|

|

|

|

|||||

|

|

Charles River Laboratories International, Inc. CRL is now part of the EASYGEN (Easy Workflow Integration for Gene Therapy) Consortium — a European Union-backed effort designed to produce CAR-T cell therapies faster, make them more affordable and widely accessible throughout Europe. The five-year research project is funded by the Innovative Health Initiative Joint Undertaking under grant agreement No 101194710, and involves collaboration among 18 leading academic, research, industry and clinical partners across eight countries.

The Consortium’s goal is to develop a fully automated, hospital-based platform capable of manufacturing personalized cell therapies within 24 hours.

Since the announcement on Aug. 26, shares of Charles River dipped 0.2%, closing at $163.31 last Friday. Oncology remains a key therapeutic area for the company, where time is critical in treating complex cancers. With the current manufacturing process for CAR-T therapies being time-consuming and significantly limiting their clinical use, Charles River hopes to create a streamlined workflow by collaborating across industry and academia to increase access to these therapies for patients who need them. The latest development should positively boost market sentiment surrounding the stock.

Charles River has a market capitalization of $8.04 billion. The company’s earnings yield of 6.19% compares favorably with the industry’s 4.04% yield. In the trailing four quarters, it delivered an average earnings surprise of 12.8%.

CAR-T cell therapy represents a major advancement in cancer treatment, yet less than 20% of eligible patients currently receive it. These therapies typically involve genetically altering a patient’s T cell to target cancer — a process that requires complex, time-intensive production in specialized facilities often located far from patients. Limited manufacturing capacity and supply-chain delays hinder timely patient access.

Charles River will leverage its deep institutional expertise in 3D screening technologies to develop an ex vivo platform to speed up early screening for safety and efficacy. By leveraging access to the company’s well-annotated patient-derived xenograft (PDX) bank in combination with high-content imaging read-outs, the new 3D screening platform will enable the fast identification of the safest and most efficacious CAR-T cell candidate for subsequent development.

Per a Grand View Research report, the global CAR T-cell therapy market was valued at $4.65 billion in 2024 and is expected to grow at a compound annual rate of 22.2% through 2030. The rising cases of cancer malignancies continue to fuel the market for CAR T-cell therapy. Additionally, multiple product launches and approvals are giving market players significant traction. The lymphoma segment held the largest CAR T-cell therapy market share in 2024 and is also expected to be the fastest-growing segment over the forecast period.

In July, CRL and BioTech Social Inc. announced that they are exploring a potential client-centric collaboration, enabling participants at the Charles River Incubator and Accelerator Program to access the BioTech Funding Portal — an investment crowdfunding platform for life science companies. If formalized, the contemplated strategic partnership would allow early-stage cell and gene therapy (CGT) developers to raise up to $5 million per year via the platform, accelerating development and enabling therapies to reach patients more quickly.

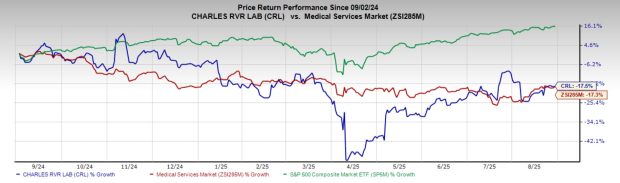

In the past year, Charles River shares have fallen 17.5% compared with the industry’s 17.3% decline.

Charles River carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space include Envista NVST, Masimo MASI and Phibro Animal Health PAHC. Each of them carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Envista’s 2025 earnings per share have increased 7.6% in the past 30 days. Shares of the company have rallied 16.7% in the past year compared with the industry’s 5.2% rise. Its earnings yield of 5.4% also outpaced the industry’s -0.9% yield. NVST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.5%.

Masimo shares have jumped 18.9% in the past year. Estimates for the company’s 2025 earnings per share have increased 5.2% to $5.24 in the past 30 days. MASI’s earnings beat estimates in each of the trailing four quarters, the average surprise being 13.8%. In the last reported quarter, it posted an earnings surprise of 8.1%.

Estimates for Phibro Animal Health’s fiscal 2026 earnings per share have climbed 5 cents to $2.35 in the past 30 days. Shares of the company have surged 76.5% in the past year compared with the industry’s 3.4% growth. PAHC’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 27.9%. In the last reported quarter, it delivered an earnings surprise of 9.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours |

Stock Market Today: Dow, Nasdaq Eke Out Gains; Gold, Silver Names Slide (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| 4 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Stock Market Today: Nasdaq, Dow Climb; Airline Name Flies Higher (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| 8 hours | |

| 8 hours |

Stock Market Today: Dow Weakens As Nasdaq Lags; Biotech Name Hits Record (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| 10 hours | |

| 10 hours | |

| 11 hours |

Masimo Stock on Pace for Record Gain After Danaher Strikes Deal

MASI +34.22%

The Wall Street Journal

|

| 11 hours |

Masimo Stock on Pace for Record Gains After Danaher Strikes Deal

MASI +34.22%

The Wall Street Journal

|

| 11 hours | |

| 11 hours | |

| 13 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite