|

|

|

|

|||||

|

|

Tesla TSLA disrupted the auto industry with its electric vehicles (EVs), but it no longer holds the first-mover advantage. The EV space has become increasingly crowded, competition is intensifying, and Tesla’s market share is shrinking. Amid this challenging backdrop, the company has been working to position itself as more than just a carmaker.

Its newly unveiled Master Plan Part IV reinforces that strategy. It emphasizes AI-driven products, robotics, large-scale autonomy and energy as the foundation for Tesla’s future growth.

The vision is bold, but so are most of Elon Musk’s promises. The Tesla CEO has a history of making sweeping promises and bold predictions to rekindle investor enthusiasm. That leaves investors with a critical question: Does this Master Plan IV strengthen Tesla’s investment case, or is it just another Musk play to generate hype when the core business is under pressure?

The central theme of the new plan is what Tesla calls “sustainable abundance.” The company believes that its next chapter is about eliminating scarcity, with artificial intelligence (AI) and automation driving productivity and freeing up human time.

Autonomous driving remains a key pillar of the plan. Tesla is pinning much hope on AI-powered vehicles, which it thinks can make transportation safer, more affordable, and more widely accessible. But with the company already lagging behind Alphabet’s GOOGL Waymo — the current frontrunner — and its robotaxi debut falling short of expectations, questions remain if Tesla can catch up fast. Backed by a $5 billion multi-year investment by Alphabet, Waymo has years of real-world testing and strong partnerships. Meanwhile, it is yet to be seen if Tesla can overcome the technical and regulatory hurdles ahead.

Then there’s Optimus, the humanoid robot that Musk claims could one day represent 80% of Tesla’s value. Still in early development, Optimus is pitched as a solution for repetitive tasks. If Tesla can commercialize it at scale, the robot could become a major new revenue stream in the future. But for now, that kind of projection feels wildly optimistic, especially given Tesla’s mixed record of meeting its own ambitious timelines.

Energy is another cornerstone. Solar generation and large-scale battery storage are not new to Tesla, but they play a key role in the master plan. The logic is simple: autonomous EVs and robots will only thrive if they are powered by abundant, sustainable energy. And Tesla wants to be the provider of that ecosystem from end to end. While that strategy aligns with its existing strengths, it’s worth noting that energy remains a much smaller piece of Tesla’s overall revenues.

After Tesla’s first-ever annual delivery decline in 2024, 2025 also started on a rough note. Deliveries fell 13% year over year in the first quarter, followed by another 13.4% drop in the second quarter. China’s EV giant BYD Co Ltd BYDDY continued to challenge Tesla. In first-quarter 2025, BYD delivered over 416,000 BEVs, outpacing Tesla’s 336,000. In the second quarter, BYD reported 606,993 BEVs sold (up 42.5% year over year), marking its third straight quarter of beating Tesla in battery EV sales.

In fact, the last reported quarter marked Tesla’s sharpest quarterly revenue decline in more than a decade, raising questions not only about demand but also about the company’s brand image amid Elon Musk’s increasingly polarizing political activity.Profitability has also come under pressure. Discouragingly, Musk has already warned of rough quarters ahead.

Year to date, shares of Tesla have declined 16%, underperforming the industry.

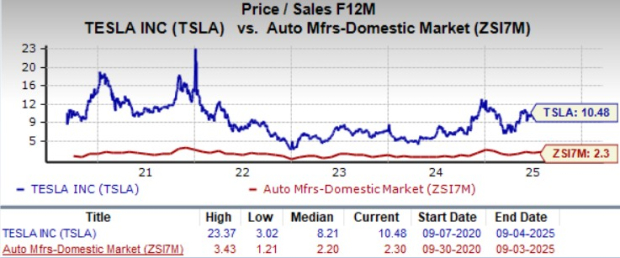

From a valuation perspective, Tesla looks overvalued. Based on its price/sales ratio, the company is trading at a forward sales multiple of 10.48, higher than the industry as well as its own 5-year average. TSLA has a Value Score of D.

The Zacks Consensus Estimate for Tesla’s 2025 sales and EPS implies a year-over-year contraction of 5% and 31.4%, respectively. The downward EPS estimate revisions over the past 90 days signal dimming confidence in the stock.

Tesla’s Master Plan Part IV, in reality, looks more like a continuation than a breakthrough. Musk has been talking about autonomy, energy and robotics for years. While the long-term vision of autonomy and robotics sounds exciting and may add value one day, for now it seems too premature to invest just in these ultra-ambitious plans, especially at a time when this EV pioneer is facing intensifying competition, declining deliveries and profitability pressure.

In fact, this master plan looks like an attempt to redirect attention from core challenges. Until Tesla can show execution beyond words, Master Plan IV looks like old promises in a new package and is hardly a reason to bet on Tesla now.

The company carries a Zacks Rank #4 (Sell) currently.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite