|

|

|

|

|||||

|

|

A rising proportion of elderly citizens fuels demand for Medicare plans, enabling insurers to tap into a growing senior population. Centene Corporation CNC and Humana HUM — two major managed-care providers, heavily focused on government-sponsored health insurance programs such as Medicaid and Medicare Advantage (“MA”) — are poised to benefit from this demographic tailwind.

Enacted in July 2025, the One Big Beautiful Bill Act (OBBBA) aims to simplify and digitize the U.S. healthcare payment system by consolidating medical billing and reducing administrative inefficiencies. Centene and Humana, being major players, face challenges in the form of hampered enrollment, increased administrative costs and reimbursement uncertainty. The new regulatory landscape presents opportunities like developing tailored individual products and expanding into private markets to offset potential Medicaid revenue losses.

Yet, as an investment option, which stock is more attractive? Let’s closely look at the fundamentals of these stocks.

Centene is a major player in government-sponsored healthcare, offering services across Medicaid, MA, the ACA Marketplace, Tricare and correctional health. Its scale is reinforced by a broad and growing membership base. Over the years, acquisitions such as Health Net, WellCare and Magellan Health have expanded Centene’s reach and diversified its service portfolio, providing a strong platform for long-term growth.

The company’s Marketplace segment has been a key growth driver, with membership rising 12.4% as of Dec. 31, 2024. However, profitability has come under pressure. A spike in the second-quarter health benefits ratio (HBR) forced management to sharply lower its 2025 earnings guidance to about $1.75 per share, down from the earlier projection of more than $7.00. Results were further weighed down by lower-than-anticipated 2025 risk adjustment transfers and elevated medical utilization, particularly within Medicaid and MA. Enrollment losses in these higher-margin businesses have added to the strain.

Centene’s balance sheet also reflects the costs of its acquisition-led expansion, with long-term debt of $17.6 billion as of June 30, 2025.

Looking ahead, management is focused on recovery. The company intends to reprice its Marketplace plans in 2026 to restore margins, while pursuing disciplined pricing and operational improvements to stabilize MA. These initiatives are expected to drive meaningful progress, with management targeting breakeven in MA by 2027. Despite near-term challenges, Centene’s scale and diversified operations leave it well-positioned to regain profitability and sustain growth in a competitive healthcare landscape.

Humana stands as one of the strongest players in the U.S. healthcare insurance sector, with a dominant position in MA, holding nearly 21% market share. The company continues to benefit from favorable demographics, as an aging population sustains steady demand for MA plans. As of June 30, 2025, Humana reported approximately 3.54 million MA members, with continued expansion in both Medicare Advantage and state-based programs driving premium growth.

Diversification beyond traditional insurance remains central to Humana’s strategy. Its CenterWell business—which delivers value-based primary care, pharmacy services, and home health solutions—has gained meaningful traction, enhancing long-term growth visibility and reducing dependence on insurance margins. The company is also leveraging AI-driven efficiencies, disciplined cost management and conservative guidance to strengthen operating performance and restore investor confidence.

Strategic acquisitions have further bolstered Humana’s footprint. Deals for Family Physicians Group, Your Home Advantage and Curo extended its presence in primary care and home health. The acquisition of Enclara built scale in hospice pharmacy, while iCare and Inclusa expanded Medicare and Medicaid offerings in Wisconsin. At the same time, Humana has sharpened its portfolio by divesting non-core assets, most notably by selling a 60% stake in Kindred at Home’s Hospice and Personal Care units to Clayton, Dubilier & Rice, while retaining a 40% interest to benefit from the standalone company’s long-term growth.

Supported by stabilizing medical cost trends and stronger-than-expected MA retention, Humana raised its 2025 EPS outlook to about $17 and revenues above $128 billion .

The Zacks Consensus Estimate for CNC’s 2025 revenues implies a year-over-year increase of 16.9% while that for EPS implies a 77% decline. EPS estimates have moved 14.6% southward over the past seven days.

On the other hand, the Zacks Consensus Estimate for HUM’s 2025 revenues and EPS implies a year-over-year increase of 9.3% and 4.8%, respectively. EPS estimates have moved 0.4% north over the past seven days.

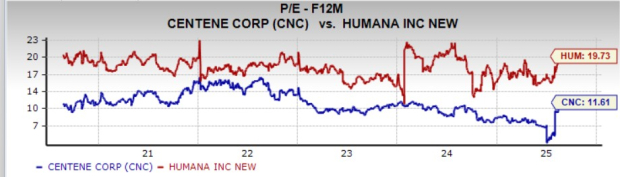

Centene is trading at a price-to-earnings multiple of 11.61, above its median of 11.18 over the last five years. Humana’s price-to-earnings multiple sits at 19.73, above its median of 17.72 over the last five years.

Centene is expected to face notable headwinds under OBBBA, including reduced membership, tightening profit margins and rising operational costs. The company’s Medicaid business is already strained by increasing expenditures related to behavioral health, home-based care and costly medications.

Humana’s Medicaid business stands to benefit from several contract wins and renewals, which contribute to top-line growth. Despite witnessing strong, consistent performance in its Medicare business in recent quarters, the unit came under stress. With Humana deciding to exit certain unprofitable plans and counties, its individual MA membership might take a hit. Nonetheless, its growing focus on Florida is a major positive.

On the basis of return on equity (“ROE”), which reflects a company’s efficiency in generating profit from shareholders' equity as well as gives a clear picture of the company's financial health, HUM, with a ROE of 16.7%, scores higher than CNC, which has a ROE of 9.6%.

Moreover, shares of HUM have gained 13% year to date, in contrast to the industry and CNC’s decline of 31.6% and 51.8%, respectively, over the same time.

HUM, with a Zacks Rank #3 (Hold), has an edge over CNC, which carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite