularly given its proven execution track record and multiple growth drivers extending well into the future.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| 25 min | |

| 27 min | |

| 49 min | |

| 1 hour | |

| 1 hour | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Land Grab for Data Centers Is One More Obstacle to Much-Needed Housing

GOOGL MSFT

The Wall Street Journal

|

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite