|

|

|

|

|||||

|

|

GSK GSK stock has risen 6.4% over the past month, adding nearly $5 billion to its market value.

The consistently strong performance of the Specialty Medicines unit, regulatory and pipeline successes and an optimistic outlook for the long term are the key factors driving the increase amid several headwinds like slowing sales in the Vaccines unit, generic competition for some drugs and broader economic pressure.

Let's discuss these factors in detail to understand how to play GSK’s stock amid the recent price increase and rise in market value.

GSK is witnessing increased sales growth of its Specialty Medicines unit, particularly reflecting successful new launches in Oncology and long-acting HIV medicines. Sales are rising in all areas, HIV, Immunology/Respiratory as well as Oncology. Sales of the Specialty Medicines unit rose 16% in the first half of 2025, driven by double-digit growth in all therapy areas.

In the segment, while products like Nucala and Dovato are key top-line drivers, new long-acting HIV medicines, Cabenuva and Apretude, as well as new oncology drugs, Jemperli and Ojjaara, are also witnessing strong patient demand and contributing to top-line growth. In 2025, the company expects sales in the Specialty Medicines segment to rise in the low teens percentage at CER, despite the impact of the Inflation Reduction Act or IRA. Specialty Medicines, which now accounts for around 40% of GSK’s sales, is expected to constitute more than 50% of GSK’s total revenues by 2031.

GSK is increasing R&D investment in promising new long-acting and specialty medicines in Respiratory, Immunology & Inflammation, Oncology and HIV areas.

Its pentavalent MenABCWY meningococcal vaccine and Blujepa/gepotidacin for treating uncomplicated urinary tract infection (“UTI”) were approved in the United States in the first quarter of 2025. Its blockbuster drug Nucala was approved for treating chronic obstructive pulmonary disease or COPD, its fifth indication, in May 2025.

Regulatory applications seeking approval of the Blenrep combination for relapsed/refractory multiple myeloma, Blujepa (gepotidacin) for urogenital gonorrhea and depemokimab for two indications (chronic rhinosinusitis with nasal polyps or CRSwNP and asthma with type II inflammation) are under review in the United States and some other countries. FDA decisions on all these filings are expected in 2025. Blenrep combinations were approved in the EU, the United Kingdom, Japan and some other countries in 2025. GSK expects to file a global regulatory application for tebipenem pivoxil (complicated UTIs) and begin pivotal phase III studies on four more pipeline candidates later this year.

In 2025, GSK expects to launch five new products/line extensions, including Blenrep, depemokimab (severe asthma and CRSwNP), Nucala for COPD, Penmenvy and Blujepa. Of these, Penmenvy, Blujepa and Nucala for COPD are already approved in the United States.

GSK’s Vaccine sales are declining in the United States due to lower sales of its shingles vaccine, Shingrix and RSV (Respiratory Syncytial Virus) vaccine, Arexvy. U.S. sales of Shingrix are declining due to lower demand driven by challenges in activating harder-to-reach consumers.

Revised recommendations for RSV vaccinations issued in June 2024 by the US Advisory Committee on Immunization Practices (ACIP) are hurting sales of Arexvy in the United States. In June, the ACIP recommended the use of Arexvy for all adults aged 75 and above. However, for adults aged 60-74, the ACIP recommended the vaccine only for those who are at increased risk of severe RSV disease.

While sales of Arexvy and Shingrix rose in Europe, their sales declined 18% and 56%, respectively, in the United States in the first half of 2025. Total vaccine sales declined 11% at CER in the United States in the first half of 2025. Vaccines sales declined 5% in International Markets (other than Europe).

In 2025, the company expects sales in the Vaccines segment to decrease by a low single-digit percentage to broadly stable at CER.

GSK stock has risen 21.2% year to date compared with an increase of 1.4% for the industry. The stock has also outperformed the sector and the S&P 500 index, as seen in the chart below. The stock has also been trading above its 200 and 50-day moving averages since mid-August.

GSK’s stock is trading at an attractive valuation relative to the industry. Going by the price/earnings ratio, the company’s shares currently trade at 8.58 on a forward 12-month basis, lower than 14.78 for the industry. The stock also trades below its 5-year mean of 10.09. The stock is much cheaper than several other large drugmakers like Eli Lilly LLY, Novo Nordisk NVO, AbbVie ABBV, J&J, AstraZeneca and others.

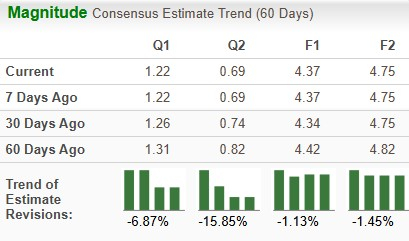

The Zacks Consensus Estimate for earnings has risen from $4.34 to $4.37 per share for 2025, while that for 2026 is stable at $4.75 per share over the past 30 days.

GSK has its share of problems. Competitive pressure on HIV and respiratory drugs has risen. The dolutegravir HIV franchise patent expires in the 2028-2029 period, and U.S. vaccine sales are slowing down. In 2025, GSK expects a negative sales impact of £400-500 million due to the impact of the IRA Medicare Part D redesign.

However, the company is consistently growing its sales and profits, mainly driven by its Specialty Medicines segment.

For the five-year period till 2026, GSK expects to record more than 7% sales growth, while core operating profit is expected to increase more than 11% on a CAGR basis. In this period, Specialty Medicines is expected to rise in the low-to-mid teens percentage, while General Medicines is expected to rise by a low single-digit percentage. The growth in Specialty Medicines and General Medicines is making up for a slowdown in the Vaccines unit.

We suggest investors who own this Zacks Rank #3 (Hold) stock stay invested for now, considering the potential for steady sales and profit improvement in the coming years. Consistently rising estimates also reflect analysts’ optimism around profit growth. Buying the stock at its present cheap valuation can prove prudent for long-term investors who are interested in buying blue-chip companies.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours |

Novo Nordisk and Vivtex collaborate for oral medicines development

NVO

Pharmaceutical Business Review

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite