|

|

|

|

|||||

|

|

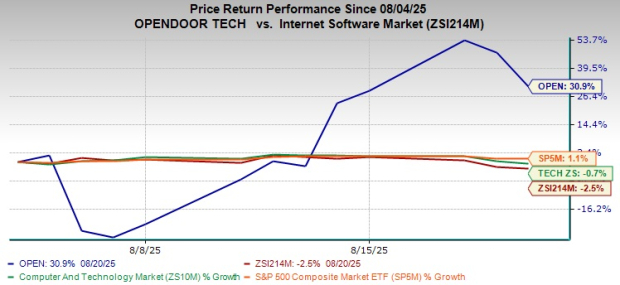

Since reporting the second quarter of 2025 earnings, Opendoor Technologies Inc. OPEN has trended upward 30.9% to date, outperforming the Zacks Internet - Software industry, the Zacks Computer and Technology sector and the S&P 500 index.

During the second quarter, the company reported an adjusted loss per share of one cent, which met the Zacks Consensus Estimate but was lower than the year-ago loss per share of four cents. On the other hand, quarterly revenues of $1.57 billion topped the consensus mark by 5.3% and grew 4% year over year. The top line benefited from higher sales volumes, with 4,299 homes sold compared with 4,078 homes sold in the year-ago quarter, representing 5% growth. However, the bottom line was affected by the pressures of high revenue costs and an increase in restructuring costs.

Opendoor is currently shifting its focus toward transforming from a single-product iBuyer to a distributed platform powered by real estate agents and expanded offerings. Piloted in selected markets in the first quarter of 2025, the new agent-led model has resulted in five times more listing conversion rates, with customers reaching double the time of the final underwritten cash offer (all-cash proposal made directly to the homebuyer) compared with OPEN’s traditional flow. The launch of the Key Agent iOS app and Cash Plus was aimed at diversifying revenue streams, reducing capital intensity and improving contribution margin stability.

In the long term, the agent-led model is expected to boost Opendoor’s revenue visibility and profitability, as long as it continues to broaden its toolkit surrounding this cornerstone, leading to a multi-product, agent-enabled ecosystem.

Besides top-line growth, the company’s ongoing cost-reduction and organizational streamlining efforts are expected to bode well in expanding margins and increasing cash flow in the long term.

Challenging Housing Market: The housing market of the United States seems far from normalizing, given the still-high mortgage rate scenario, keeping homebuyers at bay. This scenario is directly impacting Opendoor, resulting in lower clearance and record delisting. During the first half of 2025, the company’s adjusted gross margin and contribution margin contracted year over year by 100 basis points (bps) and 110 bps, respectively, due to a higher mix of old inventory in the resale cohort due to a soft real estate market with lower clearance.

Given the soft housing market, uncertain macro environment and prospective seasonality trends in its cash offer business, OPEN expects lower acquisition and resale volumes in the second half of 2025.

Gloomy Q3 View: Owing to the market challenges, Opendoor has laid out a cautious third-quarter 2025 outlook, inducing bearish sentiments among investors and analysts. In the third quarter, it expects revenues to be between $800 million and $875 million, down from $1.4 billion reported in the year-ago quarter. Moreover, the outlook for the contribution profit of $22-$29 million also reflects a year-over-year decline between 57.7% and 44.2%.

Besides, for the fourth quarter of 2025, the company expects a sequential decline, similar to the third quarter’s sequential decline level (50-45.3%). Also, OPEN anticipates contribution margin to be pressured in the second half of 2025 because of the continued unfavorable mix of older and lower-margin homes, given lower acquisition volumes.

Opendoor operates in a highly competitive digital housing landscape, where Zillow Group, Inc. ZG, Offerpad Solutions, Inc. OPAD and Rocket Companies, Inc. RKT are emerging as strong rivals leveraging their distributed operating platforms.

Zillow combines its vast traffic, rental marketplace and financing solutions to deepen engagement, challenging Opendoor’s ability to dominate customer acquisition. Offerpad, though smaller in scale, competes directly with Opendoor by focusing on flexible selling and buying options through its streamlined digital platform, often appealing to homeowners seeking tailored solutions. Meanwhile, Rocket Companies strengthens competition from a financing perspective. Its massive mortgage origination and digital lending platform integrates tightly with housing transactions, creating a distributed operating model that rivals both Zillow and Opendoor in customer reach.

Compared with Offerpad’s more targeted approach, both Opendoor and Zillow focus on scaling full-stack housing platforms, while Rocket Companies extends the competition by bridging digital financing and property transactions. Together, these rivals intensify the competitive pressures around Opendoor’s growth.

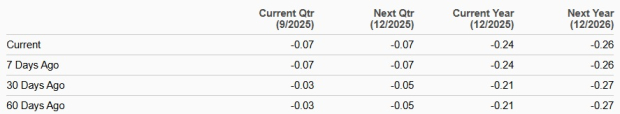

OPEN’s bottom-line estimates for 2025 and 2026 indicate a loss per share. Over the past 30 days, the estimates for 2025 have widened to 24 cents per share from 21 cents, while those of 2026 have contracted to 26 cents from 27 cents.

The estimated figures for 2025 indicate improvement from the year-ago loss of 37 cents per share.

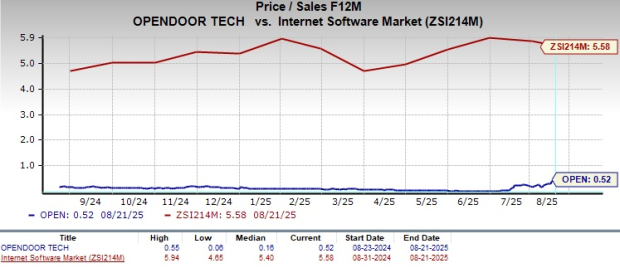

OPEN stock is currently trading at a discount compared with the industry peers, with a forward 12-month price-to-sales (P/S) ratio of 0.52, as evidenced by the chart below. The discounted valuation of the stock, compared with its peers, advocates for an attractive entry point for investors.

Opendoor is indeed benefiting from shifting its focus toward the new AI-driven agent-led model, substantiated by promising results from the pilot project. However, this business restructuring process is still in the early stages and is not yet making any notable material contribution to the company’s business performance. Long-term prospects surrounding this strategic shift are promising, but in the short term, the increased restructuring costs amid an unfavorable housing market are not in Opendoor’s favor.

With the company laying out a gloomy outlook for the second half of 2025 and the housing market not nearing a normalized level any time soon, the investors’ sentiments are likely to be bearish regarding the stock. Although a discounted valuation looks promising, the external factors weighing heavily on OPEN cannot be ignored.

Thus, based on the detailed discussion and the trends of the technical indicators, it is prudent for the existing investors to shake off this Zacks Rank #4 (Sell) stock from their portfolio until the market trends move in favor of it.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 19 min | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite