|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

This e-commerce company's growth remains impressive, with plenty of opportunity ahead.

MercadoLibre is spending more now to ensure it wins its fair share of this future growth.

Interested investors will want to make sure they enter a position with a true long-term mindset.

You're probably aware of how the market's biggest companies fared last quarter. The biggest earnings reports, however, aren't necessarily the best we've seen. Many of this earnings season's most impressive numbers are coming from names that few people have even heard of, and even fewer are talking about yet.

Case in point: MercadoLibre (NASDAQ: MELI). This profitable e-commerce outfit's top line soared 34% last quarter (up 53% on a constant-currency basis), extending a multi-year growth streak that's likely to persist at this pace for at least a few more. Better still, the stock didn't jump after the company posted its second-quarter numbers last Monday. They're down just a bit since then, in fact, translating into opportunity for investors looking for a reasonably valued growth stock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Here's the deal.

If you've never heard of MercadoLibre, the most likely reason is that it doesn't do business in the United States. MercadoLibre's focus is exclusively on the Latin American market, and for now, mostly Brazil, Mexico, and Argentina.

It's an e-commerce platform, although the description doesn't quite do it justice. It would be more accurate to describe it as a complete business ecosystem, offering everything from payment processing to banking to logistics to advertising, and, of course, a place to sell goods online. It's often referred to as the Amazon of Latin America, in fact, although even that comparison somehow seems to fall short of everything that MercadoLibre is.

It's certainly growing like Amazon did during its early years. Last quarter's top line of just under $6.8 billion was 34% better than the year-earlier comparison, lifted by a 21% improvement in the number of merchandise sales it facilitated, and a 39% increase in the number of payments it handled. Indeed, despite offering a wide range of retail technology solutions, payments are actually its biggest business.

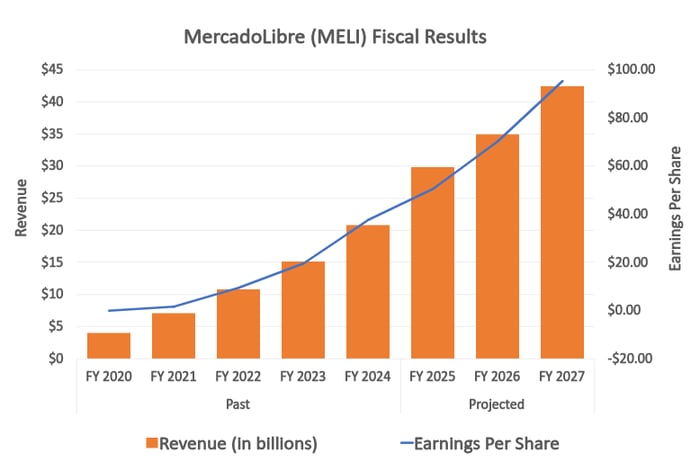

Although the company doesn't provide guidance, the analyst community is looking for comparable revenue growth at least through 2027. Earnings growth is expected to keep pace too, improving from last fiscal year's $37.69 per share to $95.20 by the end of the three-year stretch.

Data source: StockAnalysis.com. Chart by author.

This begs the question...why aren't more people talking about this amazing growth story? For that matter, how has this ticker been allowed to drift lower since its short-lived and relatively small surge following May's release of its first-quarter numbers? There's a reason -- just not a good one.

Obviously, there are no absolute certainties as to why a stock behaves as it does. There are only conjectures. Conjectures can be well-informed, though.

In this case, the post-earnings buzz was focused on MercadoLibre's thinning profit margins. Sales grew well enough, but its costs grew a bit more, limiting last quarter's net income to only $10.31 per share versus analysts' expectation for a per-share profit of $11.93. Free shipping of online orders to more of Brazil's e-commerce customers was the key culprit, although several categories of expenditures -- including marketing -- grew more than a little during the company's fiscal second quarter.

There's something the market's not fully appreciating about MercadoLibre's relatively expensive decision to lower the minimum order threshold for free shipping. As MercadoLibre's commerce president (and future CEO) Ariel Szarfsztejn commented during the company's Q2 earnings conference call:

"We just launched this [more free shipping] a few weeks back. So it's a bit early, but we definitely expect the trend that we see in traffic increases, conversion rate increasing, more engagement, more frequency to continue in the future. And with that, we expect to see orders going up, order sizes going up and so on."

Let's not forget that such an investment in its future growth worked incredibly well for Amazon several years back.

Perhaps the most exciting aspect of MercadoLibre's growth story has nothing to do with the company itself, and everything to do with the market it serves.

In many ways, Latin America is now where North America was 20 years ago. Although online shopping had been around for a while by then, high-speed internet was still relatively new at that time, and broadband-connected smartphones were just starting to become the norm. That's a big reason Amazon's (and for that matter, the industry's) fastest and most explosive growth didn't materialize in earnest until around 2007, when the first iPhone debuted.

Image source: Getty Images.

Now, it's Latin America's turn. Although mobile phones and broadband connectivity have been offered in most of the region's major markets for a while, both are only just now becoming widely available and affordable. Market research firm Canalys says that smartphone shipments to Latin America grew 15% last year to reach a record high of 137 million units, versus a market population of nearly 670 million.

Meanwhile, Cognitive Market Research predicts that South America's fiber-to-the-home market is set to grow at an average annual pace of 12.5% through 2030, underscoring the broadband connectivity newness and lingering lack of penetration in the region.

As was the case in the U.S., it's not taking Latin America's consumers and companies long to figure out they can easily connect online. That's why AI-powered decision-intelligence software provider Parcel Perform believes the region's e-commerce market is set to grow at a brisk 19% per year through 2027.

As the leader of the markets where it focuses its efforts, MercadoLibre is well-positioned to capture more than its fair share of this growth. The fact that these markets are currently highly fragmented only improves the opportunity to consolidate this business under one all-encompassing roof.

Just because a company is doing all the right things well doesn't inherently mean its stock is always easy to own -- an idea proven by this stock since shortly after May's earnings report. MercadoLibre is still growing, and there's sound, proven reasoning for its sizable spending growth. Investors still aren't convinced, though, and they're dragging the stock lower due to their doubt. That's understandable.

Just don't forget the brilliant observation that economist Benjamin Graham made in his 1949 book, The Intelligent Investor, which still applies today: "In the short run, the market is a voting machine but in the long run, it is a weighing machine."

The recent weakness in MercadoLibre's shares is an emotionally driven "vote" against the company's profit-pinching decision to cast a wide net by offering more free shipping, and spending more on marketing. In the long run, shares will reflect the benefit of this investment that MercadoLibre's making in its own bright future. The stock's pricing disparity in the meantime spells opportunity for long-term-minded growth investors.

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $668,155!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,106,071!*

Now, it’s worth noting Stock Advisor’s total average return is 1,070% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 13, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and MercadoLibre. The Motley Fool has a disclosure policy.

| 2 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite