|

|

|

|

|||||

|

|

Celestica Inc. CLS and Jabil Inc. JBL are two leading players in the electronics manufacturing services (EMS) industry. Celestica is one of the largest EMS companies in the world, primarily serving original equipment manufacturers, cloud-based and other service providers, and business enterprises across several industries. It offers a comprehensive range of manufacturing and supply-chain solutions that support various customer requirements, from low-volume, high-complexity custom products to high-volume commodity products.

On the other hand, Jabil is one of the largest global suppliers of EMS solutions. The company offers electronics design, production, product management and after-market services to customers in the aerospace, automotive, computing, consumer, defense, industrial, instrumentation, medical, networking, peripherals, storage and telecommunications industries.

With domain-specific expertise in core areas, both Celestica and Jabil are strategically positioned in the EMS landscape and have the wherewithal to cater to the evolving AI (artificial intelligence) demands of business enterprises. Let us delve a little deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

With more than two decades of experience in manufacturing, backed by a simplified and optimized global network, Celestica is committed to delivering next-generation, cloud-optimized data storage and industry-leading networking solutions to help customers balance performance, power efficiency and space as technologies evolve. The growing proliferation of AI-based applications and generative AI tools is fueling solid AI investments across the technology ecosystem. This, in turn, is driving demand for Celestica’s enterprise-level data communications and information processing infrastructure products, such as routers, switches, data center interconnects, edge solutions and servers and storage-related products.

Celestica’s focus on product diversification and increasing its presence in high-value markets is positive. Its strong research and development foundations allow it to produce high-volume electronic goods and highly complex technology infrastructure products for a wide range of industries, including communication, healthcare, aerospace and defense, energy, semiconductor and various cloud-based and other service providers. Such a diverse customer base enhances business resilience by reducing dependence on a single industry and minimizing the effects on financial results from an economic downturn in one specific sector.

However, the company remains plagued by margin woes. Celestica’s products are highly sophisticated and typically based on the latest technological innovations, which have historically led to high research and development costs. High operating expenses have contracted margins. Moreover, besides Jabil, Celestica faces stiff competition from industry giants like Foxconn, Flex and Sanmina Corporation SANM. The highly cyclical nature of the semiconductor industry further remains an overhang, particularly in the aftermath of reciprocal tariffs.

With a presence across 100 locations in 30 countries, Jabil is likely to gain from secular growth drivers with strong margins and cash flow dynamics. Moreover, its unmatched end-market experience, technical and design capabilities, manufacturing know-how, supply chain insights and global product management expertise have put it in good stead. An extensive global footprint is further strengthened by a centralized procurement process, which, coupled with a single Enterprise Resource Planning system, aids customers with end-to-end supply chain visibility. A worldwide connected factory network enables it to scale up production per the evolving market dynamics. Management’s focus on improving working capital management and integration of sophisticated AI and ML (machine learning) capabilities to enhance the efficiency of its internal processes are major tailwinds.

Jabil’s top-line is expected to benefit from strength in AI data center infrastructure, capital equipment and warehouse automation markets. The company is expected to gain from the rapid adoption of 5G wireless and cloud computing in the long run. The company is benefiting from solid demand in key end markets, together with excellent operational execution and skillful management of supply chain dynamics.

However, Jabil operates in a highly competitive environment, facing competition from both domestic and international electronic manufacturers, manufacturing service providers and designers like Sanmina. The tense geopolitical situation between the United States and China and the wars in Europe and the Middle East remain headwinds. Against the backdrop of this global uncertainty, low demand in some consumer-centric markets is negatively impacting its margins.

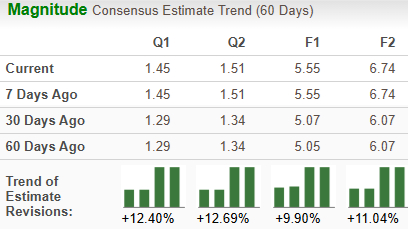

The Zacks Consensus Estimate for Celestica’s 2025 sales and EPS implies year-over-year growth of 20.6% and 43%, respectively. The EPS estimates have been trending northward (up 9.9%) over the past 60 days.

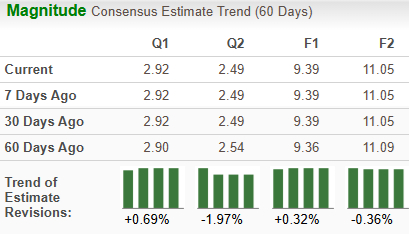

The Zacks Consensus Estimate for Jabil’s 2025 sales and EPS implies a year-over-year growth of 0.9% and 10.6%, respectively. The EPS estimates have been trending northward (up 0.3%) over the past 60 days.

Over the past year, Celestica has gained 244.1% compared with the industry’s growth of 112.2%. Jabil has gained 89.7% over the same period.

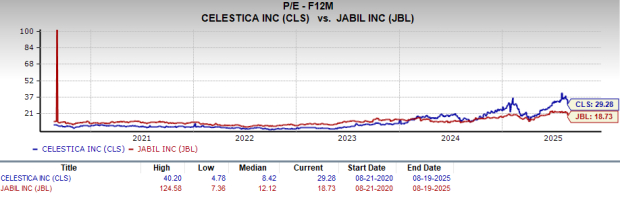

Jabil looks more attractive than Celestica from a valuation standpoint. Going by the price/earnings ratio, Jabil’s shares currently trade at 18.73 forward earnings, lower than 29.28 for Celestica.

While Celestica sports a Zacks Rank #1 (Strong Buy), Jabil has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Both Celestica and Jabil expect sales and profits to improve in 2025, although the former’s growth expectations far exceed those of the latter. Celestica has shown sharp revenue and EPS growth over the years, while Jabil has been facing a downtrend. Celestica boasts a better price performance, but Jabil’s valuation metrics appear comparatively more attractive. However, Celestica has outperformed Jabil in most of the other metrics, tilting the overall scale in its favor. Consequently, Celestica seems to be a better investment option at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 7 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite