|

|

|

|

|||||

|

|

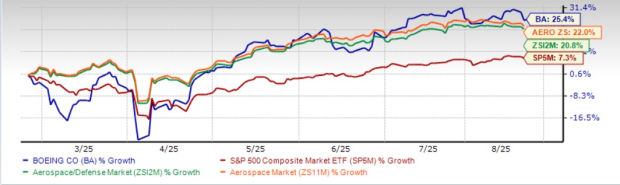

Shares of aerospace giant Boeing (BA) have surged a solid 25.4% over the past six months, outperforming the Zacks aerospace-defense industry’s growth of 20.8% and the broader Zacks Aerospace sector’s rise of 22%. They have also outpaced the S&P 500’s return of 7.3% in the same time frame.

Shares of other prime aircraft makers like Embraer (ERJ) and Airbus Group (EADSY) have risen considerably over the past six months. Notably, shares of Embraer and Airbus have gained 34% and 21.5%, respectively.

Thanks to notable order inflows for both its commercial and defense programs, along with successful delivery announcements for new products, Boeing has been gaining in the stock market lately. The company started its six-month share price hike streak in February 2025, with the Japan Self-Defense Forces placing an order for 17 CH-47 Block II Chinooks. Next, in March, Malaysia Aviation Group placed an order for 18 737-8 and 12 737-10 single-aisle jets, Japan Airlines finalized an order for 17 737-8s and BOC Aviation placed an order for 50 737-8 jets. In the same month, Boeing clinched a contract from the U.S. Air Force to build its next-generation fighter aircraft.

In May, Qatar Airways agreed to purchase up to 210 widebody jets from Boeing, setting a new record as the largest widebody order for Boeing as well as the largest order for 787 Dreamliners. In July, Boeing successfully delivered the ninth and tenth O3b mPOWER satellites to network provider SES, in addition to securing a $2.8 billion order for the Evolved Strategic Satellite Communications program.

More recently, this month, Boeing delivered the Satelit Nusantara Lima communications satellite to Indonesia’s PT Pasifik Satelit Nusantara.

No doubt, these announcements have instilled significant investor confidence in Boeing's trajectory, which resulted in the share price hike since February.

As Boeing remains the largest aircraft manufacturer in the United States in terms of revenues, orders and deliveries, particularly in the commercial aerospace industry, a steadily growing demand trend in commercial aerospace should bode well for the company. To this end, it is imperative to mention that as per the latest Boeing Commercial Market Outlook, BA anticipates that the world will need 43,600 new commercial planes through 2044, backed by passenger traffic growth of 4.2% annually over the next 20 years. This should continue to fuel demand for Boeing-built commercial planes, thereby boosting its long-term growth prospects significantly.

Thanks to its diverse defense product portfolio and established footprint in the space technology industry, Boeing witnesses a solid inflow of contracts. Impressively, during the second quarter of 2025, the BDS unit won key contract awards worth $19 billion, which resulted in a solid backlog amount of $74 billion for this segment as of June 30, 2025. Such solid contract wins and subsequent backlog count should continue to bolster the operational performance of Boeing Defense & Space Security (“BDS”) unit, which registered a solid year-over-year increase of 10% in its second-quarter revenues.

In line with this, the Zacks Consensus Estimate for BA’s long-term (three-to-five years) earnings growth rate is pegged at 17.9%, higher than the industry’s 15.9%.

Now, let’s take a sneak peek at the company’s near-term estimates to understand whether the figures mirror similar growth prospects.

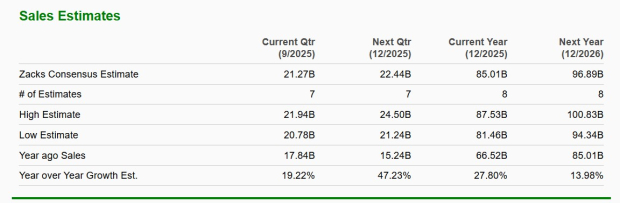

Boeing’s estimate for third-quarter 2025 sales suggests an improvement of 19.2% from the year-ago quarter’s reported figure, while that for full-year 2025 sales indicates a rally of 27.8%. A similar improvement trend can be expected from its 2026 sales estimates.

Its quarterly as well as yearly earnings estimates also imply similar robust performance on a year-over-year basis.

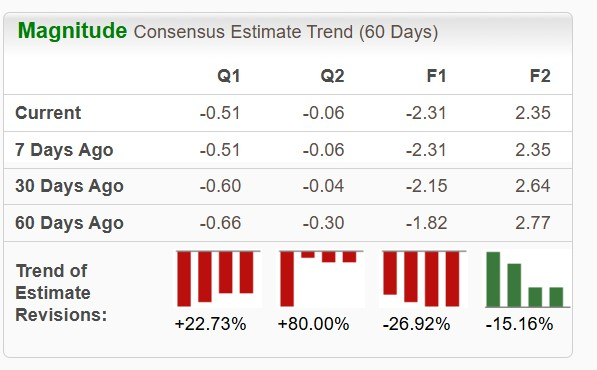

However, the company’s near-term earnings estimates suggest mixed revision movement over the past 60 days. While the upward revision reflects investors’ gaining confidence in the stock’s earnings-generating capabilities, the downward revision implies declining confidence in the same.

While Boeing presents strong growth potential, it also faces key challenges that investors should weigh carefully. Despite a recovery in air travel driving demand for commercial aircraft, persistent global supply-chain disruptions, especially shortages of critical parts, continue to hinder and are expected to affect the aviation industry in 2025. This remains a major risk factor for jet manufacturers like Boeing, Airbus and Embraer.

Moreover, the persistent trade tensions between China and America continue to pose a threat for Boeing. Notably, as of June 30, 2025, Boeing had approximately 20 737-8 aircraft in inventory for customers in China, scheduled to be delivered by the end of this year. In case of any escalation of the trade tensions between the United States and China, the latter may refuse to take deliveries from Boeing, like it did in April 2025. This, in turn, would hurt BCA’s revenues and push up inventory cost for Boeing.

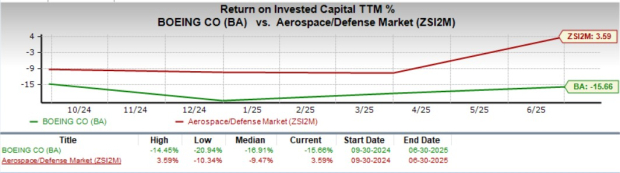

The image below shows that BA stock’s trailing 12-month return on invested capital (ROIC) not only lags the industry’s average return but also reflects a negative figure. This suggests that the company's investments are not yielding sufficient returns to cover its expenses.

However, the ROIC of its peers, Embraer and Airbus, is currently better than that of Boeing. While the ROIC for ERJ is currently 13.63, the same for EADSY is 4.86.

In terms of valuation, Boeing’s forward 12-month price-to-sales (P/S) is 1.84X, a discount to the industry’s average of 2.25X. This suggests that investors will be paying a higher price than the company's expected sales growth compared to that of its peer group. The stock’s forward 12-month P/S, however, seems stretched when compared to its five-year median value, 1.44.

While Boeing's recent operational success and discounted valuation are compelling, potential investors should await a better entry point, considering the stock's negative ROIC and downward earnings estimate revisions. BA currently has a VGM Score of F, which is also not a very favorable indicator of strong performance.

However, those who already own this Zacks Rank #3 (Hold) stock may continue to do so, considering its recent share price hike, solid sales and earnings growth potential. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 19 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 |

BAE Systems In Buy Zone On Major Contracts; Boeing Lands Defense Awards

BA

Investor's Business Daily

|

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite