|

|

|

|

|||||

|

|

Shares of CRISPR Therapeutics CRSP have rallied 41.4% in the past three months, driven by encouraging data from a study of its in-vivo candidate, CTX310, as well as better-than-expected sales of Casgevy in the second quarter of 2025. Casgevy is slowly gaining momentum.

Let us assess these factors in detail to understand whether an investor should buy, sell or hold the stock amid the recent price gain.

CRISPR Therapeutics is studying its first two in-vivo candidates, CTX310 and CTX320, in separate phase I clinical studies targeting ANGPTL3 and lipoprotein(a), respectively. In June, the company announced updated data from the first 10 patients across the first four cohorts of the phase I study on CTX310. The data showed that a single dose of CTX310 demonstrated dose-dependent decreases in low-density lipoprotein (LDL) and triglyceride (TG) levels, with peak reduction of up to 82% in TG and up to 86% in LDL.

The data not only highlights the potential of CTX310 but also raises hopes around CRSP’s other in vivo candidate, CTX320, which is being developed in an early-stage for targeting lipoprotein(a), also associated with heart disease. Data from the study is expected in the first half of 2026.

CRISPR Therapeutics and partner Vertex Pharmaceuticals’ VRTX one-shot gene therapy, Casgevy, was approved in late 2023 and early 2024 across the United States and Europe for two blood disorder indications — sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT). VRTX leads global development, manufacturing and commercialization of Casgevy and splits program costs and profits worldwide with CRSP in a 60:40 ratio.

Despite its groundbreaking therapeutic potential, Casgevy experienced a slow start in 2024, generating only $10 million in full-year product revenues for Vertex. However, sales have picked up momentum since then, with Casgevy recording sales worth $30.4 million in the second quarter of 2025, reflecting a 114.1% sequential increase and underscoring strong and accelerating market adoption. Per VRTX, the global launch of Casgevy continues to gain momentum with patient initiations, cell collections and infusions.

On its second-quarter earnings call, CRISPR Therapeutics stated that more than 75 authorized treatment centers were activated across all regions where Casgevy is approved. As of June 2025-end, about 115 patients completed their first cell collection since the therapy’s commercial launch. New patient starts are expected to grow significantly throughout 2025.

Growing Casgevy sales could secure a reliable revenue base for CRISPR Therapeutics, enabling greater investment in its gene-editing pipeline.

The company is pursuing the development of CRISPR candidates to create novel CAR-T cell therapies. It is currently focused on the development of two next-generation CAR-T therapy candidates — CTX112 (for CD9-positive B-cell malignancies and autoimmune disorders) and CTX131 (for solid tumors and hematological malignancies) — in separate phase I/II studies. Data from all these studies are expected later in 2025.

CRSP intends to further expand its in vivo pipeline with two more programs, CTX340 (for refractory hypertension) and CTX450 (for acute hepatic porphyria), before this year’s end.

Meanwhile, the recent collaboration with Sirius Therapeutics in May helped the company diversify its pipeline beyond gene therapies and into RNA therapeutics. Following the deal, CRISPR Therapeutics added Sirius’ lead candidate, SRSD107, a novel small interfering RNA (siRNA), which is being developed in early-to-mid-stage studies for the treatment of thromboembolic disorders.

The companies will jointly develop SRSD107 and share all costs and profits equally. Upon potential approval, CRISPR Therapeutics will be responsible for commercializing the drug in the United States and Sirius in Greater China.

Besides CRISPR Therapeutics, several companies are advancing gene-editing treatments using similar CRISPR-based technology.

Beam Therapeutics BEAM is developing its lead ex-vivo genome-editing candidate, BEAM-101, in the phase I/II BEACON study for treating SCD. Enrollment is completed in both the adult and adolescent cohorts of the BEACON study. Beam Therapeutics expects to present updated data from the BEACON study by the end of 2025

Intellia Therapeutics NTLA is leading the race in the in vivo therapies space with two late-stage candidates — Lonvo-z (NTLA-2002) for hereditary angioedema (HAE) and nex-z (NTLA-2001) for transthyretin (ATTR) amyloidosis. NTLA plans to submit a regulatory filing with the FDA for the HAE therapy in the second half of 2026.

Casgevy also faces competition from chronic therapies like Bristol Myers’ Reblozyl for TDT and Novartis’ Adakveo for SCD.

Shares of CRISPR Therapeutics have risen 34.8% year to date compared with the industry’s increase of 3%. The stock has also outperformed the sector and the S&P 500 Index, as seen in the chart below.

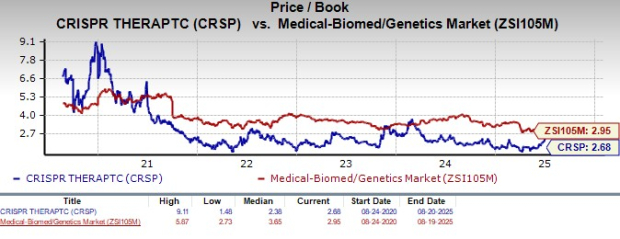

From a valuation standpoint, CRISPR Therapeutics is trading at a discount to the industry. Going by the price-to-book value (P/B) ratio, the company’s shares currently trade at 2.68, lower than 2.95 for the industry. The stock is trading above its five-year mean of 2.38.

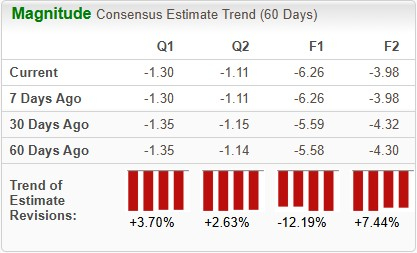

Estimates for CRISPR’s 2025 loss per share have widened from $5.58 to $6.26 in the past 60 days. During the same timeframe, loss per share estimates for 2026 have narrowed from $4.30 to $3.98.

We suggest retaining this Zacks Rank #3 (Hold) stock for now, considering its growth prospects. While we acknowledge that most of CRSP’s pipeline is still in early-stage development, the initial success of its in-vivo candidate builds hope. Also, the company’s pipeline spans both in vivo and ex vivo therapies, offering greater diversification to investors.

With Casgevy sales picking up pace, the company’s strong cash balance of around $1.7 billion (as of June-end) should assure investors that it can smoothly carry out its day-to-day operations, including potential late-stage studies on its pipeline candidates. We believe there is room for growth in CRSP stock, driven by solid fundamentals and a recent positive uptrend in stock price movement.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 5 hours | |

| 10 hours | |

| 10 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite