|

|

|

|

|||||

|

|

Dell Technologies DELL and Apple AAPL are leading personal computer (PC) makers in a market that is now expected to see year-over-year shipment growth of 4.1% in 2025, per IDC. Global PC shipment volume is expected to hit 274 million in 2025, driven by growing demand for artificial intelligence (AI)-powered PCs and the transition to Microsoft Windows 11. However, U.S. tariffs on partners like China and a challenging macroeconomic environment are expected to hurt second-half 2025 PC shipments.

So, Dell Technologies or Apple, which is a better buy under the current scenario?

Dell Technologies is benefiting from strong demand for commercial PCs. In first-quarter fiscal 2026, Client Solutions Group (CSG) revenues were $12.5 billion, up 5% year over year. Commercial Client revenues increased 9% year over year to $11.04 billion. The company saw double-digit demand growth across small and medium businesses and large enterprises. Commercial demand was strongest in North America, with Europe, the Middle East, and Africa (EMEA), and Asia Pacific and Japan (APJ), increasing in the double-digit range.

Dell Technologies’ commercial growth is driven by an innovative portfolio. The company offers the broadest portfolio of Copilot+ capable AI PCs. The new Dell Pro Max notebooks and desktops are equipped with NVIDIA RTX PRO Blackwell GPUs, Intel Core Ultra processors, and AMD Ryzen and Threadripper processors. The Dell AI Factory combines DELL’s solutions and services optimized for AI workloads and supports an open ecosystem of partners comprising Meta Platforms, Microsoft and Hugging Face, apart from NVIDIA.

However, consumer business remains weak with revenues declining 19% due to stiff competition from the likes of Lenovo and HP HPQ. Per IDC, DELL had a market share of 9.8%, down 140 basis points (bps) on a year-over-year basis in the second quarter of calendar 2025. Lenovo led with a market share of 24.8% trailed by HP’s 20.7%. DELL’s second-quarter shipment grew 3% year over year to hit 9.8 million, trailing both HP’s and Lenovo’s shipments of 14.1 million and 17 million. According to Gartner, DELL shares fell 110 bps while shipments fell 3% year over year in the second quarter of 2025.

Based on commercial demand, Dell Technologies expects CSG revenues to increase in the low-to-mid single digits for both second-quarter fiscal 2026 and fiscal 2026. The Zacks Consensus Estimate for second-quarter fiscal 2026 revenues is pegged at $12.89 billion, indicating 4% growth from the figure reported in the year-ago quarter.

Apple’s Mac business is benefiting from strong demand for M4, M4 Pro, and M4 Max chips. In March, Apple expanded its Mac portfolio with the new MacBook Air powered by the M4 chip with up to 18 hours of battery life and a new 12MP Center Stage camera. Apple also announced the new Mac Studio featuring M4 Max and the new M3 Ultra chip. The new chip is the most powerful created by Apple and features double Neural Engine cores, Thunderbolt 5 with more than 2 times the bandwidth per port for faster connectivity and robust expansion.

In April, Apple expanded the availability of Apple Intelligence with iOS 18.4, iPadOS 18.4, and macOS Sequoia 15.4 updates in new languages, including French, German, Italian, Portuguese (Brazil), Spanish, Japanese, Korean, and Chinese (simplified), as well as localized English for Singapore and India. The features help Mac users the ability to create a memory movie by simply typing a description, and an added Sketch style in Image Playground. Apple is set to launch new features with the upcoming macOS Tahoe 26 update.

Apple’s strong Mac portfolio helped it gain market share in the second quarter of 2025. Per IDC, Apple had a market share of 9.1%, up 110 bps on a year-over-year basis. Shipment grew 21.4% year over year to hit 6.2 million. According to Gartner, Mac shares inched up 70 bps while shipments increased 13.4% year over year.

The Zacks Consensus Estimate for Apple’s fourth-quarter fiscal 2025 Mac revenues is currently pegged at $8.05 billion, indicating 14.8% growth over the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for DELL’s fiscal 2026 earnings is pegged at $9.47 per share, up by a couple of cents over the past 30 days, indicating a 16.3% increase over fiscal 2025’s reported figure.

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

The consensus mark for AAPL’s fiscal 2025 earnings has increased 3.1% to $7.33 per share over the past 30 days, suggesting 8.6% growth over fiscal 2024.

Apple Inc. price-consensus-chart | Apple Inc. Quote

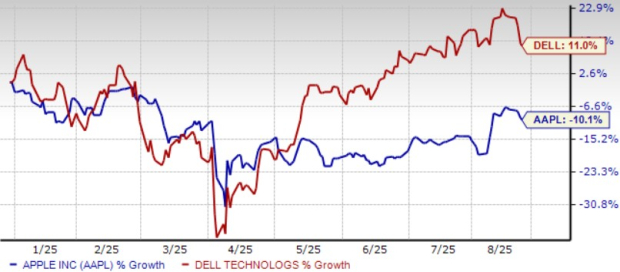

Dell Technologies shares have returned 11% year to date, outperforming Apple’s decline of 10.1%.

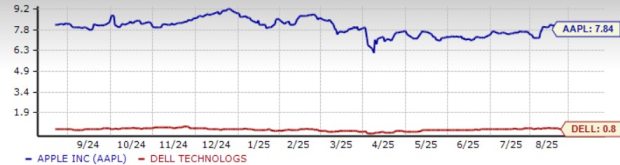

Valuation-wise, Dell Technologies shares are cheaper compared with Apple. While DELL has a Value Score of B, Apple has a Value Score of F, suggesting stretched valuation for the iPhone-maker.

In terms of forward 12-month Price/Sales, Dell Technologies shares are trading at 0.8X, lower than Apple’s 7.84X.

Dell Technologies’ strong AI-powered PC portfolio and a rich partner base are noteworthy apart from a cheaper valuation. Although Apple benefits from strong demand for Mac, China-related tariffs, where Apple has significant production, are a significant risk for the iPhone-maker.

Dell Technologies currently has a Zacks Rank #2 (Buy), which implies that the stock is a better buy compared with Apple, which currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 59 min | |

| 2 hours | |

| 3 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite