|

|

|

|

|||||

|

|

The payments industry sits at the heart of consumer activity, making it highly sensitive to shifts in spending. With macro headwinds mounting, questions are rising about which players can sustain earnings momentum if consumer demand cools.

Estimates from the U.S. Commerce Department show spending rose just 1.4% in the second quarter, an improvement from the meager 0.5% in the first quarter, but well below the 2.8% growth recorded in 2024. It marks the fifth-slowest rate since the third quarter of 2021. Tariffs, stubborn inflation, and softer job growth are weighing on sentiment, while longer purchase cycles point to more cautious behavior. Some consumers may pull forward spending ahead of tariff-driven price hikes, but the real test will come once those higher costs hit, particularly for middle- and lower-income households.

Against this backdrop, two of the sector’s heavyweights, Visa Inc. V and American Express Company AXP, stand out as timely comparables. Both are deeply embedded in the global payments ecosystem, yet their models and customer bases differ meaningfully. That contrast could prove decisive in how each weathers a slowdown.

The question is clear: which stock stands stronger against a potential spending cooling? Let’s take a closer look at Visa and AmEx to see who comes out ahead.

Visa’s strongest edge in a potential slowdown is the breadth of its customer base. While AmEx also has a global presence, its business leans heavily on U.S. premium cardholders and lending income. Visa, by contrast, benefits from a far more diversified mix of consumers, merchants, and geographies, reducing the risk of being disproportionately hit by weaker spending in any one segment. In the latest quarter, Visa’s payments volume climbed 8% year over year, with cross-border activity holding firm, a sign that international strength might balance any domestic weakness.

The company’s model also benefits from scale and efficiency. Visa operates a four-corner model that connects consumers, merchants, issuing banks and acquirers, making it less exposed to direct credit risk. With a slowdown potentially increasing delinquencies, Visa’s lack of credit exposure stands out compared to AmEx, which carries lending risk on its balance sheet. This structural distinction makes Visa’s earnings more predictable in volatile conditions. Visa’s long-term debt-to-capital of 33.6% is significantly below AmEx’s 64.3%.

Cross-border travel remains another bright spot, with Visa’s cross-border volume surging 12% year over year in the last reported quarter. This stream provides higher margins than domestic transactions and could be a stabilizing factor if discretionary retail spending pulls back. While AmEx also benefits from travel and entertainment, it is far more concentrated among affluent U.S. households. That strategy works in boom times, but during a slowdown, younger growth targets like Millennials and Gen Z are unlikely to spend at the same pace as older and wealthier cohorts.

Visa is also positioning itself for the future. Investments in e-commerce, real-time payments, tokenization, and even stablecoin initiatives are expanding their reach well beyond traditional card transactions. This adaptability not only deepens Visa’s relevance in the payments ecosystem but also gives it more levers to pull if consumer spending cools further.

American Express has long differentiated itself with its premium cardholder base, generating higher average spending per customer compared to Visa. In times of strength, this provides an advantage as affluent consumers often spend disproportionately on travel, entertainment and luxury goods. The latest quarter reflected this strength, with AmEx posting a 9% YoY revenue increase and continued momentum in travel and services.

However, this model can also become a vulnerability during a slowdown. AmEx’s revenue model, which combines transaction fees with interest income from its lending operations, exposes it more directly to credit risk. Unlike Visa, which sidesteps this exposure, AmEx must contend with higher delinquencies if consumers begin to struggle with debt repayment. Already, AmEx has seen its provisions for credit losses rise in the last reported quarter, due to higher net write-offs. This signals cautious credit management.

Moreover, while AmEx’s premium branding helps retain loyalty, its customer concentration reduces diversification. The company is more U.S.-centric and less globally distributed than Visa, making it more susceptible to a downturn in domestic discretionary spending. Travel remains a bright spot, but a broad-based slowdown could still erode volumes.

Finally, while AmEx continues to invest in digital innovation and expanding merchant acceptance, it lacks Visa’s unmatched scale. It is less agile in capitalizing on emerging non-card-based payment technologies. Visa’s role as the default global payment rails gives it a buffer that AmEx cannot fully replicate. In a period of economic strain, scale and network breadth become key differentiators, and here, Visa’s lead is difficult to ignore. AmEx’s return on capital of 11.9% is significantly lower than Visa’s 36.7%.

The momentum is with Visa. Its fiscal 2025 earnings estimates witnessed 11 upward revisions and one downward movement over the past month. The Zacks Consensus Estimate for Visa’sfiscal 2025 sales and EPS implies year-over-year growth of 10.9% and 13.7%, respectively. It beat earnings estimates in each of the past four quarters, with an average surprise of 3.9%.

Visa Inc. price-consensus-eps-surprise-chart | Visa Inc. Quote

Meanwhile, AXP’s 2025 earnings estimates witnessed one upward revision and one downward movement over the past month. The estimates for AmEx’s 2025 sales and EPS signal 8.3% and 14.3% year-over-year increases. It also beat earnings estimates in all the past four quarters with an average surprise of 4.6%.

American Express Company price-consensus-eps-surprise-chart | American Express Company Quote

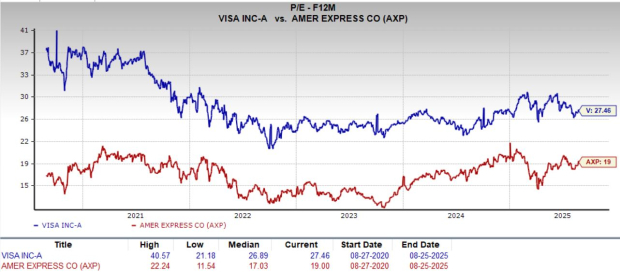

Although AmEx appears cheaper at first glance, Visa’s higher multiple is backed by stronger earnings visibility and defensive stability. Visa trades at 27.46X forward earnings, while AmEx sits at 19X, a discount that largely reflects its greater exposure to credit risk and a less diverse customer base.

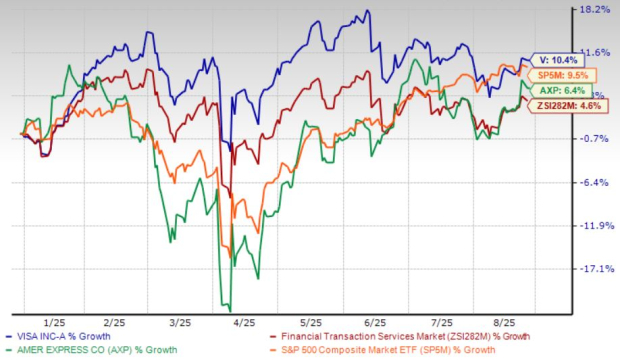

Year to date, Visa shares have advanced 10.4%, outpacing both the broader industry and the S&P 500 Index. The steady climb highlights the market’s confidence in Visa’s resilient business model, even against concerns of a consumer slowdown. American Express has also delivered gains, up 6.4% in the same period, but its performance trails Visa’s.

Both Visa and American Express remain central players in the payments industry, but their contrasting models make the trade-off clear in the face of a potential spending pullback. AmEx’s premium strength and lending income provide upside during economic expansions but leave it more exposed if delinquencies climb or U.S. discretionary spending softens. Visa’s broader diversification, lower credit risk, and unmatched scale provide sturdier defenses. Its cross-border strength and investments in digital rails further enhance its resilience.

While both stocks currently hold a Zacks Rank #3 (Hold), Visa stands stronger against a potential spending cooling. Its superior global reach, defensive yet strong earnings model, and steadier investor confidence suggest it is better positioned to navigate a choppier consumer landscape.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 15 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite