|

|

|

|

|||||

|

|

JD.com's JD seemingly attractive 9.74x price-to-earnings (P/E) ratio compared to the Zacks Internet - Commerce industry average of 24.9x masks a deteriorating financial reality that should give investors serious pause. The valuation multiple reflects market recognition of JD.com's deteriorating fundamentals rather than representing a bargain opportunity.

While the Chinese e-commerce giant reported 22.4% revenue growth in the second quarter, reaching RMB 356.7 billion, beneath these headline numbers lies a troubling narrative of profit collapse, cash flow destruction, and strategic missteps that make the stock a clear sell candidate for 2025.

With earnings estimates being revised downward by 30.8% over the past 60 days for 2025, projecting a 41.55% year-over-year earnings decline, the stock's compressed valuation accurately prices in the company's bleak near-term prospects and structural challenges.

JD.com, Inc. price-consensus-chart | JD.com, Inc. Quote

JD.com's aggressive expansion into food delivery through JD Takeaway represents one of the most financially destructive strategic decisions in recent corporate history. The company's New Businesses segment, primarily driven by food delivery operations, reported a staggering operating loss of RMB 14.8 billion in the second quarter alone, representing a negative operating margin of 106.7%. This catastrophic performance followed a RMB 1.3 billion loss in the second quarter, indicating an accelerating cash burn that shows no signs of abating.

The damage extends beyond quarterly losses. With projected food delivery losses of RMB 34 billion for 2025, this single segment threatens to wipe out 36% of JD.com's total operating profit. The company's attempt to challenge entrenched competitors Meituan and Alibaba's BABA Ele.me through a RMB 10 billion subsidy war represents a desperate gamble that is unlikely to succeed given Meituan's commanding 64-67% market share dominance.

The financial devastation from JD.com's ill-conceived expansion strategy becomes even more alarming when examining broader profitability metrics. Net income attributable to ordinary shareholders plummeted 50.8% year over year to RMB 6.2 billion in the second quarter, despite robust revenue growth. Non-GAAP net income similarly collapsed 49% year over year to RMB 7.4 billion, demonstrating that this isn't merely an accounting issue but fundamental operational deterioration.

Most concerning is the complete collapse in cash generation capabilities. Free cash flow nosedived to negative RMB 21.6 billion in the first quarter, while the second quarter showed only modest recovery to RMB 22 billion, down 55% from RMB 49.6 billion in the prior year. Rolling 12-month free cash flow has catastrophically declined over 80% from RMB 55.6 billion to just RMB 10.1 billion. This cash flow destruction occurs precisely when JD.com needs capital most to fund its money-losing ventures and maintain competitiveness in its core business.

The company's operating margin compressed to just 0.3% on a non-GAAP basis in the second quarter, while net profit margin fell to 3.77% as of March 2025. These margins rank among the worst in China's major tech sector, indicating severe operational inefficiencies and unsustainable competitive positioning. With the company burning through RMB 12.4 billion in financing activities during the second quarter, primarily for dividends and share buybacks it can ill afford, the financial pressure continues to mount.

JD.com faces an increasingly hostile competitive environment where its traditional advantages are rapidly eroding. Alibaba maintains approximately 80% market share in China's e-commerce sector, while PDD Holdings PDD continues to capture price-conscious consumers with its innovative C2M model and aggressive international expansion through Temu. JD.com's market share stands at merely 15.9%, leaving it vulnerable to being squeezed between larger competitors and nimble upstarts. The company also competes globally with Amazon AMZN, eBay, and Walmart.

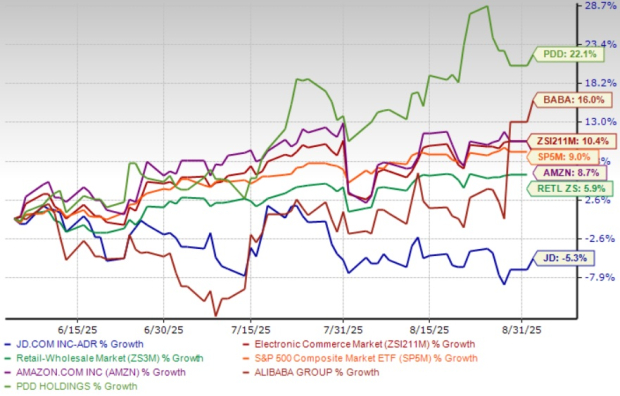

JD.com's stock has severely underperformed the broader market throughout 2024 and into 2025, declining approximately 18.5% over the trailing three-month period while the industry, the Zacks Retail-Wholesale sector and the S&P 500 index have returned 10.4%, 5.9% and 9%, respectively. In comparison, Alibaba, Amazon and PDD have gained 16%, 8.7% and 22.1%, respectively, in the same time frame.

The competitive dynamics have triggered destructive price wars across multiple fronts. China's State Administration for Market Regulation summoned JD.com, Meituan, and Alibaba in May 2025, warning against anti-competitive practices and predatory pricing. This regulatory scrutiny threatens to limit JD.com's ability to subsidize growth, potentially accelerating market share losses in both core e-commerce and new ventures.

The company's desperate promotional tactics, including coffee priced at RMB 2 yuan through massive subsidies, demonstrate the unsustainable nature of its current strategy. The food delivery segment alone requires maintaining more than 150,000 full-time delivery workers, creating massive fixed cost obligations that will pressure margins for years. These losses are likely to persist through 2026, with profitability remaining elusive even under optimistic scenarios.

JD.com's 9.74x P/E ratio reflects not opportunity but a value trap that will likely ensnare unwary investors throughout 2025. The combination of collapsing profitability, cash flow destruction, strategic missteps in food delivery, and intensifying competitive pressures creates a toxic mix that makes the stock uninvestable. With analysts cutting price targets and earnings forecasts while the company burns through cash reserves, investors should recognize that sometimes a low valuation exists for compelling reasons. The prudent course is clear: avoid JD.com stock entirely and seek opportunities elsewhere in 2025. JD.com currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite