|

|

|

|

|||||

|

|

On Friday, during his speech at Jackson Hole, Federal Reserve Chair Jerome Powell signaled that a rate cut could come as early as September, citing rising risks in the labor market and easing inflation pressures. This marks a shift from the Fed’s “higher-for-longer” stance to a more flexible approach. Markets reacted positively, with equities rallying, and investors now expect at least a 25-basis-point cut in September and possibly another by year-end.

Against this backdrop, let’s take a look at how JPMorgan’s JPM business will be affected.

JPMorgan’s balance sheet is highly asset-sensitive. Hence, the Fed rate cut will likely put downward pressure on the company’s NII. Lower rates will lead to reduced asset yields on variable-rate loans and securities, compressing margins unless deposits or funding costs reprice faster.

Nonetheless, management expects the near-term impact of rate cuts to be manageable, driven by robust loan demand and deposit growth. JPMorgan raised its 2025 NII guidance to almost $95.5 billion, highlighting continued strength but warning that further moves are “market dependent.” Earlier, the bank had guided NII to be approximately $94.5 billion for this year.

JPM’s NII recorded a five-year (2019-2024) CAGR of 10.1%, mainly driven by the high-interest rate regime since 2022 and the acquisition of First Republic Bank in 2023. The trend continued in the first half of 2025, driven by solid loan and deposit growth and higher revolving balances in Card Services.

Similarly, JPMorgan’s close peers – Bank of America BAC and Citigroup C – are expected to witness a modest NII decline over the medium term when the central bank cuts interest rates. Both banks expect continued NII expansion in 2025, driven by strong loan demand and deposit growth. Bank of America projects NII to rise 6-7% in 2025, reaching $15.5-$15.7 billion in the fourth quarter, even as the Fed initiates rate cuts. Likewise, Citigroup expects 2025 NII (excluding Markets) to grow around 4%, indicating improved loan demand and higher deposit balances.

The shift toward easier monetary policy is expected to support client activity, deal flow and asset values. Thus, JPMorgan’s non-interest income streams will likely see meaningful upside.

Investment Banking (IB) & Advisory Fees: Lower borrowing costs will further support the revival of corporate financing activity, encouraging debt issuance, M&A and equity offerings. After a slow deal environment in the last two years, rate cuts are expected to spark a solid rebound in capital markets, boosting JPMorgan’s advisory and underwriting fees. The company continues to rank #1 for global IB fees, garnering a wallet share of 8.9% at the end of the first half of 2025. The healthy IB pipeline, an active M&A market and JPMorgan’s leadership position in the IB business ensure stronger growth once the macro situation changes.

Markets Revenues (FICC & Equities): Rate transitions often fuel volatility in fixed income, currencies and commodities. Thus, JPMorgan, with the industry’s leading trading desk, stands to gain from increased client hedging and speculative activity. Equities trading is also expected to benefit from higher volumes as investors reposition portfolios for a lower-rate environment. While structural normalization in trading activity is inevitable over time, JPMorgan’s broad product coverage across fixed income, currencies, commodities and equities positions it to capture upside during volatility spikes.

Wealth & Asset Management Fees: Declining yields typically push investors into equities and alternative assets. JPMorgan’s asset management business benefits from rising assets under management (AUM) and higher fee revenue as markets rally. Stronger sentiment is expected to drive inflows into the company’s private banking and wealth platforms.

Lower rates will likely support JPMorgan's asset quality, as declining rates will ease debt-service burdens and improve borrower solvency. The overall effect is expected to be moderate and vary by loan segment and macro conditions. Variable-rate consumer and leveraged corporate portfolios are likely to see the most direct benefit, reflecting the lower risk of near-term credit losses as rates fall.

JPMorgan expects that anticipated Fed cuts will help stabilize or even modestly improve overall credit performance this year, especially in consumer and corporate loan books, as long as the U.S. economy remains resilient. Management anticipates the card net charge-off rate to be approximately 3.6% for 2025.

Branch Openings & Opportunistic Acquisitions: With 4,994 branches as of June 30, 2025, more than any other U.S. bank and a presence in all 48 contiguous states, JPMorgan continues to invest in brick-and-mortar to strengthen its competitive edge in relationship banking, despite the digital shift. In 2024, JPMorgan opened nearly 150 branches and plans to add 500 more by 2027 to deepen relationships and boost cross-selling across mortgages, loans, investments and credit cards.

JPMorgan isn’t alone in branch expansion. Bank of America is growing its 3,664-center network, with 40 new openings last year and 110 more by 2027, despite most interactions being digital.

Additionally, JPMorgan has expanded through strategic acquisitions, including a larger stake in Brazil’s C6 Bank, partnerships with Cleareye.ai and Aumni, and the 2023 purchase of First Republic Bank. These moves boosted profits and supported its strategy to diversify revenues and grow digital and fee-based offerings.

Fortress Balance Sheet and Solid Liquidity: As of June 30, 2025, JPM had a total debt of $485.1 billion (the majority of this is long-term in nature). The company's cash and due from banks and deposits with banks were $420.3 billion on the same date. The company maintains long-term issuer ratings A-/AA-/A1 ratings from Standard and Poor’s, Fitch Ratings and Moody’s Investors Service, respectively.

Hence, JPMorgan continues to reward shareholders handsomely. It cleared this year’s stress test impressively and announced plans to increase its quarterly dividend by 7% to $1.50 per share. It also authorized a new share repurchase program worth $50 billion (became effective from July 1, 2025).

In March 2025, the company raised its quarterly dividend by 12% to $1.40 per share, while in September 2024, it announced a 9% hike in the quarterly dividend to $1.25 per share. In the last five years, it hiked dividends five times, with an annualized growth rate of 7.99%.

Similar to JPM, Bank of America and Citigroup have cleared the 2025 stress test. Following this, Bank of America raised its quarterly dividend 8% to 28 cents per share and authorized a new $40 billion share repurchase program, effective Aug. 1, 2025. Citigroup also announced a dividend hike of 7% to 60 cents per share. It is continuing with the previously announced buyback plan, which had $16.3 billion worth of authorization remaining as of June 30, 2025.

So far this year, shares of JPMorgan have soared 23.5% compared with a 9.8% rise for the S&P 500 Index. Meanwhile, Bank of America and Citigroup have gained 12.5% and 35.3%, respectively, in the same time frame.

YTD Price Performance

From a valuation perspective, the stock appears expensive relative to the industry. The stock is currently trading at a forward 12-month price/earnings (P/E) of 14.80X. This is above the industry’s 14.65X, reflecting a stretched valuation.

P/E F12M

Also, JPM stock is trading at a premium compared with Bank of America and Citigroup. At present, Bank of America has a forward 12-month P/E of 12.17X, and Citigroup is trading at a forward 12-month P/E of 10.65X.

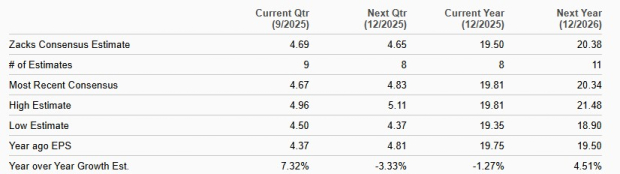

Further, earnings estimates for JPMorgan for 2025 and 2026 have been revised upward over the past month. The positive estimate revision depicts bullish analyst sentiments for the stock.

The Zacks Consensus Estimate for JPM’s 2025 earnings implies a 1.3% fall year over year owing to macro headwinds and higher non-interest expenses. Management anticipates non-interest expenses to be $95.5 billion this year, up from $91.1 billion in 2024. On the other hand, the consensus estimate for 2026 earnings suggests 4.5% growth.

Earnings Estimates

While a September rate cut may trim JPMorgan’s lending margins, the overall shift toward easier monetary policy is likely to support client activity, deal flow and asset values, offsetting the pressure on NII and positioning the company for stronger non-interest revenue growth.

With a fortress balance sheet, robust capital returns and a proven ability to grow through acquisitions and branch expansion, JPMorgan remains the most resilient U.S. bank. Continued dividend hikes, a massive buyback program and upward earnings revisions reinforce its premium valuation and support the case for owning the stock.

JPM currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 3 hours |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

BAC

Investor's Business Daily

|

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite