|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Ecolab Inc. ECL has been gaining from its solid product portfolio. The optimism, led by a solid second-quarter 2025 performance and continued focus on research and development, is expected to contribute further. However, concerns regarding macroeconomic factors persist.

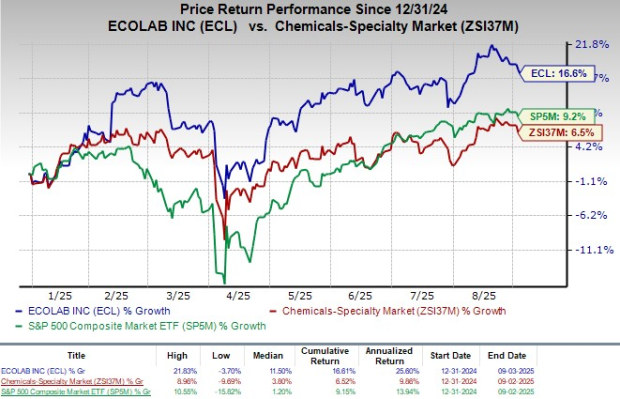

This Zacks Rank #3 (Hold) stock has gained 16.6% in the year-to-date period compared with the industry’s 6.5% growth. The S&P 500 Composite has increased 9.2% during the same time frame.

The renowned water, hygiene and infection prevention solutions and services provider has a market capitalization of $77.94 billion. It projects 13% growth for the next five years and expects to maintain a strong performance in the future. Ecolab’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 0.29%.

Strong Product Portfolio With a Focus on R&D: Ecolab’s diverse portfolio spanning water treatment, hygiene, life sciences, digital technologies, and pest control gives it a strong competitive edge, reinforced by consistent R&D investments. The global water treatment market, valued at $38.56 billion in 2023, is forecasted to register a CAGR of 8.1% through 2030, offering significant expansion potential.

Per the second-quarter earnings call, Ecolab highlighted meaningful progress in reshaping its portfolio and advancing innovation to support long-term growth. The company is exiting non-core, low-margin hospital and retail businesses to sharpen focus on higher-value segments, while Pest Elimination is seeing strong results from its digital intelligence model, with pilot programs delivering pest-free rates well above industry norms. Life Sciences remains a standout, with robust momentum across biopharma, pharma, and personal care, supported by ongoing investments in R&D, capacity, and talent to sustain operating margins near 30%.

Complementing this, Ecolab is driving future growth through new technologies such as the 3D TRASAR AI Dishmachine Program, which leverages IoT and machine learning to reduce water use, and the 3D Cloud platform, which applies advanced analytics to optimize water treatment in real time. Together, these steps underscore a disciplined portfolio strategy and a strong innovation pipeline in high-margin, high-growth areas.

Ecolab’s Global High-Tech Business & Digital Platform: Ecolab is accelerating its transformation through two key high-growth, high-margin drivers — its Global High-Tech business and the Ecolab Digital Platform. Per the second-quarter earnings call, the Global High Tech segment delivered sales growth of more than 30%, driven by accelerating demand for data center cooling and water circularity solutions in the fast-expanding microelectronics industry. Management noted that operating margins in this segment now exceed 20%, underscoring both the scalability and profitability of the model, and described it as the beginning of an “incredible growth story” with significant runway as global demand for high-performance and sustainable solutions rises.

Complementing this, Ecolab Digital continued its rapid expansion, with nearly 30% sales growth in the second quarter and an annualized revenue run rate of about $380 million. Growth was fueled by a mix of subscription-based services and digital hardware, demonstrating the company’s ability to monetize its technology platform at scale. These businesses not only enhance Ecolab’s recurring revenue base but also strengthen its positioning in critical industries where efficiency, water management, and sustainability are top priorities, reinforcing the long-term durability of its growth strategy.

Strong Q2 Results: Ecolab exited the second quarter of 2025 with better-than-expected revenues. The company registered a robust year-over-year uptick in its top and bottom lines, along with solid performances across the majority of its segments. The expansion of both margins bodes well for the stock.

Per management, the Institutional & Specialty and Global Water segments delivered solid growth, outperforming end-market trends as ECL benefited from share gains supported by the One Ecolab growth strategy, breakthrough innovation and strong value pricing. The company’s growth engines (which include Life Sciences, Pest Elimination, Global High-Tech and Ecolab Digital) collectively grew sales in double digits. This looked promising for the stock.

Macroeconomic Factors: Ecolab operates in 170 countries, which is why its operations are subjected to unfavorable social, political and economic challenges that may be ongoing in various countries. Per the second-quarter earnings call, management acknowledged several macroeconomic challenges that are creating near-term headwinds.

Tariffs and tariff-related inflation remain a pressure point, with commodity costs running in the low to mid-single-digit range and expected to persist through the back half of the year. The company also pointed to softer demand in paper and basic industries, which weighed on its performance compared with more resilient sectors. In addition, foreign exchange movements are expected to have an unfavorable impact on expenses relative to last year.

Ecolab is witnessing a positive estimate revision trend for 2025. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 3 cents north to $7.53 per share.

The Zacks Consensus Estimate for the company’s third-quarter 2025 revenues is pegged at $4.12 billion, indicating a 3.1% improvement from the year-ago quarter’s reported number.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

Medpace Holdings, sporting a Zacks Rank of 1 (Strong Buy), reported second-quarter 2025 EPS of $3.10, beating the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, beating the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite