|

|

|

|

|||||

|

|

Amid the broader stock market rally yesterday, Morgan Stanley MS shares touched an all-time high of $148.23 during the trading session to finally close at $147.29. The rally came after the release of the latest inflation report, which suggests that core inflation increased 3.1% year over year in July 2025, more than June’s 2.9% rise.

As Wall Street digests the inflation data, investors have become more optimistic about a Fed rate cut next month, which drove the market rally.

In the past 3 months, Morgan Stanley shares have gained 12.4%, outperforming the S&P 500 Index’s 8.8% rise and its industry’s 11.3% growth. While MS has performed better than its peer, Bank of America BAC, it has underperformed another close competitor, Citigroup C. The BAC stock has moved up 6.2%, whereas shares of Citigroup have rallied 27.2% in the same time frame.

Does the MS stock have more upside left despite hitting an all-time high? Let us find out.

Increased Focus on Wealth & Asset Management Operations: Morgan Stanley has lowered its reliance on the capital markets for income generation. It has now been focusing on expanding its wealth and asset management operations. The acquisitions of Eaton Vance, E*Trade Financial and Shareworks are steps in this direction. These moves have bolstered the company’s diversification efforts, enhanced stability and created a more balanced revenue stream across market cycles.

The wealth and asset management businesses’ aggregate contribution to total net revenues jumped to more than 55% in 2024 from 26% in 2010. We project both segments' total contribution (in aggregate) to the top line to be 53.8% in 2025.

The wealth management segment’s total client assets witnessed a five-year (2019-2024) compound annual growth rate (CAGR) of 18.1%, while the investment management segment’s total assets under management saw a CAGR of 24.7% over the same period. The upward momentum is expected to continue as the operating environment becomes more favorable.

Strategic Alliances: MS’s partnership with Mitsubishi UFJ Financial Group, Inc. will likely keep supporting its profitability. In 2023, the companies announced plans to deepen their 15-year alliance by merging certain operations within their Japanese brokerage joint ventures. The new alliance saw combined Japanese equity research, sales and execution services for institutional clients at Mitsubishi UFJ Morgan Stanley Securities and Morgan Stanley MUFG Securities. Also, their equity underwriting business has been rearranged between the two brokerage units. These efforts will solidify the company’s position in Japan’s market.

Also, this has helped the company achieve record equity net revenues, particularly in Asia, through outperformance in prime brokerage and derivatives, led by solid client activity amid heightened volatility. The company’s Asia region revenues jumped 28% year over year to $4.65 billion in the first half of 2025.

Solid Balance Sheet & Capital Position: Morgan Stanley has a solid balance sheet. As of June 30, 2025, the company had long-term debt of $320.1 billion, with $23.8 billion expected to mature over the next 12 months. The company’s average liquidity resources were $363.4 billion as of the same date.

MS’s capital distribution plans have been impressive. Following the clearance of the 2025 stress test, it announced an 8% hike in quarterly dividend to $1.00 per share and reauthorized a multi-year share repurchase program of up to $20 billion (no expiration date). The company has increased its dividend five times in the last five years, with an annualized growth rate of 22.8%.

Given a solid liquidity position and earnings strength, Morgan Stanley is expected to be able to continue with efficient capital distribution activities, thereby enhancing shareholder value.

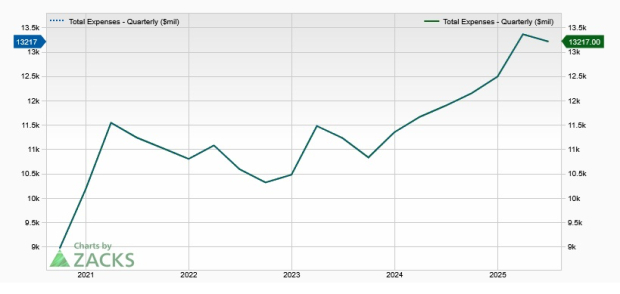

Rising Expense Base: Despite Morgan Stanley’s restructuring and streamlining efforts that resulted in achieving its cost savings target of $1 billion in 2017, overall expenses have been increasing. Though expenses declined in 2022, the metric witnessed a five-year (ended 2024) CAGR of 7.8%. The rising trend continued in the first half of 2025.

Expenses are expected to remain elevated on the steady increase in revenues (leading to higher compensation costs) and inflation, as well as the company’s investments in franchise and inorganic growth efforts.

Reliance on Trading Revenues: Morgan Stanley’s over-dependence on trading revenues is worrisome. While sales and trading revenues improved in 2021, 2022 and 2024, they declined in 2023. Because of the uncertainty surrounding the tariff plans, trading revenues increased again in the first half of 2025. However, the volatile nature of the business and the expectation that it will gradually normalize toward the pre-pandemic level are likely to make growth challenging in the upcoming quarters.

MS’s efforts to become less dependent on capital markets-driven revenues, its inorganic expansion efforts/strategic alliances, along with relatively high rates, are expected to support financials. Moreover, supported by a solid balance sheet position, the company is expected to be able to meet near-term debt obligations, even if the economic situation worsens.

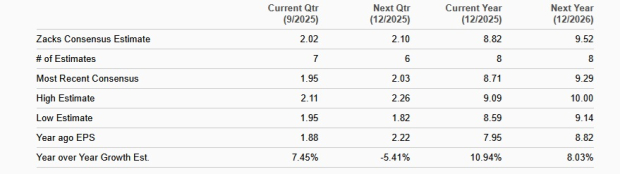

Analysts seem to be bullish regarding MS’s earnings growth prospects. Over the past 30 days, the Zacks Consensus Estimate for the company’s 2025 and 2026 earnings has moved upward. The estimates reflect year-over-year growth rates of 10.9% for 2025 and 8% for 2026.

However, rising expenses, given higher compensation costs and inorganic growth efforts, will likely hurt the company’s profitability in the near term. High reliance on trading revenues is another headwind.

Hence, investors should not rush to buy the MS stock now; instead, they should keep this Zacks Rank #3 (Hold) stock on their radars and wait for an attractive entry point. Those who already own the MS stock in their portfolio can retain it because it is less likely to disappoint over the long term.

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite