|

|

|

|

|||||

|

|

ServiceNow NOW is benefiting from a rich partner base that includes the likes of NVIDIA NVDA, Cisco Systems, Amazon, Aptiv, Vodafone Business, UKG, Zoom and others. This, along with an innovative portfolio, is helping NOW generate strong top-line growth, which jumped 22.4% year over year to $3.22 billion in the second quarter of 2025.

The NVIDIA-NOW collaboration is redefining employee support as the semiconductor giant is using ServiceNow AI to resolve issues, deliver personalized help and provide answers in a short span of time. The long-term partners have collaborated to develop the Apriel Nemotron 15B model that evaluates relationships, applies rules, and weighs goals to reach conclusions or make decisions. ServiceNow and NVIDIA plan to bring accelerated data processing to ServiceNow Workflow Data Fabric with the integration of select NVIDIA NeMo microservices.

ServiceNow’s collaboration with Amazon Web Services helped in bi-directional data integration solutions to eliminate enterprise silos. ServiceNow and Cisco have collaborated to bring together the latter’s AI Defense with ServiceNow SecOps to provide more holistic AI risk management and governance. The integration of ServiceNow CRM capabilities with Aptiv’s platforms and technology from Wind River will offer greater automation and efficiency for telecommunication and enterprise customers. The alliance with UKG has modernized workforce management.

The rich partner base is helping ServiceNow offer solutions that are driving substantial productivity increases for its customers. NOW’s workflows are gaining traction. In the second quarter of 2025, technology workflows won 40 deals worth over $1 million, including four over $5 million. ITSM, ITOM, ITAM, security and risk were all in at least 15 of the top 20 deals. CRM and industry workflows were in 17 of NOW’s top 20 deals, with 17 of those deals over $1 million. Core business workflows were in 16 of the top 20 deals, with seven deals over $1 million.

An innovative portfolio and rich partner base are expected to help NOW generate subscription revenues. ServiceNow raised subscription revenue guidance for 2025, which is now expected between $12.775 billion and $12.795 billion, suggesting 19.5-20% on a non-GAAP constant currency (cc) basis. For third-quarter 2025, subscription revenues are projected between $3.26 billion and $3.265 billion, suggesting year-over-year growth of 19.5% at cc.

NOW faces stiff competition from the likes of Atlassian TEAM and Salesforce CRM.

Atlassian is a global leader and innovator in the enterprise collaboration and workflow software space. Atlassian is poised to grow given the rising demand for automated and improved communication systems within organizations. TEAM will benefit from the ongoing digitalization of work from organizations and the rapid adoption of cloud services. Atlassian’s AI-powered capabilities are seeing rapid adoption, with more than 2.3 million monthly active users engaging with Atlassian Intelligence features, marking a 20 times year-over-year increase in AI interactions during the fourth quarter of fiscal 2025.

Salesforce continues to see broad adoption of its platform as enterprises connect sales, service, marketing and analytics workflows under one system. CRM’s Customer 360 architecture integrates core applications with real-time data and AI, helping enterprises unify engagement and scale digital operations. Salesforce has extended its ecosystem through integrations with Snowflake, Databricks, Google BigQuery, and Amazon Redshift to support zero-copy data access and streamline AI workflows.

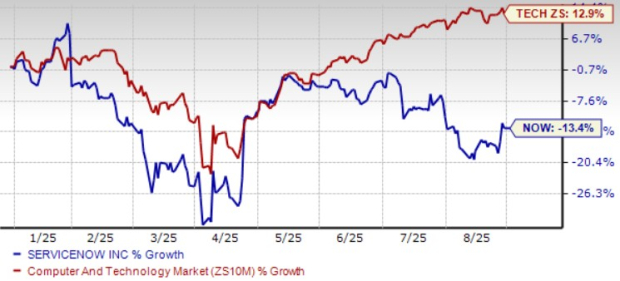

NOW shares have dropped 13.4% year to date, underperforming the broader Zacks Computer and Technology sector’s return of 12.9%.

ServiceNow stock is overvalued, with a forward 12-month price/sales of 12.94X compared with the broader sector’s 6.62X. NOW has a Value Score of F.

The Zacks Consensus Estimate for third-quarter 2025 earnings is pegged at $4.22 per share, unchanged over the past 30 days, suggesting 13.4% year-over-year growth.

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

ServiceNow currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite