|

|

|

|

|||||

|

|

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

We have a dedicated sector classification for Retail rather than grouping these companies with the Consumer Discretionary and Consumer Staples sectors. We believe that the stand-alone Retail sector allows for a more nuanced and granular understanding of the space.

For reference, Zacks has 16 ‘economic’ sectors, including the Retail sector, which compares to 11 such sectors in the ‘official’ S&P classification system. We also have dedicated sectors for the Automobile, Construction, Aerospace/Defense, Transportation, and Business Services sectors. Please note that the Zacks Retail sector includes conventional brick-and-mortar operators like Walmart WMT and Home Depot HD, restaurant players, and e-commerce players like Amazon AMZN.

For the Retail sector in the S&P 500 index, we now have Q2 results from 28 of the 32 companies, or 87.5% of all the retailers in the large-cap index. For the small-cap S&P 600 index, we now have Q2 results from 27 of the 35 retailers, or 77.1% of the retailers in the index.

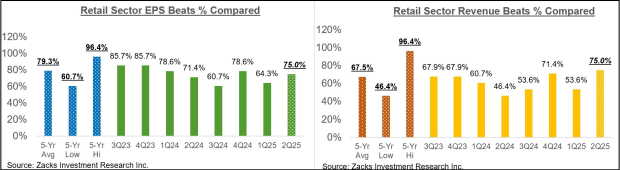

Total Q2 earnings for the Retail sector companies in the S&P 500 index that have reported are up +12.9% from the same period last year on +6.6% higher revenues, with 75% beating EPS estimates and an equal proportion beating revenue estimates.

The comparison charts below put the Q2 EPS and revenue beats percentages in a historical context.

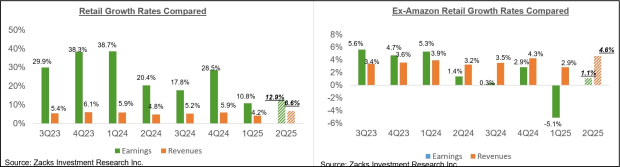

To put the Retail sector’s Q2 earnings and revenue growth rates in a historical context, we present the growth rates with and without Amazon’s substantial contribution below.

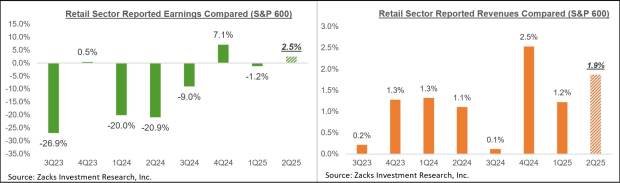

Total earnings for the 77.1% of Retail sector members in the S&P 600 index that have reported Q2 results already are up +2.5% on +1.9% higher revenues, with 70.4% beating EPS estimates and an equal proportion beating revenue estimates.

The comparison charts below show the Q2 EPS and revenue beats percentages for these small-cap retailers in a historical context.

The comparison charts below show the Q2 earnings and revenue growth rates for these small-cap retailers in a historical context

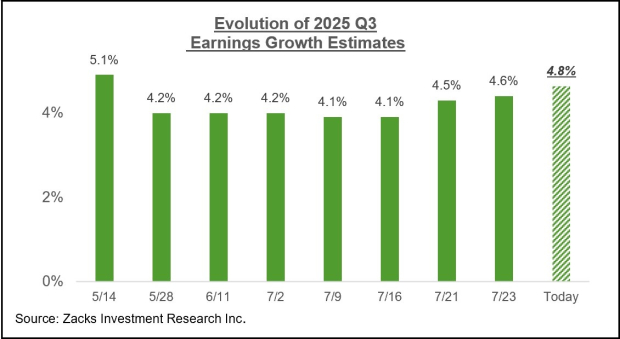

As we have consistently highlighted in recent weeks, the overall revisions trend remains favorable. We see this in estimates for the current period (2025 Q3) as well as for the last quarter of the year.

For 2025 Q3, the expectation is for earnings growth of +4.8% on +5.8% revenue gains. The chart below shows how Q3 earnings growth expectations have evolved in recent weeks.

Since the start of Q3 this month, estimates have modestly increased for five of the 16 Zacks sectors, including Finance, Tech, Energy, Retail, and others.

On the negative side, Q3 estimates remain under pressure for the remaining 11 Zacks sectors, with significant declines to estimates for the Medical, Basic Materials, Construction, Transportation, and other sectors.

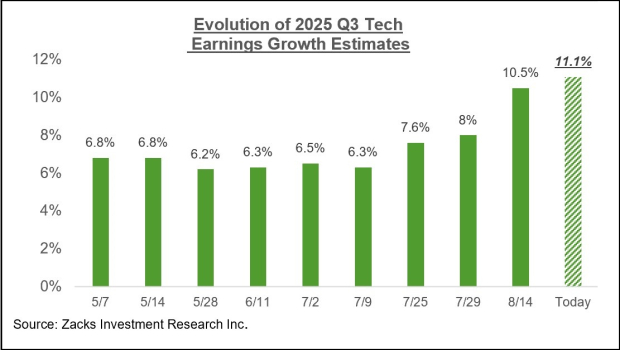

For the Tech sector, Q3 earnings are expected to be up +11.1% from the same period last year on +11.9% higher revenues. The chart below shows how the sector’s Q3 earnings growth expectations have evolved over the last couple of months.

The Earnings Big Picture

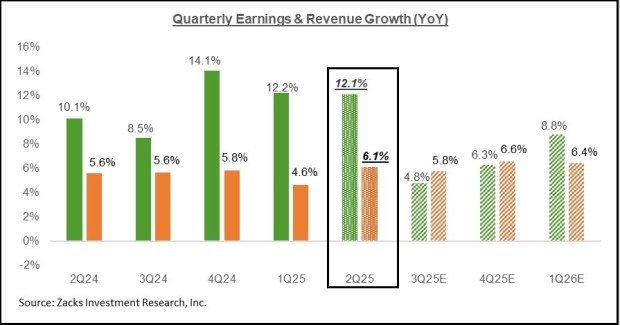

Combining the estimates for the still-to-come S&P 500 member results with actuals from the 479 companies, total Q2 earnings are on track to increase by +12.1% from the same period last year on +6.1% higher revenues.

The chart below shows expectations for 2025 Q2 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

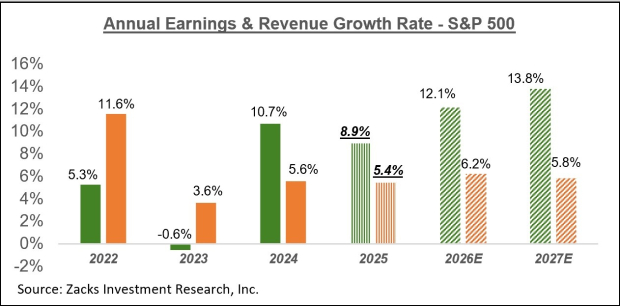

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

The aforementioned favorable revisions trend validates the market’s rebound from the April lows. With the Q2 reporting cycle now effectively behind us, the revisions trend has plateaued in recent days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 22 min | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| Feb-15 |

Companies Are Replacing CEOs in Record Numbersand Theyre Getting Younger

WMT

The Wall Street Journal

|

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite