|

|

|

|

|||||

|

|

CoreWeave, Inc. CRWV has raised a staggering $25 billion in debt and equity since 2024 as it doubles down on capacity expansion amid accelerating AI compute demand. The financing includes two high-yield offerings: the first (in May), a $2 billion issuance, which was upsized by $500 million, and the second (in July), a separate $1.75 billion issuance.

CoreWeave also recently closed a $2.6 billion delayed draw term loan facility (DDTL 3.0 Facility) to ramp up delivery of services for OpenAI and boost its infrastructure footprint. This facility, priced at a cost of capital of SOFR plus 400, which is 900 basis points below a prior non-investment-grade portion of DDTL 2. Management added that investor appetite has been strong, with oversubscribed issuances allowing the company to secure lower borrowing costs.

CoreWeave is using these funds for its aggressive data center buildout. CRWV had nearly 470 megawatts (“MW”) of active power and contracted power of 2.2 gigawatts (“GW”) at the second quarter-end. With more than 900 MW of active power targeted by year-end, CRWV is positioning itself as a top-tier provider capable of meeting the needs of large-scale AI training and inference workloads. Key projects include a $6 billion data center investment in Lancaster, PA, and another in Kenilworth, NJ, through a joint venture with Blue Owl.

Though increasing capital is enabling CRWV to accelerate data center investments and meet surging AI demand, it is adding financial strain. Interest expense surged to $267 million compared with $67 million a year ago. For the third quarter, it expects interest expenses to be between $350 million and $390 million, owing to high leverage. Higher interest expenses can exert pressure on the adjusted net income and potentially affect free cash flow generation and undermine near-term profitability. CRWV posted a net loss of $291 million and an adjusted net loss of $131 million in the second quarter, primarily due to heavy interest expenses.

It is imperative to expand capacity to gain market share in an already “structurally supply-constrained” AI cloud market. Whether this funding proves to be a growth driver or a leverage headache will depend on CoreWeave’s execution, which does not look easy. Challenges for CRWV remain plenty as it juggles ballooning interest expense, heavy capex ($20-$23 billion in 2025) and intense competition from rivals like pure-play Nebius NBIS and tech behemoths like Microsoft MSFT, which are also aggressively ramping up capacity.

Let us take a look at Nebius and Microsoft's capacity expansion plans and debt profile.

Nebius is another upcoming pure-play AI infrastructure company. It has set an ambitious target of securing 1 GW of capacity by 2026. Nebius plans to secure 220 MW of connected power (active or ready for GPU deployment), including 100 MW of active power. This also includes new data centers in the United Kingdom, Israel and New Jersey (new site), and capacity expansion in Finland. The company is also finalizing two new large-scale greenfield sites in the United States.

NBIS highlighted that as it scales up capacity and is also “able to sell it quickly”. Annualized run rate (“ARR”) surged to $430 million in June from $249 million in March. The company expects the additional capacity, which comes online later in the year, to help it achieve updated ARR guidance. While the scale-up demands capital, management pointed to significant cash on hand and an opportunistic approach. NBIS has reaffirmed its 2025 capex guidance at $2 billion.

Microsoft has altered every Azure region into an AI-first environment with liquid cooling capabilities, positioning itself at the forefront of the AI infrastructure wave. Over the past year, the company has added more than 2 GW of new data center capacity. Now it has more than 400 data centers across 70 regions. MSFT’s financial resources are stupendous.

As of June 30, 2025, it had $94.6 billion in cash, cash equivalents and short-term investments, while long-term debt was $40.1 billion. Microsoft’s global scale, strategic partnerships and financial resilience offer some serious competition. MSFT plans to spend more than $30 billion in capex for the first-quarter fiscal 2026 after spending $24.2 billion in capex in the fourth quarter of fiscal 2025.

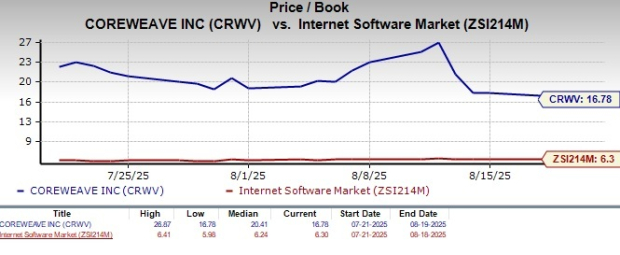

Shares of CoreWeave have lost 25.6% over the past month against the Internet Software industry’s growth of 3.1%.

In terms of Price/Book, CRWV shares are trading at 16.78X, way higher than the Internet Software Services industry’s ratio of 6.3X.

The Zacks Consensus Estimate for CRWV’s earnings for 2025 has been revised downwards over the past 60 days.

CRWV currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 min | |

| 58 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours |

AI Stocks Reset In 2026 Amid Software Reckoning, Hyperscaler Capex Boom

MSFT

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite