|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Rising defense spending amid heightened geopolitical risks worldwide, along with increasing global air travel, remains the major driving force behind the steadily growing aerospace market. This provides long-term growth opportunities for Boeing (BA) and Airbus (EADSY), the world’s leading aerospace manufacturers.

U.S.-based Boeing operates a diversified model with significant exposure across commercial aerospace, defense systems and space technologies. In contrast, Airbus, headquartered in Europe, takes a slightly different approach with a stronger emphasis on commercial aviation, while steadily expanding into defense and space industries as well.

With airlines increasing fleets to meet surging post-pandemic travel demand and governments ramping up military modernization, investor interest in aerospace stocks has risen sharply. In this environment, choosing between Boeing and Airbus (two global aerospace titans) can be challenging. To help guide investors, we provide a detailed analysis highlighting each company’s strengths, weaknesses, growth opportunities and risks.

Boeing and Airbus remain the two dominant forces in the global aerospace industry, both benefiting from rising air travel demand and increased defense spending. Yet, their recent financial trajectories highlight contrasting challenges and strengths that investors must weigh carefully.

BA has endured a particularly tough period in recent years, largely due to quality control setbacks with its 787 Dreamliner and lingering troubles with its 737 Max program. These issues weighed on the commercial aircraft business, especially the 737 Max, pushing the company into losses despite steady defense revenues. As of June 30, 2025, Boeing continued to report negative operating cash flow and bottom-line losses, though both have narrowed over time.

Encouragingly, Boeing’s commercial recovery is gaining traction. In the second quarter of 2025, its Boeing Commercial Airplanes (“BCA”) segment delivered 63% more aircraft than the previous year, driving an 81% surge in unit revenues. The company also secured 455 net commercial airplane orders during the first half, underscoring renewed airline confidence in its planes.

From a liquidity standpoint, Boeing ended June 2025 on a stronger footing. Its current ratio of 1.23 indicated sufficient coverage of short-term liabilities, while its $22.97 billion in cash and investments comfortably exceeded its current debt of $8.72 billion. This provides a cushion as the company works toward full recovery.

Airbus, in contrast, has managed steadier performance, supported by its more resilient balance sheet and consistent commercial deliveries, even during the pandemic. In the first half of 2025, Airbus delivered 306 aircraft, ahead of Boeing’s 280 during the same period. While this marked a decline from 336 deliveries a year ago, it reaffirmed Airbus’ lead in the commercial market. However, revenues from its commercial aircraft unit slipped 2% year over year, in contrast to Boeing’s commercial rebound.

Airbus’ liquidity position also remains sound. Its current ratio of 1.16 suggests sufficient short-term coverage, with $9.54 billion in cash and equivalents exceeding its short-term debt. One concern, however, is its negative cash flow from operating activities in the first half of 2025, which may raise questions about its near-term financial strength.

Long-term growth prospects remain robust for both companies. According to Boeing’s latest Commercial Market Outlook, global demand will require 43,600 new commercial planes by 2044, driven by annual passenger traffic growth of 4.2%. This demand should bolster revenues for both manufacturers. Boeing is progressing with certifications of its 737-7 and 737-10 models, while Airbus is ramping up A320neo production, targeting 75 units monthly by 2026.

In defense, both companies stand to benefit from rising NATO budgets and heightened geopolitical tensions. Airbus maintains a strong foothold in Europe, while Boeing dominates the U.S. defense market, giving both unique competitive edges.

Both Boeing and Airbus face a few common industry challenges, including a shortage of labor in the global aerospace-defense industry, as well as supply-chain constraints in the aerospace parts market that have been further exacerbated due to the recently imposed heightened import tariffs by the U.S. government. These might lead to potential delays in the delivery of finished products from these jet giants, thereby hurting their operational performance.

In addition to these common risks, Airbus remains exposed to foreign exchange fluctuations and geopolitical risks, including sanctions or policy shifts affecting key markets.

On the other hand, although Boeing has taken all necessary steps to improve the safety and quality of the 737 program and has been delivering quite a handful of these jets lately, the production rate for this jet program still remains low. Further, all of its 737-9 aircraft in production are undergoing the FAA-implemented enhanced inspection process prior to delivery.

Such slow production and delayed delivery, along with ongoing inspection, might have hurt the sentiment of Boeing’s commercial airplane customers, resulting in order cancellations in recent times. Notably, aircraft order cancellations during the first six months of 2025 totaled $2,649 million and primarily relate to 737 aircraft.

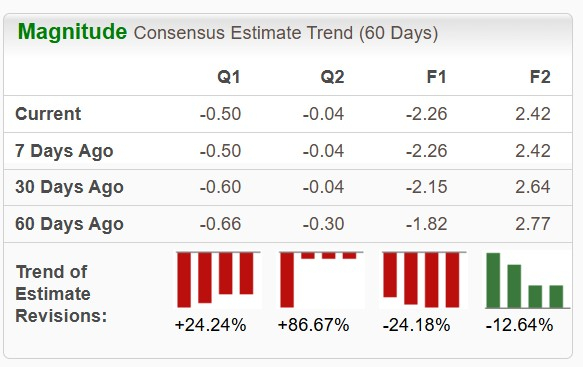

The Zacks Consensus Estimate for Boeing’s 2025 sales implies a year-over-year surge of 28.4%, and the same for its loss suggests an improvement. The stock’s near-term bottom-line estimates show mixed movement over the past 60 days.

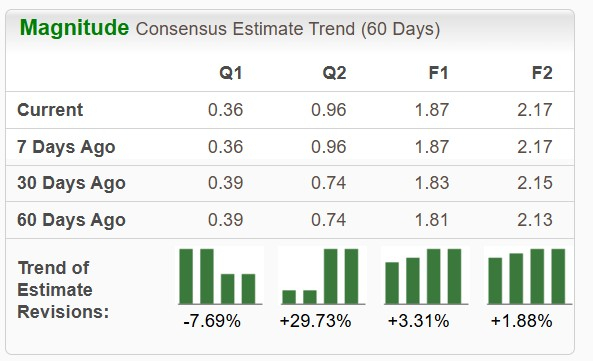

The Zacks Consensus Estimate for Airbus’ 2025 sales implies a year-over-year surge of 14.4%, while that for its earnings per share suggests an improvement of 29%. Further, the stock’s near-term bottom-line estimates have been trending northward over the past 60 days, except for the third-quarter 2025.

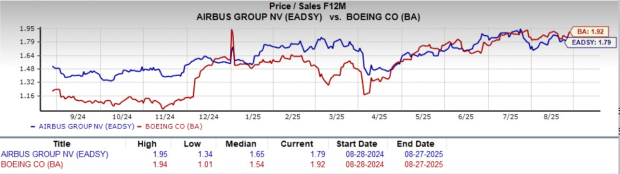

BA (up 13.2%) has outperformed EADSY (up 12.2%) over the past three months and has done the same in the past year. Shares of BA have surged 36.8%, while those of EADSY have improved 33.6%.

EADSY is trading at a forward sales multiple of 1.79, below BA’s 1.92.

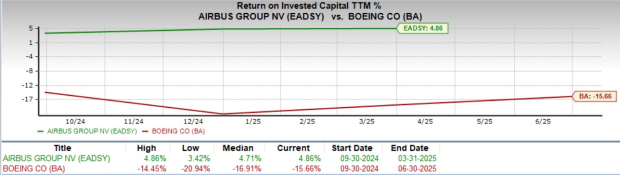

The image below reflects that BA’s Return on Invested Capital (ROIC) came in below EADSY’s ROIC. Further, its negative figure suggests that the American jet giant is not generating enough profit from its investments to cover the cost of its capital.

Both Boeing and Airbus are well-positioned to benefit from rising air travel and defense spending, but Airbus currently seems to be the stronger contender.

The company demonstrates solid financial strength, consistent profitability, and steady operational performance, supported by stable commercial deliveries and a resilient balance sheet. Boeing, while showing promising recovery in its commercial segment and improving cash flow, still faces challenges from past production issues and lower profitability on invested capital. Its share price has performed well, reflecting market optimism, but Airbus’ stability, consistent growth and attractive valuation make it the more reliable choice for long-term investors.

Both BA and EADSY carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

NASA Boss Blasts Starliner Mission that Left Astronauts in Space for Months

BA

The Wall Street Journal

|

| Feb-19 |

Boeing, Northrop Moving On Orders, Approvals; Plus Airbus' Engine Issue

BA

Investor's Business Daily

|

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite