|

|

|

|

|||||

|

|

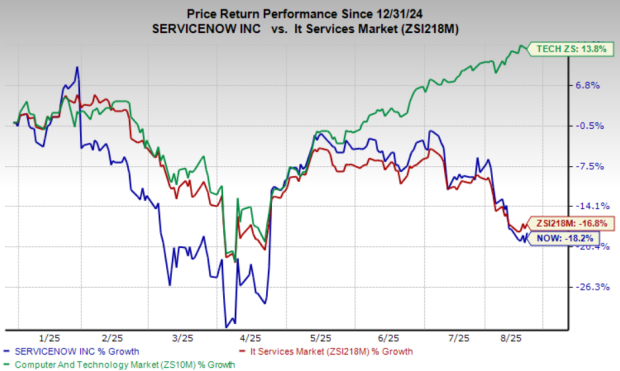

ServiceNow NOW shares have declined 18.2% year to date, while the Zacks Computers – IT Services industry has plunged 16.8%. However, the Zacks Computer & Technology sector has appreciated 13.8% during the same period. The decline in ServiceNow’s shares can be attributed to macroeconomic pressures and tightening budgets across certain enterprise and federal segments.

Despite these near-term headwinds, ServiceNow's transformation into an AI-powered enterprise platform continues to gain momentum, raising questions about whether the stock’s recent weakness creates an attractive entry point or signals deeper concerns about growth sustainability.

ServiceNow has built a broad AI ecosystem anchored by its AI Control Tower, a centralized system for governing enterprise AI agents. This framework is already showing financial traction, with subscription revenue rising 22.5% year over year to $3.11 billion in the second quarter of 2025.

The partnership with NVIDIA NVDA on the Nemotron large language model expands reasoning capabilities while allowing flexibility across multiple AI providers, including Microsoft’s MSFT OpenAI, Google’s Gemini and Anthropic’s Claude. This breadth of support has translated into tangible wins, highlighted by a $20 million Now Assist deal and 21 agreements involving five or more Now Assist products.

The acquisition of data.world strengthens ServiceNow’s data governance capabilities by adding knowledge graph technology critical for AI deployments. Workflow Data Fabric, which featured in 17 of the top 20 largest deals during the recently reported quarter, implies strong demand for integrated solutions. Together, these investments and NVIDIA’s AI infrastructure expertise position ServiceNow to become a central platform for enterprise AI operations.

ServiceNow is extending its reach beyond core IT service management into front-office workflows, underscoring its evolution into a full-scale business transformation platform. The Logik.ai acquisition strengthened configure-price-quote capabilities, leading to nine CPQ deals in June as the company builds presence in markets long dominated by Salesforce CRM.

NOW's emphasis on agentic AI provides differentiation from Microsoft’s suite, even as both players accelerate AI investments. This strategy is resonating with customers, as Pro Plus deal counts rose more than 50% sequentially and ITSM Plus deal values quadrupled year over year, reflecting growing demand for enhanced AI functionality.

Customer metrics reflect steady adoption trends, with ServiceNow ending the second quarter with 528 customers generating over $5 million in annual contract value. Customers contributing $20 million or more increased by over 30% year-over-year. A 98% renewal rate highlights strong customer satisfaction, supporting sustained growth in large accounts.

The Zacks Consensus Estimate for third-quarter 2025 earnings is pegged at $4.22 per share, unchanged over the past 30 days, indicating a 13.44% increase over 2024’s reported figure.

The consensus mark for third-quarter 2025 revenues is pegged at $3.35 billion, suggesting growth of 19.88% over 2024’s reported figure.

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

ServiceNow is navigating an environment where AI adoption is accelerating, but budget scrutiny is tightening. Lengthier procurement cycles and more rigorous approval processes are slowing deal closures, creating execution risks for large-scale platforms.

The federal segment remains a pressure point, with budget constraints limiting near-term upside despite the addition of six new logos in the second quarter. Current RPO growth expectations of 18.5% for the third quarter already reflect a 200-basis point headwind from large customer renewals, with the Zacks Consensus estimate for the same being pegged at $11.09 billion. These signals highlight how spending caution could weigh on near-term growth visibility.

Competition is intensifying. Salesforce is pushing deeper into enterprise workflows with its Einstein AI suite, while Microsoft is expanding Copilot across Azure, forcing ServiceNow to prove its differentiation in agentic AI and workflow integration. Strategic partnerships such as NVIDIA provide a lever, but the ability to convert innovation into measurable outcomes remains critical under tighter spending conditions.

ServiceNow stock is overvalued, as suggested by the Value Score of F.

In terms of the forward 12-month Price/Sales, NOW is trading at 12.32X, higher than the Computer & Technology sector’s 6.78X.

Despite strong operational execution and promising AI momentum, ServiceNow's premium valuation creates limited margin for error. The company's strategic positioning in enterprise AI automation remains compelling, with differentiated offerings that address real customer pain points. However, federal sector headwinds and heightened competitive pressure from Salesforce's AI investments and Microsoft's enterprise AI integration suggest a cautious approach is warranted.

ServiceNow currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable time to accumulate the stock. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 40 min | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours |

Stock Market Today: Nasdaq Rallies; Solar Stocks Shine But These Breakout Stocks Wither (Live Coverage)

NVDA

Investor's Business Daily

|

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite