|

|

|

|

|||||

|

|

U.S. stock markets have continued their northward journey in 2025 following an impressive rally over the previous two years. In August, all three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — advanced 3.2%, 1.9% and 1.6%, respectively.

These three indexes recorded several all-time and closing highs last month, too. No impact of tariff-related concerns on the U.S. economy, weak labor market data and Fed Chairman’s indication of a possible rate cut in September bolstered investors’ sentiment.

At this stage, it will be prudent to invest in stocks with a favorable Zacks Rank that have momentum in September. Five such stocks are: CrowdStrike Holdings Inc. CRWD, Interactive Brokers Group Inc. IBKR, Robinhood Markets Inc. HOOD, Carpenter Technology Corp. CRS and Sportradar Group AG SRAD.

Each of our picks currently sports a Zacks Rank #1 (Strong Buy) and has a Zacks Momentum Score of A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

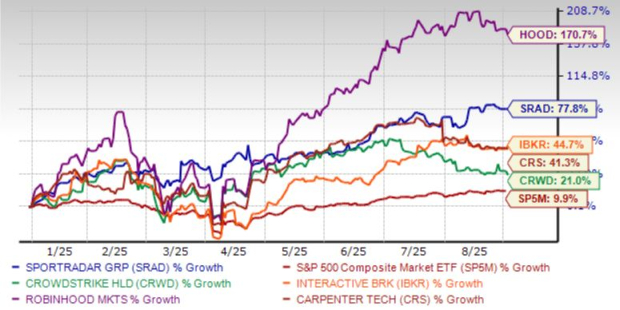

The chart below shows the price performance of our five picks year to date.

CrowdStrike Holdings, a leading provider of cybersecurity solutions in the United States and internationally, has been benefiting from the rising demand for cybersecurity solutions and the increasing need for secure networking products amid the growing hybrid working trend.

CRWD reported second-quarter 2025 adjusted earnings per share of $0.93, surpassing the Zacks Consensus Estimate of $0.83. Quarterly total revenues were $1.17 billion, outpacing the Zacks Consensus Estimate of $1.15 billion.

CRWD added a record $221 million in net new annual recurring revenues (ARR). This pushed up CrowdStrike’s total ARR to $4.66 billion, representing an increase of 20% from last year, beating the consensus mark of $4.64 billion.

A big part of this growth came from Falcon Flex, CrowdStrike’s subscription model. The company now has over 1,000 Falcon Flex customers, and more than 100 have already signed follow-on “re-Flex” deals before their contracts ended. These re-Flex deals are important because they show customers are expanding faster than expected, often boosting ARR by nearly 50%.

CrowdStrike is widening its focus to secure how enterprises use artificial intelligence (AI). Agentic AI is creating new risks as non-human identities, such as AI agents, have become part of daily business operations that can access systems and data, thereby increasing the need for governance and protection.

CRWD sees this as a major growth opportunity and is focusing on its strategy to secure AI agents, large language models, and generative AI systems. In August 2025, the company announced new steps in this direction.

CrowdStrike expanded Falcon Shield’s abilities to cover AI agents built with OpenAI’s ChatGPT Enterprise and Codex. This will help organizations see what these agents are doing, link them to their human creators, and stop risky behavior if an account is compromised.

CrowdStrike also launched Signal, a new AI detection engine. Signal learns what is normal in each customer’s environment and then spots unusual patterns that could indicate an early-stage attack. The company further expanded its AI Security Services with two new offerings, which include AI Systems Security Assessment and AI for SecOps Readiness.

CrowdStrike Holdings has an expected revenue and earnings growth rate of 20.9% and -9.9%, respectively, for the current year (ending January 2026). The Zacks Consensus Estimate for current-year earnings has improved 1.1% in the last seven days.

Interactive Brokers Group’s efforts to develop proprietary software, lower compensation expenses relative to net revenues, enhance its emerging market customers and global footprint, along with relatively high rates, are expected to continue aiding revenues. We project total net revenues (GAAP) to see a CAGR of 6.5% by 2027. IBKR’s initiatives to expand its product suite and the reach of its services will support financials.

IBKR has been undertaking several measures to enhance its global presence. In August 2025, it launched zero-commission U.S. stock trading in Singapore. In July, it launched NISA accounts to help Japanese investors build wealth tax-free.

In May, IBKR extended the trading hours for Forecast Contracts to nearly 24 hours a day. In April, IBKR launched the prediction markets hub in Canada to capitalize on the rising demand for event contracts.

Interactive Brokers Group has an expected revenue and earnings growth rate of 8.8% and 11.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.6% in the last 30 days.

Robinhood Markets operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies using its Robinhood Crypto platform.

Given the higher retail participation in markets, HOOD’s trading revenues are expected to improve in the near future. Buyouts and product diversification efforts to become a leader in the active trader market will likely bolster its financials.

HOOD’s second-quarter 2025 results were aided by solid trading activity and growth in net interest revenues. HOOD’s vertical integration will likely enhance its product velocity. Further, a robust liquidity position will help HOOD to sustain share repurchases.

Robinhood Markets has an expected revenue and earnings growth rate of 35.8% and 42.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 11.5% over the last 30 days.

Carpenter Technology is a leader in premium specialty alloys, including titanium, nickel, and cobalt, as well as alloys specifically engineered for additive manufacturing/ 3D printing processes and soft magnetics applications. CRS has expanded additive manufacturing capabilities to provide a complete “end-to-end” solution to accelerate materials innovation and streamline parts production.

Carpenter Technology has been experiencing strong booking growth for the past few quarters, indicating strong demand. CRS’ fiscal 2026 results are expected to reflect the impacts of the ongoing momentum across its end-use markets. Its financial position has been strong, providing it the flexibility to invest in the emerging technologies of additive manufacturing and soft magnetics.

CRS’ cost-reduction initiatives are also anticipated to boost its margins. Backed by solid backlog levels, its near and long-term outlooks for each end-use market remained positive. CRS’ strategic acquisitions will boost its performance in the coming quarters.

Carpenter Technology has an expected revenue and earnings growth rates of 8.1% and 27.1%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved 4.4% over the last 30 days.

Sportradar Group provides sports data services for the sports betting and media industries in the United Kingdom, the United States, Malta, Switzerland, and internationally. SRAD offers sports data services to bookmakers under the Betradar brand, and to the international media industry under the Sportradar Media Services brand name. SRAD offers mission-critical software, data, and content to sports leagues and federations, betting operators, and media companies.

Sportradar Group came up with second-quarter 2025 adjusted earnings of $0.17 per share, beating the Zacks Consensus Estimate of $0.04 per share. This compares to break-even earnings per share a year ago. Total revenues were $360.57 million, which missed the Zacks Consensus Estimate by 2.7%. However, year over year, revenues increased 20.3%.

SRAD also provides sports entertainment, gaming, and sports solutions, as well as live streaming solutions for online, mobile, and retail sports betting. In addition, SRAD’s software solutions address the entire sports betting value chain from traffic generation and advertising technology to the collection, processing, and extrapolation of data and odds, as well as to visualization solutions, risk management and platform services.

Sportradar Group has an expected revenue and earnings growth rate of 24.3% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 33.3% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite