|

|

|

|

|||||

|

|

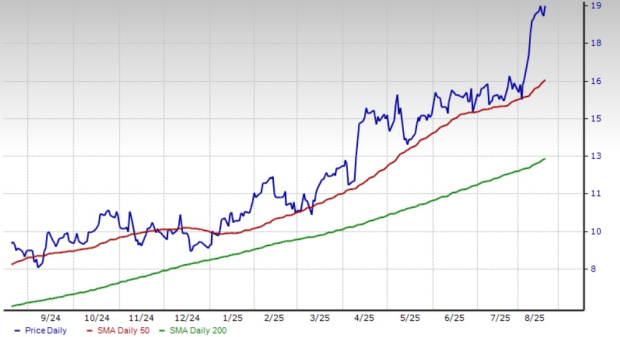

Kinross Gold Corporation’s KGC shares have soared 70.5% in the past six months, outperforming the Zacks Mining – Gold industry’s gain of 38.7% and the S&P 500’s rise of 5%. The rally has been driven by its better-than-expected earnings performance, buoyed by the strength in gold prices and strong operating performance.

KGC’s gold mining peers, Barrick Mining Corporation B, Newmont Corporation NEM and Agnico Eagle Mines Limited AEM, have gained 28.3%, 46.2% and 36%, respectively, over the same period.

Technical indicators show that KGC has been trading above the 200-day simple moving average (SMA) since March 6, 2024. The stock is also currently trading above its 50-day SMA. The 50-day SMA continues to read higher than the 200-day moving average, indicating a bullish trend.

Is the time right to buy KGC’s shares for potential upside? Let’s take a look at the stock’s fundamentals.

Kinross has a strong production profile and boasts a promising pipeline of exploration and development projects. Its key development projects and exploration programs, including Great Bear in Ontario and Round Mountain Phase X in Nevada, remain on track. These projects are expected to boost production and cash flow and deliver significant value. KGC also completed the commissioning of its Manh Choh project and commenced production during the third quarter of 2024, leading to a substantial increase in cash flow at the Fort Knox operation.

Tasiast and Paracatu, the company’s two biggest assets, remain the key contributors to cash flow generation and production. Tasiast remains the lowest-cost asset within its portfolio, with a consistently strong performance. Tasiast achieved record annual production and cash flow in 2024 and is on track to meet its full-year 2025 guidance. Paracatu continues to deliver strong performance, with second-quarter production rising on higher grades and improved mill recoveries.

KGC has a strong liquidity position and generates substantial cash flows, which allows it to finance its development projects, pay down debt and drive shareholder value. KGC ended second-quarter 2025 with robust liquidity of roughly $2.8 billion, including cash and cash equivalents of more than $1.1 billion. Second-quarter free cash flow surged roughly 87% year over year and 74% from the preceding quarter, driven by the strength in gold prices and strong operating performance.

Kinross repaid $800 million of debt during 2024 and the remaining $200 million of its term loan in the first quarter of 2025. Moreover, KGC improved its net debt position to around $100 million at the end of the second quarter from $540 million in the prior quarter. Its long-term debt-to-capitalization is 13.9%.

Higher gold prices should boost KGC’s profitability and drive cash flow generation. Gold prices have gained roughly 27% this year, driven by aggressive trade policies, including sweeping new import tariffs announced by President Donald Trump, intensified global trade tensions and heightened investor anxiety. Also, central banks worldwide have been accumulating gold reserves, led by risks arising from Trump’s policies. Prices of the yellow metal catapulted to a record high of $3,500 per ounce on April 22. While gold prices have fallen from their April 2025 highs, they remain favorable, aided by economic uncertainties, and are currently hovering above the $3,300 per ounce level.

Further, KGC offers a dividend yield of 0.6% at the current stock price. It has a payout ratio of 10% (a ratio below 60% is a good indicator that the dividend will be sustainable). Backed by strong cash flows and sound financial health, the company's dividend is perceived as safe and reliable.

Earnings estimates for KGC have been rising over the past 60 days, reflecting analysts’ optimism. The Zacks Consensus Estimate for 2025 and 2026 has been revised upward over the same time frame.

The Zacks Consensus Estimate for 2025 earnings is currently pegged at $1.38, suggesting year-over-year growth of 102.9%. Earnings are also expected to register roughly 2.2% growth in 2026.

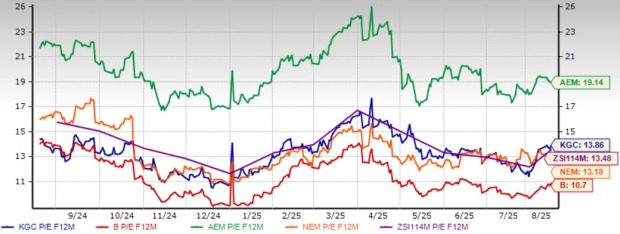

KGC is currently trading at a forward price/earnings of 13.86X, a modest 2.8% premium compared to the industry’s average of 13.48X. It is trading at a premium to Barrick and Newmont and a discount to Agnico Eagle. Kinross and Newmont currently have a Value Score of B, each. Barrick has a Value Score of A, while Agnico Eagle has a Value Score of D.

KGC presents an attractive investment case with a strong pipeline of development projects and solid financial health. Rising earnings estimates and a healthy growth trajectory are the other positives. Kinross continues to demonstrate strong financial performance and remains committed to driving shareholder returns. The company is generating solid free cash flow and deleveraging rapidly, benefiting from a favorable gold price environment. With compelling fundamentals and gold price tailwinds firmly remaining in place, KGC looks poised to deliver attractive returns to investors, making this Zacks Rank #1 (Strong Buy) stock a prudent choice to bet on for those looking to capitalize on the favorable market conditions.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite