|

|

|

|

|||||

|

|

Some of the biggest beneficiaries of the artificial intelligence (AI) boom have been semiconductor stocks.

At the heart of the chip landscape is Nvidia, whose chips are in demand from trillion-dollar hyperscalers and governments across the globe.

While Nvidia has already witnessed significant valuation expansion, several catalysts suggest the company still has meaningful long-term growth ahead.

There are only so many moments in investing when a company becomes so impactful that it transcends its peers and evolves into something greater -- a true generational wealth opportunity.

In the 1980s and 1990s, Microsoft and Berkshire Hathaway were prime examples. Microsoft pioneered the personal computing era with its Windows operating system, which became the backbone of the internet age. Berkshire, under Warren Buffett's leadership, compounded capital that consistently outperformed the broader market.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Today, I think the most compelling opportunity at the intersection of growth and value is none other than semiconductor powerhouse Nvidia (NASDAQ: NVDA).

Image source: Getty Images.

The reason is simple: Nvidia isn't just riding a single trend. Instead, it has positioned itself as the core power source at the heart of multiple revolutions, each unfolding against the backdrop of the artificial intelligence (AI) movement.

Nvidia's rapid rise in recent years comes down to one thing: its graphics processing units (GPUs). These chips have become the gold standard of generative AI development, powering everything from large language models (LLMs) to mission-critical applications across every industry.

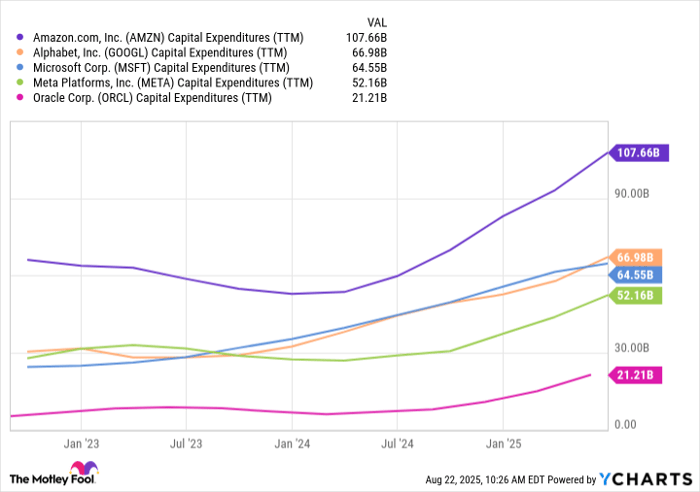

AMZN Capital Expenditures (TTM) data by YCharts.

Cloud hyperscalers and big tech giants have poured hundreds of billions of dollars into capital expenditures (capex) -- much of which they directed toward chips and networking infrastructure.

This spending spree doesn't appear to be slowing down, either. According to management consulting firm McKinsey & Company, AI infrastructure spend could reach $6.7 trillion by next decade -- with chips continuing to capture a good portion of this investment.

What makes the infrastructure narrative even more compelling is that it extends beyond the private sector. The U.S. government is supercharging its AI ambitions through Project Stargate -- a $500 billion initiative to invest in data centers and AI infrastructure over the coming years. Meanwhile, countries in the Middle East are rolling out their own sovereign AI initiatives.

Nvidia sits at the center of this activity. Its GPUs are not exclusive to powering today's data centers -- they are enabling a global race to build the foundation of tomorrow's AI economy.

Beyond infrastructure, Nvidia is also quietly shaping the rise of AI-powered software applications. Over the last few years, developers mainly focused on securing GPUs to build next-generation data centers and train LLMs. Now, however, AI investment is swiftly moving downstream and becoming a critical component of consumer and enterprise applications.

Take Perplexity's unsolicited $34.5 billion bid to acquire Google Chrome. While the deal is unlikely to materialize, it underscores an important point: AI is moving beyond hardware and into the application layer for businesses and consumers. Nvidia enjoys a rare advantage at this intersection because the company profits not just from hardware demand, but also from its software ecosystem.

Nvidia's CUDA software program serves as a foundation for developers, enabling them to build and deploy AI applications efficiently and at scale.

Where things get most exciting for Nvidia is its untapped potential across emerging markets.

For years, Nvidia's footprint in China has been constrained by strict export controls and fierce competition from rivals like Huawei.

These dynamics have begun to shift. Nvidia recently reach an agreement with the Trump Administration that allows it to remit 15% of its China sales back to the U.S. government in exchange for continued access to the key market -- which Jensen Huang estimates could be worth $50 billion annually.

Beyond geographic expansion, Nvidia is poised to ride the wave of more advanced AI use cases in areas such as quantum computing, robotics, and autonomous systems.

A recent example underscores how central Nvidia has become: Elon Musk told investors that Tesla is putting its internally built Dojo supercomputer ambition to the side in favor of a new technology stack, dubbed AI6. At the core of this new stack is none other than Nvidia.

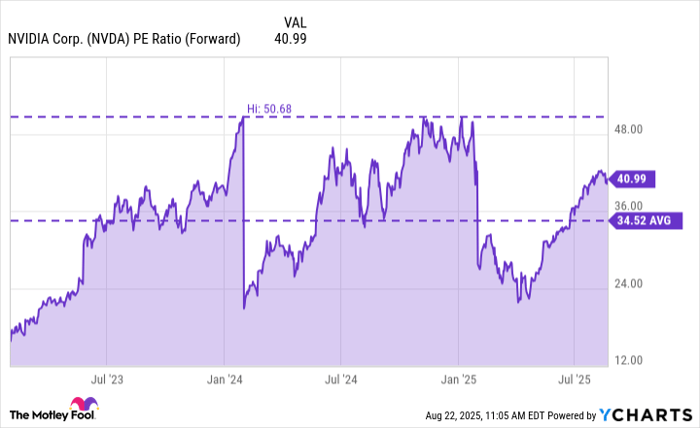

At first glance, the chart below may look contradictory. Nvidia's forward price to earnings (P/E) multiple of 41 is well-above its three-year average. Yet at the same time, the stock trades at a discount to the peak forward earnings levels reached earlier in the AI revolution. What could this mean?

NVDA PE Ratio (Forward) data by YCharts.

In my eyes, it could suggest that investors are struggling to assign a fair value to Nvidia.

The premium over its historical average reflects ongoing optimism, while the discount to prior highs implies that some view Nvidia as a maturing business at risk of decelerating growth.

I think this interpretation could be misguided. Even if Nvidia's growth rates moderate in percentage terms, those percentages will be applied to a significantly larger revenue and profit base -- fueled by data center expansion, AI software applications, and new markets.

Taken together, this suggests that Nvidia is quietly undervalued. At the very least, the company appears to have significant runway for years to come -- supported by a host of growth levers that are not yet fully priced in.

For these reasons, I see Nvidia as an opportunity trading at a reasonable price point relative to the company's potential -- making it a compelling long-term investment to buy and hold.

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 4 min | |

| 8 min | |

| 31 min | |

| 40 min | |

| 1 hour |

Stock Market Today: Dow Up 300 Points; Nvidia Jumps, Amer Sports Glows In New Breakout (Live Coverage)

NVDA

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite