|

|

|

|

|||||

|

|

Both Spotify Technology S.A. SPOT and MARA Holdings MARA are companies that are leveraging groundbreaking technologies to transform how users access value, whether via media or digital assets. Spotify Technology is one of the leading audio streaming and media services providers, operating a freemium business model. MARA Holdings is a digital asset technology, primarily engaging with Bitcoin mining and other related services.

Our comparative analysis will assist investors in figuring out which stock has more upside in the upcoming years.

Spotify Technology has maintained a firm hold on the audio streaming domain globally, with total monthly active users (MAUs) growing 11% year over year and premium subscribers increasing 12% in the June quarter. SPOT has succeeded in attracting a highly engaging subscriber base, with average revenues per user climbing 3% year over year at constant currency as price surges have been absorbed without growth hindrance.

Management is optimistic about the diversified content platform encompassing music, audiobooks, and podcasts, driven by features like AI-Playlist, advanced recommendation algorithms, and audiobook narrations in 29 languages. Spotify Technology has made significant progress utilizing its innovative ad tech stack, evidenced by 10% year-over-year growth in ad-supported MAUs.

SPOT’s gross margin of 31.5% in the second quarter of 2025 moved up by 230 basis points from the year-ago quarter, hinting at an efficient cost management strategy. The company’s liquidity is strong, with a current ratio of 1.47, suggesting effective short-term debt coverage ability. A robust liquidity position accompanied by strong cash generation abilities will allow Spotify Technology to make proactive investments and gain a large piece of the audio streaming market, which is anticipated to expand, seeing a CAGR of 14.9% from 2025 to 2030.

However, the company’s path to sustainable profitability remains agitated. In a fiercely competitive market, a loss of €86 million in the June quarter raises investor concerns. While the gross margin expansion looks impressive, return on equity of 13.7% lags the industry average of 33.4%. With increasing operating expenses and heavy reliance on a new monetization strategy, execution risk rises as the company makes a head-on collision with Apple and Amazon.

MARA Holdings' revenues surged 64% year over year in the second quarter of 2025, with net income skyrocketing to $808 million from the year-ago quarter’s net loss of $200 million. MARA’s Bitcoin holding exponentially soared 170% year over year to nearly 18,500 coins. The company’s infrastructure investment, mining firmware and immersion cooling technology enhanced the energized hash rate by 82% year over year. MARA ranks as one of the largest U.S.-mined Bitcoin holders, and its ability to boost its capacity online improves efficiency and market share.

The crypto market’s volatility did not stop the company from holding both cash and increasing its Bitcoin treasury, which is providing it with flexibility with a market capitalization of $5.7 billion. The company derives additional growth from its AI and high-performance computing (AI/HPC), serving as an opportunity to diversify beyond its crypto-mining operations. We believe MARA’s competitive edge lies in the lower cost of mining Bitcoin. The ability to draw in institutional capital and negotiate favorable energy rates provides a significant economic moat in terms of operational resiliency and margin expansion.

Despite MARA Holdings’ headline profitability in the second quarter of 2025, the net margin was negative 2.1% on a trailing basis, raising questions around earnings quality. In terms of liquidity, MARA’s current ratio of 0.56 stands significantly lower than the industry average of 1.26, hinting at a weakness in terms of covering short-term obligations.

Moreover, the company is exposed to the inherent risks of Bitcoin price swings, regulations and energy costs, while operating in the crypto-space. A lack of diversification is a major challenge despite expansion into AI/HPC, since concentration on a single volatile asset class amplifies MARA’s risk profile by limiting any downside protection.

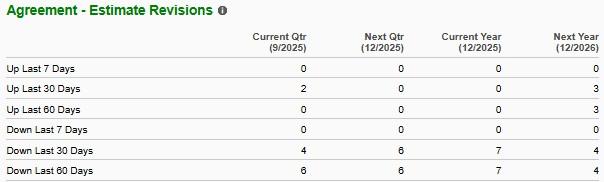

The Zacks Consensus Estimate for Spotify Technology’s 2025 sales stands at $19.9 billion, reflecting a 17.4% year-over-year increase. For 2025, the consensus mark for earnings is kept at $5.77 per share, a decrease of 3%. Over the past 60 days, seven estimates for 2025 have shifted downward, with no upward revisions.

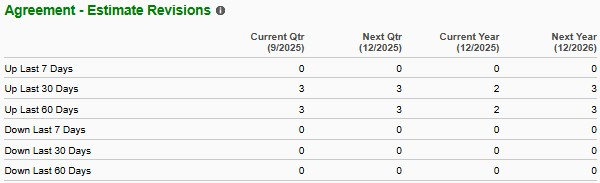

The Zacks Consensus Estimate for MARA Holdings’ 2025 sales is pegged at $1 billion, implying 56% year-over-year growth. The consensus estimate for loss is pegged at 17 cents per share, whereas it reported earnings of $1.72 a year ago. Two estimates for 2025 have moved north in the past 60 days versus no southward revisions.

Spotify Technology is currently trading at a forward 12-month Price/Sales ratio of 6.56X, which is slightly above the 12-month median of 5.78X, suggesting overvaluation. MARA Holdings looks undervalued with its 12-month price/sales ratio of 4.95X, which is below the 12-month median of 6.06X. Investors will likely find MARA more attractive because it trades at a discount relative to its historical valuations and is undervalued compared with SPOT.

Both Spotify Technology and MARA Holdings are catering to an expansive market, utilizing prominent tech advancements. SPOT’s strong member growth, AI-driven innovation and robust liquidity position have improved its ability to navigate through a fiercely competitive market. MARA, alternatively, displayed drastic improvement in its bottom line despite market volatility. That being said, effective cost management and favorable energy rates have positioned it well amid the Bitcoin price swings.

Although both companies have displayed ample strength and substantial weaknesses, we recommend investors bet on MARA Holdings as it comes out strong in terms of its fundamentals, optimistic earnings revisions, and it is a cheaper stock than Spotify Technology.

SPOT and MARA carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 18 hours | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite