|

|

|

|

|||||

|

|

Assurant, Inc. AIZ recently announced a substantial increase in its common stock dividend, showcasing its commitment to rewarding its shareholders. This move is a testament to the insurer’s strong financial position and long-term growth prospects.

Approved by the board of directors, the regular quarterly dividend has now been increased to 88 cents per share from 80 cents paid earlier. This increment represents a remarkable 10% rise over the previously declared rate. Shareholders of record on Dec. 1, 2025, will receive the increased dividend on Dec. 29, 2025. The latest hike marks the 21st consecutive year of dividend increase.

Based on the stock’s Nov. 13 closing price of $227.05, the new dividend will yield 1.41%. This makes Assurant an attractive pick for yield-seeking investors.

Besides the regular dividend hike, Assurant remains committed to returning excess cash to shareholders through share repurchases. Besides the dividend hike, the board also authorized a share buyback program to return more value to investors. With the latest authorization, the board authorized a repurchase program for up to $700 million of the company’s outstanding common stock. This is in addition to the company’s current authorization, of which nearly $141 million remained unused as of Oct. 31, 2025.

AIZ’s distribution of wealth to shareholders via dividend hikes and share repurchases is impressive. These moves to distribute wealth to its shareholders bear testimony to AIZ’s solid capital position and uninterrupted cash generation capabilities on the strength of the Global Lifestyle and Global Housing business segments. The insurer uses the cash inflows primarily to make dividend payments to stockholders, repurchase shares, and fund investments and acquisitions.

Liquidity was $613 million as of Sept. 30, 2025, which was $388 million higher than the company’s current targeted minimum level of $225 million. During the first nine months of 2025, AIZ repurchased shares for $206.3 million, exclusive of commissions. As of Sept. 30, 2025, $168.3 million aggregate cost at purchase remained unused under the repurchase authorization.

For 2025, AIZ expects to return $300 million to shareholders through share repurchases, at the top end of $200 million to $300 million anticipated range from the beginning of the year. For the fourth quarter of 2025, AIZ expects a higher level of segment dividends given the business' ability to generate meaningful cash flows. Full-year cash conversion to the holding company is expected to approximate 2024 levels.

Return on equity, a profitability measure of how efficiently a company utilizes its shareholders' money, was 18.6% in the trailing 12 months, which compared favorably with the industry average of 15.3%.

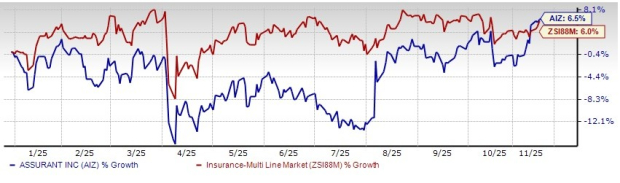

Shares of this Zacks Rank #3 (Hold) multi-line insurer have gained 6.5% year to date, outperforming the industry’s growth of 6%. Assurant expects to deploy capital primarily to support business growth by funding investments, mergers and acquisitions and returning capital to shareholders through share repurchases and dividends. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Given a solid capital level in the insurance industry and an improving operating backdrop favoring strong operational performance, insurers like RLI Corp. RLI, American Financial Group AFG, and First American Financial FAF have resorted to effective capital deployment to enhance shareholders’ value.

In November 2025, the board of directors of RLI declared a special cash dividend of $2.00 per share; the aggregate amount of this special dividend will be approximately $184 million.

The insurer has also been paying special dividends since 2011. Its dividend yield of 1% is better than the industry average of 0.2%, making the stock an attractive pick for yield-seeking investors.

American Financial declared a special cash dividend of $2.00 per share in the third quarter of 2025. The aggregate amount of this special dividend will be approximately $167 million. With this special dividend, AFG has declared $54.00 per share in special dividends since the beginning of 2021.

American Financial Group’s 2.46% dividend yield is better than the industry average of 0.2%, making the stock an attractive pick for yield-seeking investors. AFG’s robust operating profitability in the property and casualty segment and effective capital management support shareholder returns.

The board of directors of First American raised the dividend by 2% to an annual rate of $2.20 per share in the third quarter of 2025.

First American enjoys a strong liquidity position to enhance operating leverage. Its strong liquidity not only mitigates balance sheet risks but also paves the way for accelerated capital deployment. Its dividend yield of 3.4% appears attractive compared with the industry average of 0.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 8 hours | |

| 12 hours | |

| 13 hours | |

| 22 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite