|

|

|

|

|||||

|

|

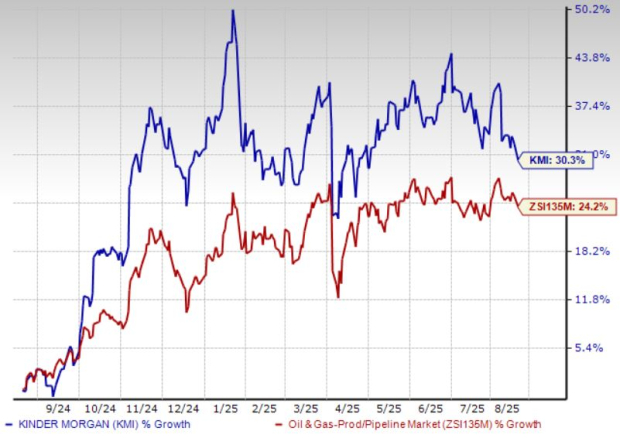

Kinder Morgan, Inc. KMI has surged 30.3% over the past year, outpacing the industry’s 24.2% rally. A rising project backlog is among the key factors supporting the company’s stock price rally. Still, before drawing any investment conclusions, it’s better to analyze the fundamentals of the midstream energy player and its overall business environment.

The leading midstream energy company experienced a surge in its project backlog during the June quarter of 2025. The backlog grew to $9.3 billion from $8.8 billion, reflecting strong demand for its services and thereby securing incremental fee-based revenues. Thus, KMI will likely generate more cash flows for its shareholders.

In the June quarter, Kinder Morgan took on $1.3 billion in new projects, which is quite encouraging. Key developments include the Trident Phase 2 project and the Louisiana Line Texas Access project, both of which are designed to transport natural gas from Texas to Louisiana, a vital region for LNG (liquefied natural gas) exports. Interestingly, with the rising demand for LNG export, both long-term projects are backed by solid customer commitments, further reassuring incremental and reliable cash flows.

Interestingly, almost half of the backlog’s projects are aided by mounting power demand. With the rising need for electricity from the booming data centers and the growth in population, natural gas transportation and storage have become paramount, thereby glorifying Kinder Morgan’s business outlook.

Being a leading midstream energy company, Kinder Morgan is well-positioned to benefit from the increasing demand for natural gas both in the United States and worldwide. Notably, LNG export is mounting in the United States, and with KMI being responsible for transporting roughly 40% of all the gas to the liquefaction terminals, the company’s outlook seems bright.

KMI is expecting LNG demand across the world to double by the end of this decade. This further brightens its outlook, considering it has a massive network of existing natural gas pipelines which is strategically located along the U.S. Gulf Coast, where the concentration of LNG facilities is high.

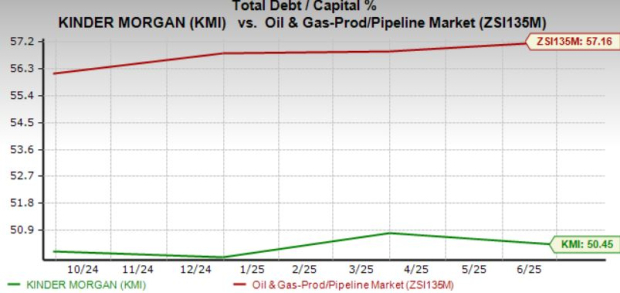

Examining Kinder Morgan’s balance sheet, the company has considerable exposure to debt capital, but it fares better than the industry’s composite stocks. KMI’s debt-to-capitalization of 50.5% is lower than the industry’s 57.2%. Therefore, KMI is in a relatively stronger position than most industry players to handle market uncertainties.

The valuation parameter suggests that Kinder Morgan is currently trading at a bargain. The stock is currently trading at a trailing 12-month enterprise value-to-EBITDA (EV/EBITDA) of 13.60x. This represents a discount compared with the broader industry average of 14.14x and midstream giants like Enbridge ENB and The Williams Companies, Inc. WMB, which trade at 15.20x and 16.31x, respectively.

However, investors shouldn’t jump to bet on the undervalued KMI stock right away, as there are some uncertainties surrounding the company’s overall business. One of the risks that could concern investors is that many new pipelines are coming online in the Permian – the most prolific basin in the United States. As a result of the expanding transportation capacities, Kinder Morgan – which generates stable fee-based revenues – may witness lower rates once its long-term contracts expire, which are scheduled by 2029 and 2030.

Like KMI, Enbridge and Williams also generate stable cash flows, due to the very structure of the midstream business.

Considering Enbridge's business, it benefits from the long-term, fee-based nature of its midstream operations. Its pipelines transport 20% of the total natural gas consumed in the United States. ENB generates stable, fee-based revenues from these midstream assets, as they are booked by shippers on a long-term basis, minimizing commodity price volatility and volume risks.

Regarding WMB’s operations, with its pipeline networks spreading across more than 30,000 miles, The Williams Companies connects premium basins in the United States to the key market. WMB’s assets can meet a considerable proportion of the nation’s natural gas consumption, which is utilized for heating purposes and clean-energy generation.

When thinking about Kinder Morgan’s investment outlook, it’s important to remember that the company is planning very large projects, such as the Copper State pipeline in Arizona, which could cost between $4 and $5 billion. While such projects have the potential to deliver strong returns, they also carry risks — if energy demand slows or regulatory rules change, it may be harder for the company to earn back those big costs.

Because of the risks mentioned, even though KMI stock looks inexpensive and its backlog of projects is steadily rising, investors may want to be cautious rather than jumping in immediately. For those who already own the stock, it makes sense to hold it. KMI carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 10 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite