|

|

|

|

|||||

|

|

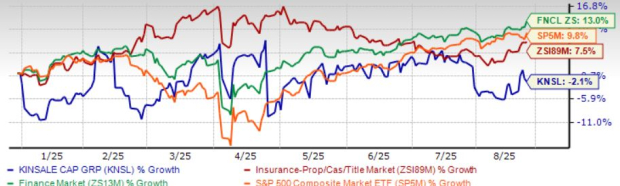

Shares of Kinsale Capital Group, Inc. KNSL have lost 2.1% year to date, underperforming its industry, the Finance sector, and the Zacks S&P 500 Composite’s growth of 7.5%, 13% and 9.8%, respectively, in the same time frame.

The insurer has a market capitalization of $10.6 billion. The average volume of shares traded in the last three months was 0.2 million.

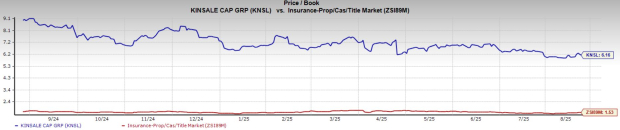

Kinsale Capital shares are trading at a premium compared to the industry. Its price-to-book value of 7.07X is higher than the industry average of 1.52X.

Shares of other insurers like American Financial Group, Inc. AFG and Arch Capital Group Ltd. ACGL are also trading at a multiple higher than the industry average, while CNA Financial Corporation CNA is trading at a discount.

The Zacks Consensus Estimate for Kinsale Capital’s 2025 earnings per share indicates a year-over-year increase of 14%. The consensus estimate for revenues is pegged at $1.8 billion, implying a year-over-year improvement of 13.4%. The consensus estimate for 2026 earnings per share and revenues indicates an increase of 12.5% and 8.8%, respectively, from the corresponding 2025 estimates.

The expected long-term earnings growth is pegged at 14.9%, better than the industry average of 7%. Kinsale Capital has an impressive Growth Score of B. This style score helps analyze the growth prospects of a company.

Kinsale Capital surpassed earnings estimates in each of the last four quarters, the average being 11.5%.

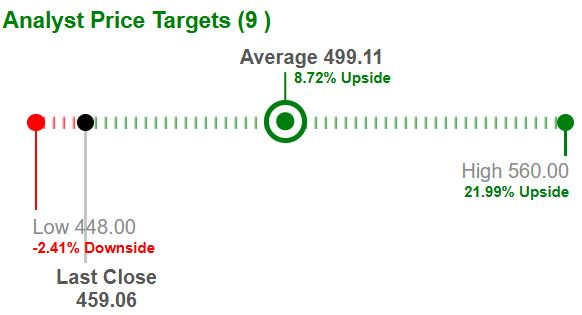

Based on short-term price targets offered by nine analysts, the Zacks average price target is $499.11 per share. The average indicates a potential 8.7% upside from the last closing price.

The Zacks Consensus Estimate for 2025 earnings has moved up 3.1% in the past 30 days, while the same for 2026 has moved up 0.7% in the same time frame.

Kinsale Capital has built steady revenue momentum, largely fueled by consistent growth in net premiums. Its strong positioning in the U.S. excess and surplus market, combined with solid renewal activity, has supported this trend. Net written premiums registered a CAGR of 27.3% between 2016 and 2024, aided by healthy broker submissions and favorable pricing conditions. This translated into revenue expansion, with the top line posting a CAGR of 38% from 2019 to 2024. Supported by rate hikes and the ongoing expansion of product lines, the company is poised to sustain revenue growth in the coming years.

Net investment income has been a key contributor to KNSL’s growth, posting a CAGR of 39.5% from 2016 to 2024. Strong operating cash flows and higher interest rates have supported this trend, and in the current rate environment, investing excess funds should further strengthen the portfolio and sustain income growth.Kinsale Capital, supported by its independent broker network and disciplined underwriting, has also maintained an underlying combined ratio below 95% and aims to sustain it.

The U.S. excess and surplus (E&S) lines market continues to expand, supported by business migrating from standard carriers, inflation-driven rate hikes, and disciplined underwriting practices. Within this environment, Kinsale Capital’s exclusive focus on the E&S space has enabled it to benefit from stronger margins and lower loss ratios, resulting in consistently favorable underwriting performance. These industry dynamics leave the property and casualty insurer well-positioned to capture ongoing growth as the E&S market becomes increasingly dislocated.

Kinsale Capital’s proprietary digital platform enhances scale, reliability, and efficiency, while streamlining underwriting through reduced manual steps. By driving automation, the platform has supported disciplined cost management, lowered the expense ratio over recent years, and strengthened customer interactions. A robust data warehouse further strengthens decision-making, while the absence of legacy systems promotes innovation. Management expects this platform to provide a lasting competitive edge, enabling sustained market share gains over time.

Despite these strengths, Kinsale Capital faces headwinds from persistent inflation, which could prolong hard market conditions and put pressure on insurer margins. Wage growth, construction costs, and legal fees are expected to intensify cost pressures, potentially necessitating pricing adjustments across the sector. Such inflationary trends remain a key risk to underwriting profitability in the near term.

Kinsale Capital continues to emphasize shareholder value creation through steady capital returns. Kinsale Capital has raised its dividend five times in the past five years, reflecting 12.43% growth in payouts during that period.The company’s current payout ratio remains at 4% of earnings. Last October 2024, the board of directors approved a $100 million share buyback program, of which $70 million still remains under authorization...

Kinsale Capital shows strength through premium growth, disciplined underwriting, investment income gains, and the advantages of its technology platform, supported by a favorable E&S market backdrop. At the same time, persistent inflation and rising cost pressures pose risks that may limit margin improvement in the near term.

Given its premium valuation and price underperformance, it is better to wait for some more time before taking a call on this Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite