|

|

|

|

|||||

|

|

The firms, Opendoor Technologies Inc. OPEN and Offerpad Solutions, Inc. OPAD, operate in the iBuying platforms market in the United States, wherein companies engage in purchasing homes directly online, making necessary repairs, and reselling them.

Opendoor is currently shifting its focus toward transforming from a single-product iBuyer platform to a distributed platform powered by real estate agents and expanded offerings. On the other hand, Offerpad is leaning heavily into asset-light services through its HomePro program.

Currently, due to the ongoing housing market softness in the United States, due to affordability concerns and the ongoing tariff-related risks, the iBuying platforms market is witnessing a setback.

With the mentioned firms currently undergoing strategic initiatives to counter this adverse scenario, we can closely compare the fundamentals of the two stocks to determine which one is a better investment now.

This California-based company is currently engaging in diversified product offerings to increase its competitive edge, given the housing market volatility. Its AI-driven cash offer model forms the foundation of its entire business operations, with cash offer (all-cash proposal made directly to the homebuyer) being its flagship product, powered by the proprietary data fed into the AI, including aspects like home visits, photos, agent notes and customer interactions.

Through its current strategic shift of focus, the company is building a distributed platform, surrounding its cash offer model, using new tools like the Key Agent iOS app and Cash Plus, to foster a more agent-led model. Piloted in selected markets in the first quarter of 2025, the new agent-led model has resulted in five times more listing conversion rates, with customers reaching double the time of the final underwritten cash offer compared with OPEN’s traditional flow.

The company believes that the inputs from the new agent-led initiative are expected to come to light in 2026. In the long term, the agent-led model is expected to boost Opendoor’s revenue visibility and profitability, as long as it continues to broaden its toolkit surrounding this cornerstone, leading to a multi-product, agent-enabled ecosystem.

However, in the near term, the housing market challenges are taking a toll on OPEN’s performance, especially the bottom line. During the second quarter, the company reported an adjusted loss per share of one cent, reflecting impacts from the pressures of high revenue costs and an increase in restructuring costs. Besides, owing to the market challenges, Opendoor has laid out a cautious third-quarter 2025 outlook, inducing bearish sentiments among investors and analysts. In the third quarter, it expects revenues to be between $800 million and $875 million, down from $1.4 billion reported in the year-ago quarter. Moreover, the outlook for the contribution profit of $22-$29 million also reflects a year-over-year decline between 57.7% and 44.2%.

This Arizona-based company is focusing on a diversified business model, including being attentive to selective market-driven acquisition decisions, expanding high-margin asset-light services like Renovate and Direct+ and strengthening the customer experience through the HomePro platform, in-person appointments and platform enhancements.

In the second quarter of 2025, OPAD launched its HomePro platform (currently live in all its markets), which integrates the specialized agents into the home and helps the sellers, through prescheduled appointments, to every available solution. Besides, the company’s proprietary technology creates a faster and more seamless experience by blending human expertise and smart automation and delivering high-quality service at scale.

During the second quarter of 2025, its Renovate business delivered revenues of $6.4 million, marking the highest quarterly revenues since the launch, reflecting increased demand from institutional and investor partners. The Direct+ is Offerpad’s asset-light marketplace, which helps it boost demand by linking homes with institutional and individual investors. As of the second quarter, the company witnessed that the ongoing investments in this platform are reaping benefits, with improved SFR buyer engagement.

Although the in-house initiatives are boding well for the company, the challenging housing market is a bit depressing. For the third quarter of 2025, OPAD expects revenues between $130 million and $150 million, down from $208.1 million reported a year ago. Homes sold are expected to be between 360 units and 410 units, down from 615 units sold in the year-ago quarter.

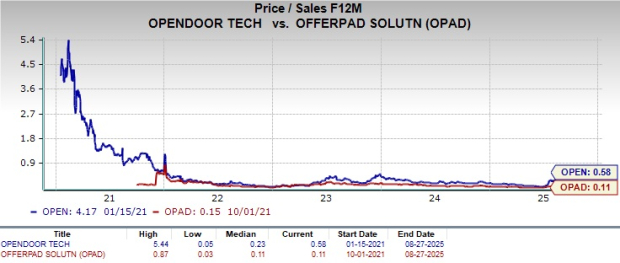

As witnessed from the chart below, in the past month, Offerpad’s share price performance stands above Opendoor’s.

Considering valuation, over the last five years, Opendoor is trading above Offerpad on a forward 12-month price-to-sales (P/S) ratio basis.

Overall, from these technical indicators, it can be deduced that OPAD stock offers an incremental growth trend with a discounted valuation, while OPEN stock offers a slow growth trend with a premium valuation.

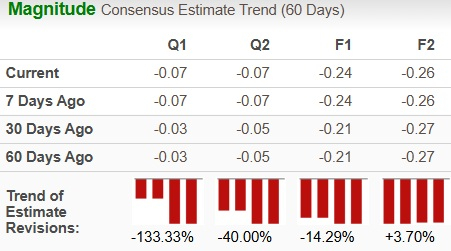

The Zacks Consensus Estimate for OPEN’s bottom line indicates a loss per share for 2025 and 2026. Over the past 60 days, the estimates for 2025 have widened, while those of 2026 have contracted. The estimated value of 2025 indicates 35.1% year-over-year growth, while that of 2026 indicates a decline of 10.4%.

OPEN's EPS Trend

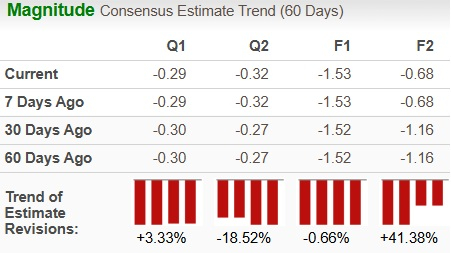

The Zacks Consensus Estimate for OPAD’s bottom line also indicates a loss per share for 2025 and 2026. Over the past 60 days, the estimates for 2025 have widened slightly, while those of 2026 have contracted notably. The estimated values of 2025 and 2026 indicate 32.9% and 55.6% year-over-year growth, respectively.

OPAD's EPS Trend

Opendoor’s strategic transition toward an agent-led, multi-product ecosystem could strengthen its long-term competitive positioning. But the company is currently struggling with revenue declines, widening losses and cautious guidance.

Offerpad, on the other hand, is executing well on its asset-light services strategy, with traction in Renovate, Direct+, and the HomePro platform providing incremental revenue opportunities. Despite facing revenue declines, its initiatives reflect healthier growth trends and improved buyer engagement.

With OPEN currently carrying a Zacks Rank #4 (Sell), investor sentiment is tilted negative, making it less favorable in the short run. On the other hand, OPAD, carrying a Zacks Rank #3 (Hold) at present and trading at a relatively discounted valuation, appears better positioned than Opendoor in the near to medium term. Thus, for now, OPAD seems to be the more reasonable stock to consider, given its steadier execution, growth visibility in asset-light services and comparatively favorable ranking.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 hours | |

| 12 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite